In spite of the Bank of England’s latest monetary stimulus, ambitious fiscal package may be needed to deal with steep drop in growth foreseen for next year On 4 August, the Bank of England (BoE) managed to beat market expectations by announcing a policy package that included a 25 bp rate cut (to 0.25%), a Term Funding Scheme (TFS) “to reinforce the pass-through” of the rate cut, a GBP60 bn increase in the bank’s purchases of government bonds, as well as up to GBP10 bn in corporate bonds purchases. According to the BoE, “this package contains a number of mutually reinforcing elements, all of which have scope for further action”.In our view, monetary easing alone is unlikely to make a significant difference to the UK’s economic outlook, but the BoE could be creating fiscal space in anticipation of possible changes to the UK budget next year.It remains to be seen how much traction monetary policy alone can have on UK economic activity, wage growth and inflation. A compelling case can be made that given already low rates and high uncertainty about growth prospects, fiscal policy is better placed to address the problem of weak aggregate demand.It could well be that the BoE by its latest actions is mostly buying time and creating fiscal space in anticipation of future changes to the UK budget.

Topics:

Frederik Ducrozet considers the following as important: Bank of England, Macroview, UK growth forecast, UK interest rates, UK quantitative easing

This could be interesting, too:

Marc Chandler writes The Dollar Remains Bid, While the Euro and Swiss Franc are Sold Through Last Week’s Lows

Marc Chandler writes Searching for Direction

Marc Chandler writes Serenity Now

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

In spite of the Bank of England’s latest monetary stimulus, ambitious fiscal package may be needed to deal with steep drop in growth foreseen for next year

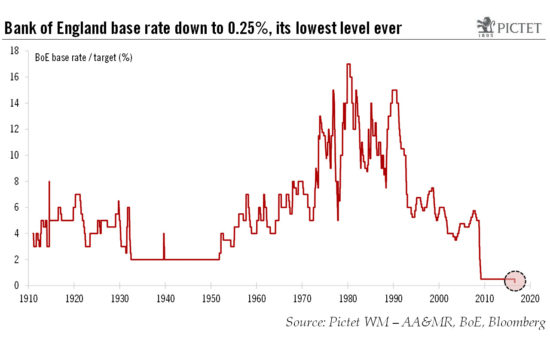

On 4 August, the Bank of England (BoE) managed to beat market expectations by announcing a policy package that included a 25 bp rate cut (to 0.25%), a Term Funding Scheme (TFS) “to reinforce the pass-through” of the rate cut, a GBP60 bn increase in the bank’s purchases of government bonds, as well as up to GBP10 bn in corporate bonds purchases. According to the BoE, “this package contains a number of mutually reinforcing elements, all of which have scope for further action”.

In our view, monetary easing alone is unlikely to make a significant difference to the UK’s economic outlook, but the BoE could be creating fiscal space in anticipation of possible changes to the UK budget next year.

It remains to be seen how much traction monetary policy alone can have on UK economic activity, wage growth and inflation. A compelling case can be made that given already low rates and high uncertainty about growth prospects, fiscal policy is better placed to address the problem of weak aggregate demand.

It could well be that the BoE by its latest actions is mostly buying time and creating fiscal space in anticipation of future changes to the UK budget. Although Mark Carney ruled out pure monetary financing in the form of ‘helicopter drops’, he did mention the potential for a closer co-ordination with the government. The hope could be to provide a backstop for public debt, reducing the risks of financial tensions in the context of elevated twin deficits. A large stimulus does not appear likely at this stage but if economic momentum continues to worsen, the government might be forced to act, using the fiscal space that the BoE has just created.

Also on August 4, the BoE made large revisions to its GDP forecasts for the UK, taking stock of the early effects of Brexit on business confidence and activity. Growth in 2017 is now anticipated to be 0.8%, down from the BoE’s previous estimate of 2.3%, and close to our own forecast of 0.9%.