U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »April Jobs Won’t Change Minds

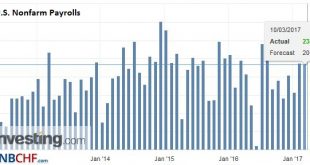

The US created 211k net new jobs in April, a sharp bounce back from the downwardly revised 79k gain in March. It is the third month this year that the US created more than 200k new jobs. United States Nonfarm payrolls Government payrolls increased by 17k. As we noted with the Administration’s federal hiring freeze, the real growth in government employment is on the state and local level. In April the federal...

Read More »Sweden’s Gold Reserves: 10,000 gold bars (pet rocks) shrouded in Official Secrecy

In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

Read More »Solid US Jobs Report in line with Expectations

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. United States Nonfarm payrolls It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k). U.S. Nonfarm Payrolls, February 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to...

Read More »A Few Thoughts on Canada

Summary: Bank of Canada meets Wed. Look for a dovish hold. Foreigners continue to buy Canadian bonds and stocks. The EU-Canadian free-trade deal is facing challenges, with the most pressing one coming from Belgium. The Bank of Canada meets Wednesday. Last month officials acknowledged that growth could be somewhat lower than previously anticipated. Those fears have likely materialized, and the central bank...

Read More »FX Weekly Preview: Four Key Events in the Week Ahead

United States Of the forces driving prices in the week ahead, events appear more important than economic reports. There are four such events that investors must navigate. The Bank of Canada and the European Central Bank meet. The UK High Court will deliver its ruling on the role of Parliament in Brexit. The rating agency DBRS updates its credit rating for Portugal. The Bank of Canada is not going to change interest...

Read More »Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org