United States Of the forces driving prices in the week ahead, events appear more important than economic reports. There are four such events that investors must navigate. The Bank of Canada and the European Central Bank meet. The UK High Court will deliver its ruling on the role of Parliament in Brexit. The rating agency DBRS updates its credit rating for Portugal. The Bank of Canada is not going to change interest rates. Still, growth has disappointed, and price pressures appear to be ebbing. It will take longer than the BoC is currently anticipating to close the output gap. It may adjust its forecasts accordingly. In addition, the recent use of macro-prudential policies to address housing market activity eases one of the inhibitions for a rate cut. The market is currently pricing in about a one in 20 chance of this materializing next year. The risk may be somewhat greater than that In part, there seems to be too much made of the trade-off between the fiscal stimulus and monetary easing. It is so pre-crisis. This week’s data is likely to show that CPI continues to moderate and, despite the launch of a new low-income family benefits program, retail sales like fell in August, and the risk is on the downside of the median forecast of -0.1%.

Topics:

Marc Chandler considers the following as important: Bank of Canada, CAD, ECB, EUR, Featured, FX Trends, GBP, newslettersent, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

United StatesOf the forces driving prices in the week ahead, events appear more important than economic reports. There are four such events that investors must navigate. The Bank of Canada and the European Central Bank meet. The UK High Court will deliver its ruling on the role of Parliament in Brexit. The rating agency DBRS updates its credit rating for Portugal. The Bank of Canada is not going to change interest rates. Still, growth has disappointed, and price pressures appear to be ebbing. It will take longer than the BoC is currently anticipating to close the output gap. It may adjust its forecasts accordingly. In addition, the recent use of macro-prudential policies to address housing market activity eases one of the inhibitions for a rate cut. The market is currently pricing in about a one in 20 chance of this materializing next year. The risk may be somewhat greater than that In part, there seems to be too much made of the trade-off between the fiscal stimulus and monetary easing. It is so pre-crisis. This week’s data is likely to show that CPI continues to moderate and, despite the launch of a new low-income family benefits program, retail sales like fell in August, and the risk is on the downside of the median forecast of -0.1%. |

Economic Events: United States, Week October 17 |

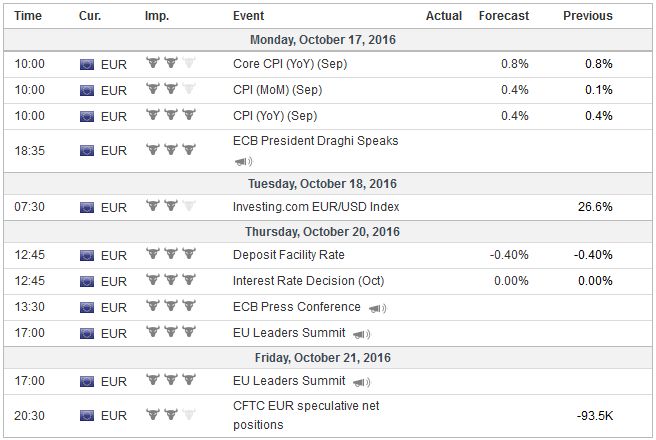

EurozoneIt does not appear that the ECB is prepared to announce a decision about whether it will extend its asset purchases after the current soft end date of March 2017, or about how it will address the potential scarcity of particular securities. Although we thought there was an opportunity to do so last month, it now seems more likely that the ECB will make its decision at the December meeting. In addition to giving it more time see the impact of its current policy setting, it will also have new staff forecasts, which Draghi seems to prefer. The updated forecasts are helpful in stealing some thunder from his critics that often make it sound as if Draghi’s commitment stems from his national origin rather than “objective” economic analysis. Draghi will likely be pulled in at least two directions at the press conference. One set of questions will likely address the tapering story. Draghi was clear at the last meeting, saying the issue was not discussed. More information will be sought amid suspicions that the ECB President was disingenuous. However, Draghi indicated before and will likely restate that the asset purchases should not end abruptly. This implies some kind of tapering process. It does not say anything about when the asset purchase program will end of when the tapering begins or the pace of tapering. At this juncture, our best guess is that one way or the other, the ECB will be expanding its balance sheet most if not all of next year. Another set of questions will likely revolve around the capital key. To avoid appearances of favoritism, the ECB buys assets in proportion to the economic size of its members. There is a concern, seemingly higher among some market participants than policymakers that shortages are emerging that could threaten the program. Those shortages will become more acute the longer the purchases continue. The less disruptive and, perhaps, the easiest to reach an agreement on, seems to be to ease self-imposed rule of not buying a security that yields lower than the minus 0.4% deposit rate. The concern here is a forcing a national central bank to realize a loss. However, instead of a narrow security-by-security imposition of the rule, it really needs only apply to the portfolio as a whole, or the average yield of the bonds purchased. At the end of the week, DBRS will update its assessment of Portugal’s sovereign credit rating. The ECB recognizes four rating agencies and provided that at least one rates a country as investment grade, the country’s bonds will be including in the asset purchase program. A country’s rating also determines the haircut given to the government bonds used by banks to secure funding from the ECB. A loss of investment grade status would make the country’s bonds no longer acceptable as collateral (without a waiver). |

Economic Events: Eurozone, Week October 17 |

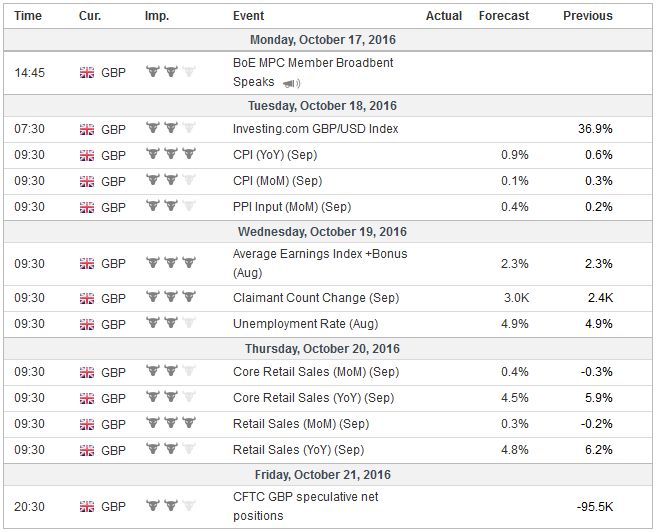

United KingdomThe UK’s decision to leave the EU remains a high divisive issue not only in Europe but within the UK itself. The referendum was approved with the narrowest of margins, but a combination of hubris and naivete prevented the establishment of a threshold for such a significant change, such as 60% or 2/3. Also, since the decision profoundly impacts the future of the UK, there is no compelling reason why the franchise was not extended to 16-year olds, as Scotland did for its referendum on independence. Despite the proximity of the outcome, pundits and politicos are trying to divine the will of the people, and like a Rorschach test, people see what they want. There was nothing in the referendum that indicated the role of Parliament and the Prime Minister in devising and negotiating with the EU over the separation. Treaty negotiation and foreign policy is usually a remit of 10 Downing Street. At stake how acrimonious does the divorce need to be, and the referendum did not address this issue. A hard Brexit is one that denies the UK access to the single market on the same terms as is the case currently. A soft Brexit preserves this access. The dilemma turns on how hard the UK wants to free itself from the EU principle of free movement of people, though it is not a member of the Schengen Agreement. The UK’s “Brexit” team, which Prime Minister May selected, is inclined to push for hard Brexit. For them, limiting immigration is the number one priority. The former head of UKIP was quoted in press putting the fine point on it: less prosperity is acceptable if it means fewer immigrants. On the other hand, Parliament is coming from the other direction. There is both a constitutional issue of the role of parliament as well as a more moderate approach to Brexit. The UK High Court is expected to announce its ruling on Monday. Sterling’s near-free fall in the foreign exchange market is a reflection of the risks of a hard exit. The value of UK assets is understood to be less if it is no longer has access to the single market. The greater the role of that the High Court insists on for Parliament, the more hard Brexit may be tempered. In turn, this could help spur a short-covering recovery of sterling. |

Economic Events: United Kingdom, Week October 17 |

Switzerland |

Economic Events: Switzerland, Week October 17 |

However, there are two mitigating factors that will not be lost on investors. First, regardless of the decision, one side or the other will appeal to the UK Supreme Court. A decision would be expected before the end of the year. Second, in some ways, and not to put too fine of a point on it, but what the UK wants may not be the deciding issue (and who doesn’t want one’s cake and eat it?).

It is not in the EU’s interest to make it easy anyone that wants to leave or to allow any member to treat the Community as a smorgasbord where one can pick the and chose one what is on one’s plate. Benefits cannot come without costs. The idea that the UK can retain access to the single market without accepting the free movement of people is a non-starter. Judging from comments from EU’s Tusk, any exit from the EU will be a hard exit. Article 50 of the Lisbon Treaty, which is to govern the exit process, is designed to give the EU not the member state the upper hand in the negotiations.