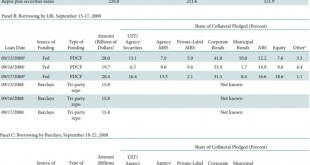

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

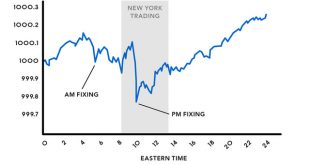

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into nothing more than a TV studio for financial cable networks. Some might be closer to the truth and say that the most important building is the true New York Stock Exchange located in Mahwah, New Jersey however that also is not true as the NYSE...

Read More »Bank Of America Reveals “The Next Big Trade”

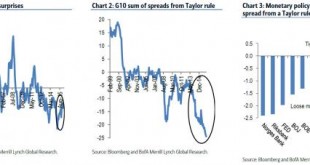

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first. The market has started testing the central banks In...

Read More »Panama Tax Haven Scandal: The Bigger Picture

A Huge Leak The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But Why Is It Mainly Focusing On Enemies of the West? But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Assad’s Syria and others disfavored by the West. Former British Ambassador Craig Murray notes: Whoever leaked the Mossack Fonseca papers appears...

Read More »With Wall Street Bitten by the Blockchain Bug, How Do We Admit the Truth About the Technology’s Disruptive Potential?

I attended a panel discussion on private blockchains in banking at UBS in NYC last night. There were two overarching misconceptions that appeared to permeate the discussions: Counterparties can be trusted, hence you can build reliable systems with trusted parties, and; Capital markets are, and always will be predicated upon the legacy, highly centralized hub and spoke model that we know today. Basically, the influential gatekeepers that control access to a centralized, authoritative...

Read More »The Global Run On Physical Cash Has Begun: Why It Pays To Panic First

Back in August 2012, when negative interest rates were still merely viewed as sheer monetary lunacy instead of pervasive global monetary reality that has pushed over $6 trillion in global bonds into negative yield territory, the NY Fed mused hypothetically about negative rates and wrote "Be Careful What You Wish For" saying that "if rates go negative, the U.S. Treasury Department’s Bureau of Engraving and Printing will likely be called upon to print a lot more currency as individuals and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org