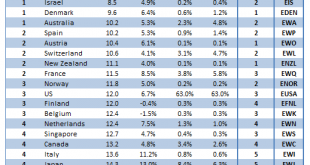

Global equity markets continue to power higher US-China trade tensions have eased MSCI World made a new all-time high today near 2290 and is up 23% YTD Our 1-rated grouping (outperformers) for Q4 2019 consists of Ireland, Sweden, Israel, Denmark, and Australia Our 5-rated grouping (underperformers) for Q4 2019 consists of the UK, Hong Kong, Greece, Germany, and Portugal Since our last update on August 21, our proprietary DM equity portfolio has risen 6.7%, slightly...

Read More »EM FX Model for Q4 2019

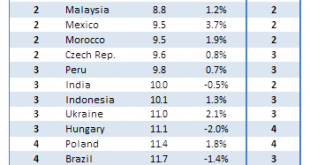

EM FX has rallied sharply in recent weeks, helped by growing optimism that we’ve seen the worst of the US-China trade war Given our more constructive outlook on EM, we believe MSCI EM FX should eventually test the 1657.50 high from July We see continued divergences within the asset class Our 1-rated (strongest fundamentals) grouping for Q4 2019 consists of TWD, THB, PHP, CNY, and KRW Our 5-rated (weakest fundamentals) grouping for Q4 2019 consists of ZAR, TRY, LKR,...

Read More »Dollar Stabilizes as Markets Await Fresh Drivers

Press reports suggest that the mood in Beijing is pessimistic after President Trump pushed back against tariff rollbacks Fed Chair Powell met with President Trump and Treasury Secretary Mnuchin yesterday Hungary is expected to keep rates steady; the deadline to form a government in Israel is fast approaching RBA released dovish minutes from its November policy meeting The dollar is mostly firmer against the majors as markets await fresh drivers. Kiwi and Stockie are...

Read More »Emerging Market Risk Map

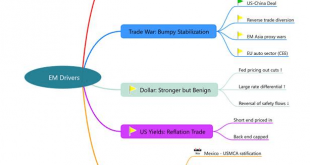

With year-end upon us, we review some of the key risks to EM assets and how we think they progress from here. In short, the two most significant downside risks would be a decisive improvement in Elizabeth Warren’s polling figures and an upset in the US-China trade negotiations. We expect a stronger dollar and higher yields in the near-term but with the upside for both capped, leaving us with a modestly favourable risk-taking environment. In terms of risk...

Read More »EM Preview for the Week Ahead

EM was mostly lower last week, as doubts crept in about the recent trade optimism. Some events also served as reminders of idiosyncratic EM risk that can’t be overlooked, such as downgrade risks (South Africa), failed oil auctions (Brazil), and violent protests (CLP). EM may remain on its back foot until we get further clarity on the US-China talks, but we remain confident in our call that a deal will be struck soon that lower existing tariffs. AMERICAS Mexico...

Read More »Dollar Rally Stalls as Fresh Drivers Awaited

US-China relations continue to improve with news of cooperation in a major fentanyl case Eurozone final services and composite PMIs surprised on the upside; UK Parliament will be dissolved today Poland is expected to keep rates steady at 1.5%; Russia October CPI is expected to rise 3.8% y/y China sold €4 bn in its first euro-denominated bond since 2004; Thailand cut rates 25 bp to 1.25%, as expected The dollar is mostly softer against the majors as its recent rally...

Read More »EM Preview for the Week Ahead

EM should continue to benefit from the generalized improvement in the global backdrop. Trade tensions have eased whilst the risks of a hard Brexit have fallen, at least for now. Yet recent developments in some major EM countries underscores how important it is for investors to differentiate between the strong credits and the weak ones. For instance, South Africa, Hong Kong, Argentina, and Chile all come with idiosyncratic risks. AMERICAS Chile reports September GDP...

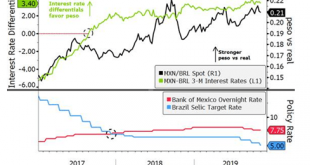

Read More »Mexico vs. Brazil Near-Term Outlook

Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real. These include: (1) the peso will maintain its carry advantage for some time; (2) hedging-related flows should be mixed for the real, but could net as a drag; (3) Mexico’s near-term...

Read More »FOMC Preview

The FOMC begins a two-day meeting today with the decision due out tomorrow afternoon. The Fed is widely expected to cut rates 25 bp for the third meeting in a row. What’s next? RECENT DEVELOPMENTS US data have undeniably softened in September. Weakness in the manufacturing sector appears to have spread to the wider economy. ISM PMI, jobs, CPI, PPI, and retail sales all came in weaker than expected. So too have inflation expectations. October data is just...

Read More »Dollar Firm as Two-Day FOMC Meeting Begins

The dollar continues to gain traction as the two-day FOMC begins; US political uncertainty has entered a new phase Yesterday marked the third time that UK Prime Minister Johnson lost a vote for elections; he will try again today Weak South Africa data support our call for imminent easing; the threat of sanctions against Turkey are back on the table Lower than expected Tokyo October CPI was reported The dollar is mostly firmer against the majors as the FOMC’s two-day...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org