Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses. As April reserves data...

Read More »Dollar Remains Under Pressure as Risk-on Sentiment Persists

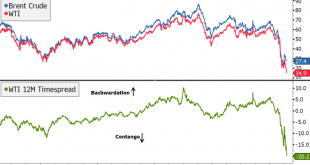

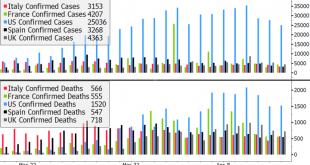

The death toll from the virus continues to trend lower in Europe and the US; the dollar remains under some pressure The Fed announced an expansion of its Municipal Liquidity Facility (MLF); regional Fed manufacturing surveys for April continue to roll out; other data will be reported Sweden kept rates and QE steady, as expected; Hungary is expected to stand pat too Oil prices are tumbling again Japan reported soft March jobs data; HKMA stepped up its intervention...

Read More »Drivers for the Week Ahead

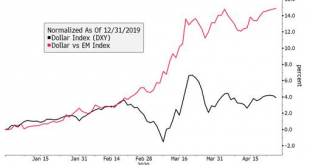

The FOMC meets Wednesday; first look at Q1 US GDP comes out Wednesday; weekly jobless claims Thursday are expected at 3.5 mln vs. 4.427 mln last week Italy dodged a bullet last Friday; ECB meets Thursday; eurozone reports Q1 GDP and April CPI data ahead of the ECB decision; Sweden’s Riksbank meets Tuesday BOJ meets Monday; Japan has a busy data week after the BOJ meeting The dollar continues to edge higher. On Friday, DXY traded at the highest level since April 6...

Read More »Thoughts on the Potential Market Impact of US Downgrades

Our sovereign rating model suggests the US will lose its AAA/Aaa rating. With fiscal stimulus efforts continuing with this latest $484 bln package, the case for downgrades just keep getting stronger but the timing is unclear. How might markets react? We look back to 2011 for some clues. RECENT DEVELOPMENTS The White House and House Democrats struck a deal on a new aid package worth $484 bln. The extra $500 bln amounts to about 2.5% of GDP. The IMF estimated...

Read More »Dollar Steady as Global Economy Falls Off a Cliff

The virus news stream is negative today; the dollar is trying to build on its recent gains Weekly jobless claims are expected at 4.5 mln vs. 5.245 mln last week; regional Fed manufacturing surveys for April continue to roll out ECB confirmed reports that it will accept sub-investment grade debt as collateral; EU leaders will hold a video conference today Preliminary April eurozone PMI readings were awful; UK readings were even worse Japan reported weak preliminary...

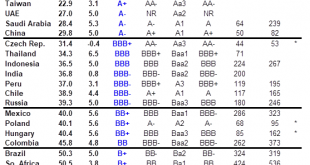

Read More »EM Sovereign Rating Model For Q2 2020

The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come. We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs. While the situation is still fluid with regards to the ultimate coronavirus impact on the global economy as well as the policy responses, we thought it...

Read More »Dollar Stalls as Market Sentiment Improves

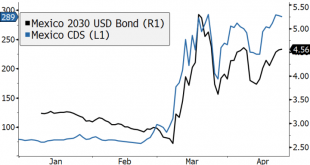

The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth $484 bln Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon ECB will consider accepting sub-investment grade bonds as collateral in its operations; reports suggest Italy will boost its fiscal stimulus efforts UK reported March CPI data; Turkey is expected...

Read More »Dollar Firm as Equities and Oil Start the Week Under Pressure

The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US Chicago Fed National Activity Index for March will be reported; late Friday, Moody’s downgraded Mexico a notch to Baa1 with negative outlook The debate about re-opening...

Read More »Dollar Firm in Thin Holiday Trading

The virus news stream is mostly positive today; yet risk assets are starting the week under some modest pressure The dollar took a hit last week but we think it will recover; some US data releases from Good Friday are worth repeating With most of Europe closed today, the news stream from the region is very light; oil prices could not extend their gains today after OPEC+ finalized output cuts over the weekend India March CPI is expected to ease to 5.90% y/y from 6.58%...

Read More »Dollar Under Modest Pressure as Europe Returns from Holiday

The tug of war between extending vs. softening lockdowns continues The dollar remains under modest pressure but we think it will eventually recover; Bernie Sanders has endorsed Joe Biden Europe reopens from holiday today but the news stream remains light; South Africa surprised with an emergency 100 bp rate cut Japan Prime Minister Abe’s approval rating is taking a hit; China’s trade figures for March came in far better than expected The dollar is mostly softer...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org