The risks of a hard Brexit are perhaps higher than markets appreciated. Here, we set forth some possible scenarios as to what may unfold after the January 31 deadline. Uncertainty is likely to be protracted and markets hate uncertainty. As such, we see UK assets continuing to underperform. RECENT DEVELOPMENTS Fears of a hard Brexit are still alive and well. Prime Minister Johnson is pushing to guarantee a Brexit by end-2020 even if a new trade arrangement is not in...

Read More »EM Preview for the Week Ahead

Risk assets such as EM got a big boost last week, as tail risks from a hard Brexit and the US-China trade war have clearly ebbed. Still, the initial lack of details on the Phase One deal as well as uncertainty regarding the next phases have left the markets a bit jittery and nervous. Hopefully, this week may bring some further clarity and the good news is that the December 15 tariffs have been canceled. AMERICAS Brazil COPOM minutes will be released Tuesday. It cut...

Read More »Risk Assets Rally as Major Tail Risks Ease

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off During the North American session, US November retail sales will be reported Russia central bank cut rates 25 bp to 6.25%, as expected Bank of Japan released a mixed Q4 Tankan report The dollar is broadly lower against the majors as tail risk evaporates. Nokkie and sterling are outperforming, while Aussie and yen are...

Read More »EM Preview for the Week Ahead

EM has had a good month so far as market optimism on a Phase One trade deal remains high.Yet November trade data due out this week should show that until that deal is finalized, the outlook for EM remains weak. Deadline for the next round of US tariffs is December 15 and so talks this week are crucial. Lastly, three major EM central banks are expected to cut rates this week, underscoring the downside risks to growth. AMERICAS Mexico reports November CPI Monday,...

Read More »Dollar Soft on Weak Data and the Return of Tariff Man

The dollar has taken a hit from the weaker than expected data Monday Tariff man is back The US economy remains solid in Q4 but there are some worrying signs for the November jobs data Friday The political pressure on Turkey from the US could increase soon; South Africa’s Q3 GDP came in well below expectations at -0.6% q/q and 0.1% y/y Japan JGB auction went poorly on supply concerns ahead of planned fiscal stimulus; RBA kept rates steady at 0.75% but the outlook was...

Read More »EM Preview for the Week Ahead

Over the weekend, China reported stronger than expected November PMI readings while Korea reported weaker than expected November trade data. While the China data is welcome, we put more weight on Korea trade numbers, which typically serve as a good bellwether for the entire region. Press reports suggest the Phase One trade deal has stalled due to Hong Kong legislation passed by the US Congress. Until a deal is wrapped up, we remain cautious on EM. AMERICAS Chile...

Read More »Dollar Builds on Recent Gains

The dollar remains resilient; optimism towards a Phase One deal continues to support risk appetite There was also optimism from Fed Chairman Powell yesterday; the US economy is not out of the woods yet Turkish President Erdogan started deploying Russia’s S-400 missile system, raising the specter of sanctions Hong Kong reported weak October trade data; Philippine central bank Governor Diokno said a December cut was possible The dollar is mostly firmer against the...

Read More »Drivers for the Week Ahead

The dollar was surprisingly resilient last week; we look for further dollar gains ahead It is a holiday shortened week in the US, but there are still some major data releases There is a fair amount of eurozone data this week; UK Prime Minister Johnson unveiled his Tory manifesto Hong Kong held local elections this weekend; tensions between Japan and Korea appear to have eased, but questions remain The dollar was surprisingly resilient last week. Despite the lack of...

Read More »Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue South Africa is expected to cut rates by 25 bp to 6.25% Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected The dollar is mostly weaker against the majors in very narrow ranges as markets...

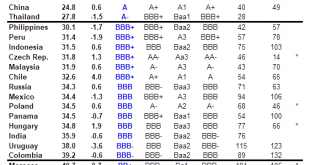

Read More »EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance. These scores...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org