Despite some positive developments last week, we think the three key issues for risk assets have not been resolved yet. Hong Kong protests continue, while reports suggest the US and China remain far apart. Even Brexit has likely been given only a three month reprieve. We remain negative on EM until these key issues have been ultimately resolved. China reports August money and loan data this week but no data has been set. With the recently announced cuts in...

Read More »Latest Thoughts on the US Economic Outlook

The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising. RECENT DEVELOPMENTS US ISM manufacturing PMI fell to 49.1 vs. 51.3 expected. This is the first sub-50 reading since August 2016 and the lowest since January 2016. The employment component fell to 47.4 from 51.7 in July, while new orders fell to 47.2 from 50.8...

Read More »Drivers for the Week Ahead

We remain dollar bulls; this is an important data week for the US Final August eurozone manufacturing PMIs will be reported Monday; UK reports August PMIs this week RBA meets Tuesday and is expected to keep rates steady at 1.0%; BOC meets Wednesday and is expected to keep rates steady at 1.75% Swedish Riksbank meets Thursday and is expected to keep rates steady at -0.25%; in EM, the central banks of Chile and Russia meet Market sentiment rallied last week on a lot of...

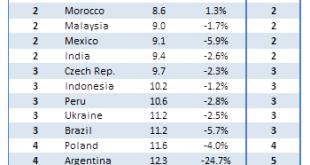

Read More »Emerging Markets: FX Model for Q3 2019

The broad-based dollar rally remains intact despite the market’s overly dovish take on the Fed We still believe markets are vastly overestimating the Fed’s capacity to ease in 2019 and 2020 What’s clear is that the liquidity story is not enough to sustain EM MSCI EM FX is on track to test the September 2018 low near 1575 and then the April 2017 low near 1568 Our 1-rated (strongest fundamentals) grouping for Q3 2019 consists of TWD, PHP, CNY, THB, and KRW Our...

Read More »Dollar Firm as Markets Calm

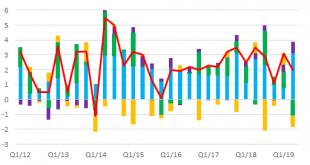

- Click to enlarge Market sentiment has improved after President Trump said China has asked to restart trade talks PBOC fixed the yuan basically flat and firmer than what models suggested The G-7 summit wraps up today with little to show for it We believe the Chicago Fed National Activity Index remains the best indicator to gauge US recession risks Germany July IFO business climate came in weaker than expected The lira experienced a flash crash against the yen...

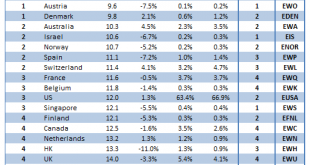

Read More »DM Equity Allocation Model For Q3 2019

We recently introduced our Developed Markets (DM) Equity Allocation model. Building on the success of our EM model, this new framework extends our analysis to cover 24 DM equity markets. Our analysis is meant to assist global equity investors in assessing relative sovereign risk and optimal asset allocation across countries within the DM universe. DM EQUITY OUTLOOK Global equity markets have come under pressure in recent weeks as the US-China trade war intensified....

Read More »Dollar Firm Ahead of Jackson Hole

FOMC minutes were not as dovish as many had hoped; bond and equity markets are set up for a big reset Today sees the start of the annual Fed symposium in Jackson Hole; the US reports a slew of data Markit flash eurozone August PMI readings were reported; ECB publishes the account of its July 25 meeting Japan-Korea relations continue to deteriorate Indonesia delivered a dovish surprise; Mexico and Brazil report mid-August inflation data The dollar is broadly firmer...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org