True story: Many weekends during my studies in Changzhou, China, my friends and I would go out to have a drink only to realize that our favorite bar was not open that night. In fact, all of the city’s clubs would be closed. The reason? Police had decided to crack down on these nightclubs. These would mostly be drug-related crackdowns, but other reasons such as prostitution would make the list. This seemed to happen in cycles. Once the crackdown happened, things would cool down and gradually build up again to reach a climax, in which another crackdown would happen. Crackdowns are a well-known theme in the Chinese economy as well. Nowadays, any online search about the Chinese economy will show results that include the word “crackdown.” There is a pattern of

Topics:

Taulant Mandreja considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

True story: Many weekends during my studies in Changzhou, China, my friends and I would go out to have a drink only to realize that our favorite bar was not open that night. In fact, all of the city’s clubs would be closed. The reason? Police had decided to crack down on these nightclubs. These would mostly be drug-related crackdowns, but other reasons such as prostitution would make the list. This seemed to happen in cycles. Once the crackdown happened, things would cool down and gradually build up again to reach a climax, in which another crackdown would happen.

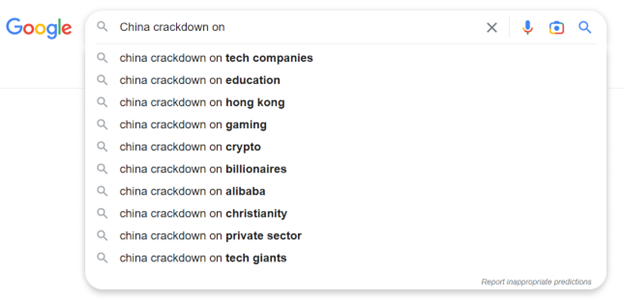

Crackdowns are a well-known theme in the Chinese economy as well. Nowadays, any online search about the Chinese economy will show results that include the word “crackdown.” There is a pattern of occasional crackdowns on big sectors, specific companies, and even individuals. The reasons are different, but the story stays the same. Sometimes a random company is deemed incompliant by some regulatory agency. Other times, an influential businessperson becomes too vocal and criticizes the government. In many cases, a scapegoat is needed to bring peace during a government crisis.

The crackdowns come in different shapes. A common one is the implementation of a new set of regulations. Another one is just stricter enforcement of regulations that are already in place. Every now and then, it has suited the country’s leaders to relax their iron grip on the economy and allow a degree of economic liberty. Corruption also plays a big role in these relaxations. The libertarian in me thinks also that sometimes, the lax enforcement is just the government’s incompetence and its inability to enforce regulations on everyone, all the time.

China was once the leading country in crypto mining. In May 2021, the Chinese government vowed to put an end to crypto mining and trading in China, which from a regulatory point of view had been illegal since 2019. Soon enough, videos of hundreds of processors being destroyed, sometimes with road rollers, were released. The data from the Cambridge Bitcoin Electricity Consumption Index, which tracks the IP addresses of mining-facility operators that connect to the servers of bitcoin mining “pools,” shows that China’s mining operations hash rate went from 75.73 percent on September 2019 to 21.11 percent as of January 2022.

Similar crackdowns have been happening since 2013. The crackdowns have been defended as protecting the stability of China’s economic growth, but with the growing state surveillance of transactions, the crackdown in 2021 seems to have been caused by the growing fear of the government and the central bank of losing their grip on monetary sovereignty. This crackdown was the first time the central bank and Beijing-based regulators joined forces to explicitly ban all crypto activities, definitely not a union to mess with. Moreover, cryptocurrencies would have been in direct competition with the sovereign digital yuan, which is in advanced pilot stage—not exactly a situation preferred by the government.

DiDi, the Uber-like app, fell under the regulators’ radar when it tried to list its shares at the New York Stock Exchange, most likely without the blessing of Beijing bureaucrats. Government officials soon deployed their regulatory forces against DiDi, which had five hundred million users at the time (far more than Uber). Accusations started to emerge, such as the claim that DiDi had violated personal data rules. These accusations were enough for the app to be banned from all mobile app stores in China.

As usual, the regulations were in place for quite some time, and the crackdown happened when it suited the government. It tumbled DiDi stock by over 20 percent. Almost all the largest Chinese tech firms list their shares on American or Hong Kong stock exchanges. There are hundreds of start-ups that have yet to follow giants like Alibaba, Tencent, and DiDi in listing their shares and that now have to worry about going down the same path as DiDi if do what is best for their company.

The famous Jack Ma suffered the same fate for criticizing China’s financial sector, and he seemed to have lost more than anyone. Jack Ma was a former English teacher who led the tech boom that forever transformed China’s economic sphere and built an incredible empire. The Alibaba Group, initially founded as a business-to-business marketplace site, later expanded into a wide range of areas. Jack Ma’s story inspired a generation of Chinese entrepreneurs. Alibaba includes e-commerce, technology, and online payment companies, the most important being Ant Group, which owns Alipay, the world’s largest payment platform at more than 1.3 billion users, eighty million merchants, and a total payment volume of ¥118 trillion in June 2020.

In late 2020, Ma was preparing for Ant Group’s stock market flotation in a $37 Billion IPO, which would have been the largest ever at the time. But on October 24, 2020, just weeks before the listing, Ma gave a now infamous speech at the Bund Finance Summit in Shanghai in which he compared China’s state-owned banks to pawn shops and blamed Chinese regulators for stifling innovation. “The competition tomorrow will focus on innovation, not regulatory capabilities,” he said in the speech. On November 3, 2020, Chinese regulators suspended Ant’s IPO. Ant was fined $2.78 billion in April 2021 and forced to undergo a systematic restructuring, and Ma stepped down. Another company appeared to bite the dust.

We cannot say for sure that all this happened because of the speech or that Ma’s time had come due to his ever-growing influence in China. What we can say is that the Chinese government will not allow any individual to hold that much power. Over the past several years, many of China’s top tech figures have stepped down from their leadership roles amid Beijing’s sweeping crackdowns on the sector.

The effects of these crackdowns vary widely, from not being able to access a favorite club to billions of dollars being wiped out. The most concerning of all is the state of uncertainty faced by entrepreneurs and the Chinese private sector as a whole. The era that Jack Ma led is over, and what is happening in China could shut all the doors to innovation.

With a crackdown cycle in place, the future does not look good for China. But even though crackdowns are hurting China’s business prospects, if the Chinese regime abandons this approach, a rebound has every opportunity to occur.

Tags: Featured,newsletter