The International Monetary Fund (IMF) has warned about the optimistic estimates for 2023, stating that it will likely be a much more difficult year than 2022. Why would that be? Most strategists and commentators are cheering the recent decline in price inflation as a good signal of recovery. However, there is much more to the outlook than just a moderate decline in price inflation rates. Price inflation is accumulative, and the estimates for 2023 and 2024 still show...

Read More »The Fed’s Quantitative Easing Gamble Costs Taxpayers Billions

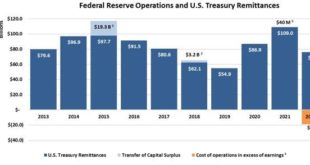

[Reprinted with permission of the authors.] The year 2023 is shaping up to be a challenging one for the Federal Reserve System. The Fed is on track to post its first annual operating loss since 1915. Per our estimates, the loss will be large, perhaps $100 billion or more, and this cash loss does not count the unrealized mark-to-market losses on the Fed’s massive securities portfolio. An operating loss of $100 billion would, if properly accounted for, leave the Fed...

Read More »The Trillion-Dollar Coin Idea Is Just Another Way to Rip Us Off

Here we go again. Every few years in Congress there is a purely political battle over the debt ceiling. We’re supposed to be horrified and worried that the US might default on some of its debt. Some commentators will insist the US has never defaulted, and that default be a disaster. (That’s wrong, by the way. The US has defaulted before.) But these debt ceiling debates always end the same way. Congress ends up increasing the debt ceiling and the US’s national debt...

Read More »Fiat Money Inflation Not Only Raises Prices but Also Undermines Division of Labor

The line for the self-checkout registers at my neighborhood Albertsons stretched into the store’s produce section. Is this human progress? I wondered, scanning my groceries—this just after I had filled my car’s gas tank at a not-so-convenient convenience store near work. Not long ago, someone not only pumped your gas and cleaned your windshield but also checked your oil and tire pressure while you waited comfortably behind the wheel of your car. Gas retailers were...

Read More »Why the Fed Is Bankrupt and Why That Means More Inflation

In 2011, the Federal Reserve invented new accounting methods for itself so that it could never legally go bankrupt. As explained by Robert Murphy, the Federal Reserve redefined its losses so as to ensure its balance sheet never shows insolvency. As Bank of America’s Priya Misra put it at the time: As a result, any future losses the Fed may incur will now show up as a negative liability (negative interest due to Treasury) as opposed to a reduction in Fed capital,...

Read More »The Rise and Fall of Good Money: A Tale of the Market and the State

Ludwig von Mises’s book The Theory of Money and Credit is a masterwork of monetary theory. Despite being written in the early twentieth century, its arguments and conclusions are still valid and interesting today. Mises describes five characteristics that are vital to the function of money: marketability, durability, fungibility, trustworthiness, and convenience. The history of money is straightforward. Markets developed and expanded as long as the private sector...

Read More »The Fed Is a Purely Political Institution, and It’s Definitely Not a Bank.

Those who know Wall Street lore sometimes recall that Fed chairman William Miller—Paul Volcker’s immediate predecessor—joked that most Americans believed the Federal Reserve was either an Indian reservation, a wildlife preserve, or a brand of whiskey. The Fed, of course, is none of those things, but there’s also one other thing the Federal Reserve is not: an actual bank. It is simply a government agency that does bank-like things. It’s easy to see why many people...

Read More »Australia: The Nation Founded by British Convicts Embraced Entrepreneurship

Australia’s superb performance on measures of international development has earned her the admiration of many. Few countries can boast such stellar achievements in economic and social affairs. Currently, Australia has the highest median wealth per adult in the world and outperforms the Organisation for Economic Co-operation and Development (OECD) average in civic engagement, health, education, and other dimensions of well-being. Australians are equally lauded for...

Read More »The Politicization of Procreation: The Ultimate in “the Personal Is Political”

In the ultimate example of “the personal is political,” families form, break up, or expand due to US presidential elections according to a recent article in the American Economic Review. Apparently, the alternative responses of doom or elation that occasions electoral politics is so extreme that the losers couldn’t bear to bring a child into such a world, while the winners . . . well, you know. In setting the stage for this phenomenon, the authors noted that when...

Read More »Real Wages Fall for the Twenty-First Month as Rent and Food Prices Keep Rising

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in fifteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.5 percent year over year during December, before seasonal adjustment. That’s the twenty-second month in a row of inflation above the Fed’s arbitrary...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org