Contemporary businesses use artificial intelligence (AI) tools to assist with operations and compete in the marketplace. AI enables firms and entrepreneurs to make data-driven decisions and to quicken the data-gathering process. When creating strategy, buying, selling, and increasing marketplace discovery, firms need to ask: What is better, artificial or human intelligence? A recent article from the Harvard Business Review, “Can AI Help You Sell?,” stated, “Better...

Read More »Joe Biden Calls for the FTC to Resurrect the Robinson Patman Act. It’s a Very Bad Idea

As former Federal Trade Commission (FTC) chairman Timothy J. Muris has recently noted, “President Biden rejects the economics-driven antitrust policies of the past 40 years.” In contrast, President Joe Biden “promised to return to earlier antitrust traditions.” Unfortunately, “those traditions were abandoned for good reason: they harmed consumers.” An important illustration Muris uses is the 1936 Robinson-Patman Act (RPA), which used to be a lynchpin of antitrust...

Read More »Capitalism Has Improved Life in India, but the Spirit of Collectivism Still Dominates

India is currently the seventh-largest country in the world with the largest youth population. There are many elements that make this country unique, the foremost being diversity—diversity of culture, race, ethnicity, and linguistics. India faced an era of colonialism under the British, who would take raw material from India at cheaper rates and import the finished products. India and Nigeria are both countries that gained independence from Britain in the same...

Read More »Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in sixteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.4 percent year over year in January before seasonal adjustment. That’s down very slightly from December’s year-over-year increase of 6.5 percent, and...

Read More »Three Reasons Why Secession and Decentralization Are Better for Human Rights

[This article is the Introduction to Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities.] The world is now, and has always been, politically decentralized. At no time in history has all of humankind been ruled by a single political regime. Although the Roman Empire claimed to be universal, the Romans never even conquered all of Europe, let alone the whole inhabited world. Roman power never extended to India, China, Sub-Saharan...

Read More »Why Mises’s Theory of Economic Calculation Still Is Relevant Today

Until the publication in 1920 of Ludwig von Mises’s work on the problem of economic calculation in socialism, there was no scientifically useful analysis of the economics of the socialist economy. With that work , and its development in the comprehensive treatise Die Gemeinwirtschaft (1922 and 1932, published in English in 1951 as Socialism: An Economic and Sociological Analysis), Mises demonstrated that because of the absence of private ownership of the means of...

Read More »Federal Government Spending Is Out of Control and Unsustainable. Maine Shows a Way to Reduce Spending.

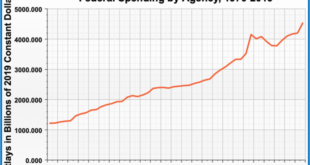

The Biden administration has increased federal government spending by a record $3.4 trillion since January 2021. That includes such signature bills as the American Rescue Plan Act of $1.8 trillion, the Inflation Reduction Act of $50.6 billion, and the Infrastructure Investment and Jobs Act of $764.9 billion. As well as providing official costings for those bills, the Congressional Budget Office has found that a number of executive orders contribute nearly another $1...

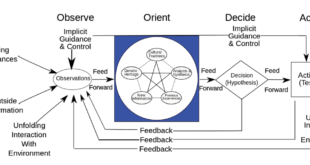

Read More »Erik Schön: The Art Of Strategy

What is strategy, and is it useful for business? Business schools want you think it is the critical factor in competitive success or failure. They teach structured markets, divided up by market share, with boundaries and external and internal forces to be assessed and countered. “Where to play and how to win.” They see strategy through their lens of financialization and utilize fictitious economic calculations like discounted future cash flows and market...

Read More »Does Government Create a “Level Playing Field” or Does It Make the Field More Uneven?

Bernie Sanders and other politicians have made socialism attractive to voters, especially young ones, because it promises to eliminate the injustices of capitalism. As to what socialism and capitalism mean, no one seems to care much, other than that by socialism, they mean a kinder, caring society without income extremes, whereas capitalism is the preferred system of ruthless exploiters who amass obscene fortunes while real workers struggle to survive. In recent...

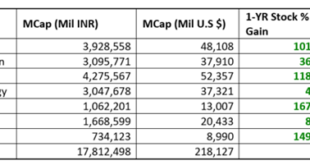

Read More »The Case of Adani versus Hindenburg

Between 2019 and 2022, the fortune of India’s Gautam Adani swelled from $9 billion to $127 billion. As the value of his seven publicly traded companies—providers of everything from natural gas to digital services—soared, he was briefly the world’s second-richest person. His meteoric rise caught the attention of Hindenburg Research, a small US investment firm devoted to profiting by exposing corporate malfeasance. Viewing with suspicion the several-hundred-percent...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org