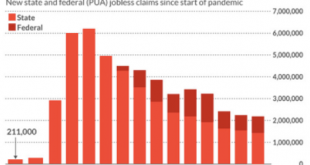

Interview with Robert Hartmann As we enter the second quarter of 2021, the year during which so many mainstream analysts and politicians have predicted we’ll see a miraculous recovery from the covid crisis, it is becoming increasingly clear that the damage inflicted by the lockdowns and the shutdowns is really very extensive an persistent. Of course, I’m referring to the damage to the real economy, that is, to actual businesses, households and the countless citizens...

Read More »“Self-control and self-respect have become undervalued”

Interview with Theodore Dalrymple After a year of lockdowns, social isolation, financial uncertainty and extreme political polarization, a lot of people are finding it very difficult to remain optimistic and to see a way back to some kind of normalcy. While the economic, social and political impact of the covid crisis can be easily identified and frequently discussed, the unseen, psychological pressures that millions of people are struggling with often go...

Read More »“The real danger comes from massive state dependence” – Part II

INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN – Part II of II Claudio Grass (CG): Since the start of the pandemic, we’ve witnessed extreme efforts to increase top-down control and to centralize power in ways that affect almost all aspects of a citizen’s life. Do you expect that this can all be reversed once the crisis is over, or has the Rubicon been crossed? HSH Prince Michael of Liechtenstein (PM): I still hope, but I am not very confident,...

Read More »“The real danger comes from massive state dependence”

INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN – Part I of II As we’re preparing to leave 2020 behind, a year that will most likely feature prominently in future history books, it is hard to look back on all that has happened without a sense of apprehension and uncertainty over what lies ahead. A lot has changed, economically, socially and politically, and those changes and challenges are unlikely to subside in the year to come. Whether they have paved the...

Read More »Swiss direct democracy in action

On the last Sunday of November the Swiss citizens once again rejected efforts staged by left-leaning groups and NGOs to chip away at the nation’s long tradition of free enterprise, respect for private property and financial freedom. Two important proposals were brought before the Swiss people in a set of referendums, both targeting private companies and attempting to place unprecedented burdens, threatening their ability to operate freely and profitably. The first...

Read More »The far-reaching impact of the US election

The 2020 election was a roller coaster experience for both sides and for all International observers who understood its massive economic and geopolitical implications for the rest of the West. There was no shortage of drama, sensationalism, half-truths and full untruths at every stage of the process, from the Democratic primaries right to this day, with politicians and partisan journalists painting their own version of reality, fueling divisions and rallying their...

Read More »Second lockdown in Europe

Implications for precious metals investors As the long-awaited “second wave” of the corona pandemic sweeps through Europe, another round of severe restrictions, travel bans and rules that prevent the proper function of international business and trade threatens to once again disrupt all kinds of sectors, including the gold industry. Lockdown 2.0 Until only a couple of months ago, multiple heads of state, government officials and all kinds of experts were openly...

Read More »Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II

Money – sound and unsound - Click to enlarge Interview with Rafi Farber: Part II of II Rafi Farber, pen name Austrolib, is the publisher of The End Game Investor, a daily market commentary written from an Austrian economics perspective focusing on precious metals, the Comex, and monetary analysis. His work is followed by leaders in the precious metals industry including Eric Sprott. He also writes a weekly column on the gaming industry at CalvinAyre. Contact him...

Read More »“Gold is Money, Everything Else Is Credit” – J.P. Morgan

Interview with Rafi Farber – Part I of II By now it is probably obvious, even to the most naive of mainstream narrative followers, that we are well past the point of no return on many fronts. Politics, on a national and global level, are never getting back to “normal”, the economy is already knee-deep in a severe recession, while social frictions and public discontent with governments, institutions and all kinds of rulers and central planners is on a sharp and...

Read More »Unless the US stops printing money, the dollar will collapse

Interview with Patrick Barron – Part II of II Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about? Patrick Barron (PB): Banks are financial intermediaries. They take deposits and make loans. That has been going on for millennia. What we...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org