Part I of II For decades, physical gold investors have had to contend with superficial, naive and wholly ahistorical “arguments” from the mainstream financial press, from economists and experts of all stripes, claiming that gold is nothing but a barbarous relic. To them, the yellow metal is akin to investment superstition. It has no yield, it serves no practical purpose and the only attraction they could conceive of is merely symbolic, or perhaps,...

Read More »Is Switzerland still a safe jurisdiction for precious metals investors?

Over the last two years, we’ve all witnessed state abuses of power and extreme overreaches the likes of which many average citizens had never imagined they’d see in their own lifetimes. This caused a great part of the body politic in many Western nations to revisit their previously held beliefs about what is and isn’t possible for their governments to do and to question whether there really is such a thing as going “too far” or whether anyone in the...

Read More »Russia’s “gold peg”: Lessons for Western investors

It is undeniable that the ongoing crisis in Ukraine has polarized Western societies to an extent unseen in decades in any other foreign conflict. For over a month, we have been bombarded unceasingly by all mainstream media sources with reports and stories about Russia’s invasion and this conflict has already created deep social rifts in many other nations, and EU members in particular. No matter where one stands on this topic and no matter how passionate one might...

Read More »Cantillon effect: Who’s paying the highest price?

Every time we hear government officials announce their big spending plans, their new welfare programs and their ambitious “job creating” schemes, they always present them as being in defense of the poorest and the most marginalized members of our societies. In coordination with their central bankers, they print and spend new money at will, claiming that it is all for the benefit of the weakest among us and that all the freshly created funds will support them...

Read More »Ukraine conflict: A dispassionate analysis

I realize that I shouldn’t be surprised at the way the crisis in Ukraine has divided our societies or at the blind fanaticism the conversations around it have provoked. After all, virtually every other development of consequence has tuned out exactly the same. From covid to the economy and from freedom of speech to science itself, rational, respectful and productive debates are nowhere to be found. Dogma, propaganda, and zealotry have prevailed, with the unrelenting...

Read More »Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that the only way...

Read More »The forgotten art of Debate

One quick glance at different news headlines or just 5’ switching between TV networks suffice to convince even the most naive news consumer that there is something seriously wrong with the way public discourse was (d)evolved in our societies over the last years. Of course, journalism was never entirely devoid of bias, not even in its “golden age”. Reporters and editors are merely human after all and their own views, beliefs, hopes and opinions have always tainted...

Read More »JERM WARFARE WITH ASTRID STUCKELBERGER & CLAUDIO GRASS & BREAKING FREE FROM COVID MADNESS

Astrid Stuckelberger and Claudio Grass have been on my podcast before. Both are from Switzerland, and both featured in the super documentary Planet Lockdown. You can also see the video here: https://jermwarfare.com/blog/astrid-stuckelberger-claudio-grass (copy/past into browser). Feel free to share! [embedded content] You Might Also Like Gold Gives You Personal Sovereignty 2022-03-09 Dave...

Read More »Lessons from 2021: The rational way out

As we are all preparing to bid farewell to 2021, there is a general feeling that this year, much like its predecessor, will not be missed. To my mind, however, it is clear that even though the past 12 months didn’t really teach us anything new, they did help cement the lessons of 2020 and spread important ideas to people who might otherwise have never come to question anything about the status quo. To me, this is a crucial step forward and one that is absolutely...

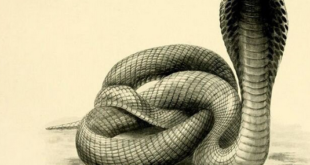

Read More »Government interventions and the Cobra effect – Part II

Part II of II Unsound money, unsound society Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime. Ever since the gold standard was officially...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org