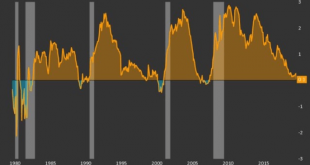

True Money Supply Growth Rebounds in September In August 2019 year-on-year growth of the broad true US money supply (TMS-2) fell to a fresh 12-year low of 1.87%. The 12-month moving average of the growth rate hit a new low for the move as well. The main driver of the slowdown in money supply growth over the past year was the Fed’s decision to decrease its holdings of MBS and treasuries purchased in previous “QE” operations. This was partly offset by bank credit...

Read More »A buying opportunity in precious metals

After a remarkable run over the past few months, gold and silver now appear to have entered a period of consolidation. Many speculators and short-term focused investors have sold their positions fearing a correction, while mainstream market commentators fuel these fears, with analyses that proclaim “the end of the road” for gold and silver. Of course, nothing could be further from the truth. All the very serious concerns and the fundamental reasons that caused the...

Read More »Fed Chair Powell’s Inescapable Contradiction

Under the Influence “This feels very sustainable.” – Federal Reserve Chairman Jerome Powell, October 8, 2019 Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best...

Read More »Repo Quake – A Primer

Chaos in Overnight Funding Markets Most of our readers are probably aware that there were recently quite large spikes in repo rates. The events were inter alia chronicled at Zerohedge here and here. The issue is fairly complex, as there are many different drivers at play, but we will try to provide a brief explanation. There have been two spikes in the overnight general collateral rate – one at the end of 2018, which was a first warning shot, and the one of last...

Read More »A turning point in the bond market?

We’ve recently seen a lot of coverage and even more “expert analyses” on the state of the bond market, to the extent that the average investor, or the average citizen for that matter, is likely to be overwhelmed and very confused about what it all means. Experts from the institutional side and defenders of the current monetary direction argue that it is all the result of policy choices, that’s it’s all under control and that we really shouldn’t worry about the...

Read More »Is it platinum’s time to shine?

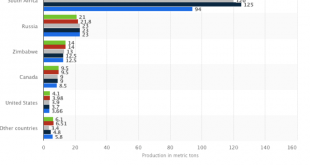

Even with seasoned precious metals investors, it is often the case that platinum gets overlooked, while gold and silver dominate the conversation over which metal affords the best long-term protection of one’s wealth. Nevertheless, platinum has proved to be an excellent store of value, while it also offers a number of interesting advantages as a long-term investment that could play an important part in a conservative and proactive strategy. Although it might not...

Read More »THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the...

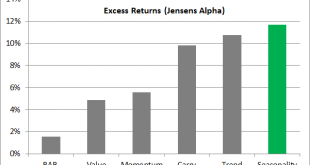

Read More »Scientific Long-Term Study Confirms: Seasonality is the Best Investment Strategy!

A Pleasant Surprise You can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of...

Read More »Paul Tudor Jones Likes Gold

Gold is Paul Tudor Jones’ Favorite Trade Over the Coming 12-24 Months In a recent Bloomberg interview, legendary trader and hedge fund manager Paul Tudor Jones was asked what areas of the markets currently offer the best opportunities in his opinion. His reply: “As a macro trader I think the best trade is going to be gold”. The relevant excerpt from the interview can be viewed below (in case the embedded video doesn’t...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org