Traders and Analysts Caught Wrong-Footed Over the past week gold and gold stocks have been on a tear. It is probably fair to say that most market participants were surprised by this development. Although sentiment on gold was not extremely bearish and several observers expected a bounce, to our knowledge no-one expected this: Back in April the so-called “managed money” category in the disaggregated commitments of...

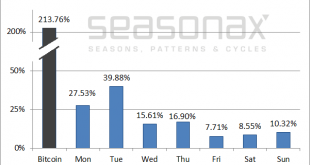

Read More »Bitcoin: What is the Best Day of the Week to Buy?

Shifting Patterns In the last issue of Seasonal Insights I have discussed Bitcoin’s seasonal pattern in the course of a year. In this issue I will show an analysis of the returns of bitcoin on individual days of the week. It seems to me that Bitcoin is particularly interesting for this type of study: it exhibits spectacular price gains, it is a very new instrument and it is unregulated. Moreover, it trades around the...

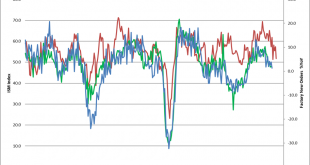

Read More »US Money Supply Growth and the Production Structure – Signs of an Aging Boom

Money Supply Growth Continues to Decelerate Here is a brief update of recent developments in US true money supply growth as well as the trend in the ratio of industrial production of capital goods versus consumer goods (we use the latter as a proxy for the effects of credit expansion on the economy’s production structure). First, a chart of the y/y growth rate of the broad US money supply TMS-2 vs. y/y growth in...

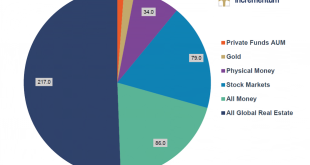

Read More »In Gold We Trust 2019

The New Annual Gold Report from Incrementum is Here We are happy to report that the new In Gold We Trust Report for 2019 has been released today (the download link can be found at the end of this post). Ronnie Stoeferle and Mark Valek of Incrementum and numerous guest authors once again bring you what has become the reference work for anyone interested in the gold market. Gold in the Age of Eroding Trust This year’s...

Read More »Two Junior Miners Offering Arbitrage Opportunities – an Interview with Jayant Bhandari

Maurice Jackson of Proven and Probable Interviews Jayant Bhandari Maurice Jackson of Proven & Probable has just conducted another interview with Jayant Bhandari, who is known to long-time readers as a frequent guest author on this site. Jayant Bhandari Below is a video of the interview as well as a link for downloading the transcript of the interview in PDF form. But first here is a list of the topics discussed:...

Read More »Is Inflation Beginning? Are You Ready?

Extrapolating The Recent Past Can Be Hazardous To Your Wealth “Those who cannot remember the past are condemned to repeat it,” remarked George Santayana over 100 years ago. These words, as strung together in this sequence, certainly sound good. But how to render them to actionable advice is less certain. Aren’t some facets of the past – like the floppy disk – not worth remembering? And aren’t others – like a first...

Read More »In Gold We Trust 2019 – The Preview Chart Book

The new IGWT report for 2019 will be published at the end of May… …and for the first time a Mandarin version will be released as well. In the meantime, our friends at Incrementum have decided to release a comprehensive chart book in advance of the report. The chart book contains updates of the most important charts from the 2018 IGWT report, as well as a preview of charts that will appear in the 2019 report. A brief...

Read More »Bitcoin Bottom Building

Defending 3,800 and a Swing Trade Play For one week, bulls have been defending the 3,800 USD value area with success. But on March 4th they had to give way to the constant pressure. Prices fell quickly to the 3,700 USD level. These extended times of range bound trading are typical for Bitcoin Bottom Building in sideways ranges. This 60 minute chart of Bitcoin shows (represented by the yellow candlestick wicks) how the...

Read More »The Gold Debate – Where Do Things Stand in the Gold Market?

A Recurring Pattern When the gold price recently spiked up to approach the resistance area even Aunt Hilda, Freddy the town drunk, and his blind dog know about by now, a recurring pattern played out. The move toward resistance fanned excitement among gold bugs (which was conspicuously lacking previously). This proved immediately self-defeating – prices pulled back right away, as they have done almost every time when...

Read More »The Recline and Flail of Western Civilization and Other 2019 Predictions

The Recline and Flail of Western Civilization and Other 2019 Predictions “I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” – President Donald Trump, Christmas Day 2018 Darts in a Blizzard Today, as we prepare to close out the old, we offer a vast array of tidings. We bring words of doom and despair. We bring words of contemplation and reflection. And we also bring words of hope...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org