Stars in the Night Sky The U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes. The short-term significance of the DJIA’s 8 percent decline...

Read More »The Big Picture: Paper Money vs. Gold

Numbers from Bizarro-World The past few months have been really challenging for anyone invested in gold or silver; for me personally as well. Despite serious warning signs in the economy, staggering debt levels and a multitude of significant geopolitical threats at play, the rally in risk assets seemed to continue unabated. In fact, I was struggling with this seeming paradox myself. As I kept looking at the state of...

Read More »A Global Dearth of Liquidity

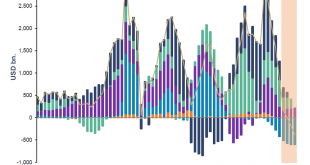

Worldwide Liquidity Drought – Money Supply Growth Slows Everywhere This is a brief update on money supply growth trends in the most important currency areas outside the US (namely the euro area, Japan and China) as announced in in our recent update on US money supply growth (see “Federal Punch Bowl Removal Agency” for the details). The liquidity drought is not confined to the US – it is fair to say that it is a global...

Read More »The Interesting Seasonal Trends of Precious Metals

Precious Metals Patterns Prices in financial and commodity markets exhibit seasonal trends. We have for example shown you how stocks of pharmaceutical companies tend to rise in winter due to higher demand, or the end-of-year rally phenomenon (last issue), which can be observed almost every year. Gold, silver, platinum and palladium are subject to seasonal trends as well. Although gold and silver are generally perceived...

Read More »Pushing Past the Breaking Point

Schemes and Shams Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up. Systems of elaborate folly have been erected with the most impossible of promises. That prosperity can be attained without labor. That benefits can be paid without taxes. That cheap credit can make...

Read More »Eastern Monetary Drought

Smug Central Planners Looking back at the past decade, it would be easy to conclude that central planners have good reason to be smug. After all, the Earth is still turning. The “GFC” did not sink us, instead we were promptly gifted the biggest bubble of all time – in everything, to boot. We like to refer to it as the GBEB (“Great Bernanke Echo Bubble”) in order to make sure its chief architect is not forgotten....

Read More »You Can’t Eat Gold – Precious Metals Supply and Demand

You Actually Can Eat Gold, But Its Nutritional Value is Dubious “You can’t eat gold.” The enemies of gold often unleash this little zinger, as if it dismisses the idea of owning gold and indeed the whole gold standard. It is a fact, you cannot eat gold. However, it dismisses nothing. This gives us an idea. Let us tie three facts together. One, you can’t eat gold. Two, gold is in backwardation in Switzerland. And three,...

Read More »The Gold Standard: Protector of Individual Liberty and Economic Prosperity

A Piece of Paper Alone Cannot Secure Liberty The idea of a constitution and/or written legislation to secure individual rights so beloved by conservatives and among many libertarians has proven to be a myth. The US Constitution and all those that have been written and ratified in its wake throughout the world have done little to protect individual liberties or keep a check on State largesse. Sound money vs. a piece of...

Read More »Fed Credit and the US Money Supply – The Liquidity Drain Accelerates

Federal Reserve Credit Contracts Further We last wrote in July about the beginning contraction in outstanding Fed credit, repatriation inflows, reverse repos, and commercial and industrial lending growth, and how the interplay between these drivers has affected the growth rate of the true broad US money supply TMS-2 (the details can be seen here: “The Liquidity Drain Becomes Serious” and “A Scramble for Capital”)....

Read More »In Gold We Trust – Incrementum Chart Book 2018

The Most Comprehensive Collection of Charts Relevant to Gold is Here Our friends from Incrementum (a European asset management company) have just released the annual “In Gold We Trust” chart book, which collects a wealth of statistics and charts relevant to gold, with extensive annotations. Many of these charts cannot be found anywhere else. The chart book is an excellent reference work for anyone interested in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org