Is the energy crisis something that can be resolved? Was it always inevitable? Will renewable energy make it all OK? Are Western financial policies to blame? All this and more in today’s The M3 Report! If you’re not already subscribed to GoldCoreTV then click here right now to make sure you’re all set to watch the fifth episode of our flagship show. [embedded content] Featuring Mr. Energy himself Steve St. Angelo as well as a short explanation from Brent Johnson on...

Read More »US CPI Data Release Update

It is easy to get caught up in data releases. The media is keen to read a lot into them, hoping it will offer some sense of what is really going on, so often the news is about numbers just announced or expectations for what one economic measure will show from one month to the next. However, as we outline below, many of the numbers that are released on a frequent and regular basis (CPI and employment, for example) can be misleading. Whether it’s down to the inputs or...

Read More »Silver Fever, or Silver Fading?

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked. 😉 Silver Basis and the Dollar This graph goes back one year, through...

Read More »The Russians (Propaganda) Are Coming!

The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh? Not so fast. Betting Against the Incumbent? For one thing, there are sanctions. If you’re a citizen of a Western country, there is a legal barrier between you and a...

Read More »What Problem Does Gold Solve?

Realising that you need to protect your portfolio from financial systemic risks is a tricky thing. Because, not only have you identified that all is not well in the economy but you now need to make a decision about how best to protect your investments. In all likelihood, this is why you own or are thinking about owning gold bullion. Have you ever asked yourself? What problem does gold solve in today’s environment? Should I own gold ETFs or gold bullion? What is and...

Read More »We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

One of the reasons people choose to invest in gold bullion or to buy silver coins is because they are simple and they are finite; basically the opposite of fiat currency. The complexity of fiat-driven markets and infinite possibilities to create money works to the advantage of central banks. . And they particularly like to take advantage when asked by the general public a very obvious question… Central banks are on the defensive over printing too much money during...

Read More »Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance

Dan Oliver of Myrmikan Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the history of credit bubbles, the inevitability of central bank failings, and what history can tell us about the Fed’s current trajectory. Connect with Dan on Twitter: @Myrmikan and at Myrmikan.com Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources CMRE.org Myrmikan.com Gold Backwardation...

Read More »Keith Weiner on the VoiceAmerica Business Channel

CEO Keith Weiner returns to popular radio show Turning Hard Times into Good Times hosted by Jay Taylor. Jay argues that the U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits. The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. Keith and Jay discuss why...

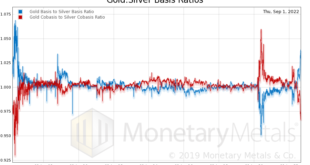

Read More »Silver Update: Scarcity Gets More Extreme

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading. Warren Buffett, 2008, and the Cobasis But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis. It shows a measure of gold’s...

Read More »When markets forget that Central Banks cannot fix the world with interest rates

It would be easy for those who have decided to buy gold and silver bullion to lose heart over the precious metals, had they seen how prices reacted to Chairman Powell’s comments, last week. However, to do this would be very short-sighted. Whilst Powell may well have signaled that the Fed will stay on this path of tightening this does not mean that they have resolved the issue. Rather, it likely means that the Fed is reacting a little too hard, a little too late and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org