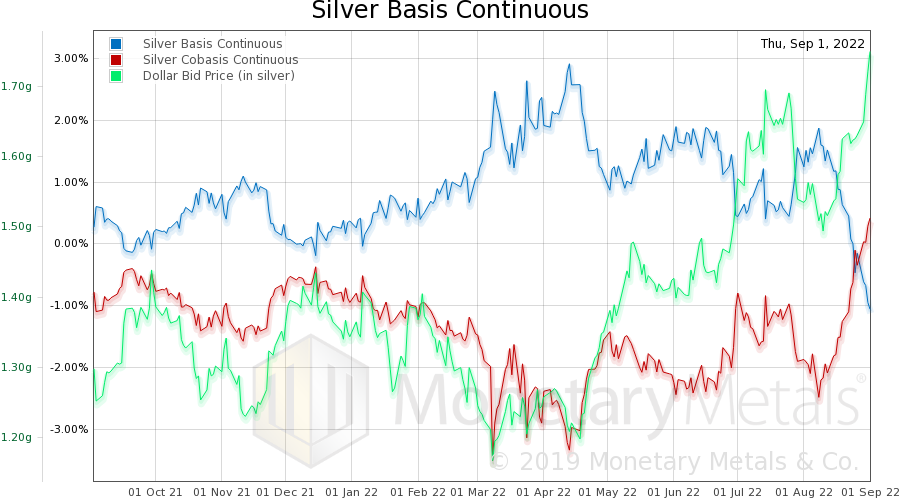

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked. ? Silver Basis and the Dollar This graph goes back one year, through September 1. We ended on this date, because it’s the highest price of the dollar along with the greatest scarcity of silver. Notice the red line going over zero. This is notable, as the 6-month continuous basis seldom goes into backwardation (our definition is stricter than most, backwardation is when

Topics:

Keith Weiner considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, backwardation, Basic Reports, Featured, newsletter, silver

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked. ?

Silver Basis and the DollarThis graph goes back one year, through September 1. We ended on this date, because it’s the highest price of the dollar along with the greatest scarcity of silver. Notice the red line going over zero. This is notable, as the 6-month continuous basis seldom goes into backwardation (our definition is stricter than most, backwardation is when cobasis > 0). As it turns out, we top-ticked the price of the dollar (i.e. called the bottom in the silver price), and put out an article on September 2 (written the day prior, and based on that day’s data). |

|

|

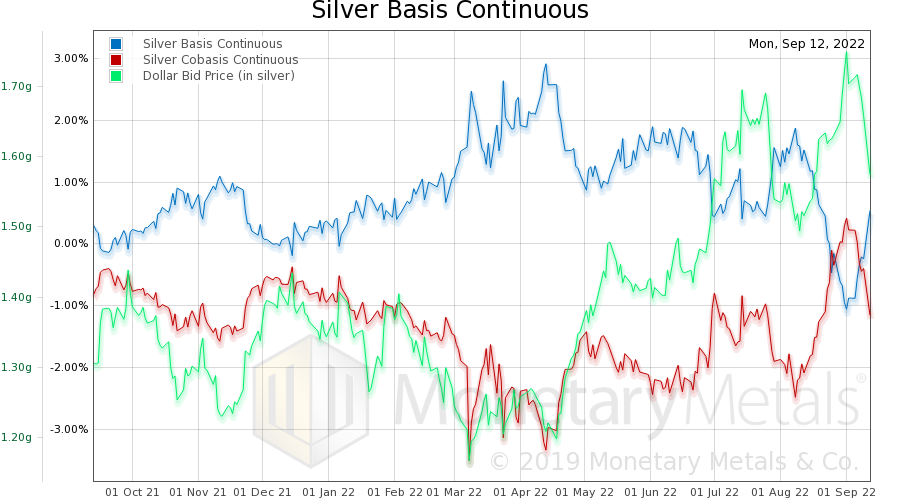

Since then, there’s been a big move downwards in the price of the dollar (i.e. move upwards in the price of silver), and downwards in the scarcity of silver. The correlation continues. Here’s a graph as of September 12. |

Silver Fever

Where to from here? Well, there’s two distinct possibilities. One, the price action from Sep 1 to Sep 12 ignited silver fever. Which might go by another name, such as “inflation fears”, and people may buy more silver as a result.

Or, as we said in our Gold Outlook Report 2022, with the Fed expected to hike interest rates aggressively this may signal to traders to sell silver until the hiking is done.

We don’t know. And neither does anyone else. Beware the purveyors of stale stories like “precious metals being shipped from West to East”. Much less conspiracy theory mongers, who will no doubt claim that the price action on Tuesday was “da boyz getting control of the price, again.”

We do know that markets have increasingly become Keynesian Beauty Contests.

Where everyone has to guess how everyone else will respond to a central bank (which is trying to guess how everyone else will respond). That’s in the short term.

In the long term, it’s a different story. Maybe better to just put your gold and silver to work, earning more metal with Monetary Metals. And in the end come out better than those who paid storage fees, and over-traded, suffering both bad trades and lots of brokerage commissions.

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Tags: Backwardation,Basic Reports,Featured,newsletter,silver