How much gold will you trade for a few eggs? It depends on how hungry you are. Two ideas will help us understand the rest of this tumultuous decade: core-periphery and the revaluation of what’s truly important: systemic adaptability, transparency, accountability, risk, capital and resources. I recently discussed the core-periphery model in a blog post, Crash Is King: “Crashes reveal what’s core and what’s periphery because the core controls the destiny of the periphery. In systems terminology, the initial conditions set the parameters of options and the efficacy of various choices. The core’s initial conditions are considerably more constructive than the initial conditions of the periphery. In network terms, the critical connections between nodes run through the

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

How much gold will you trade for a few eggs? It depends on how hungry you are.

Two ideas will help us understand the rest of this tumultuous decade: core-periphery and the revaluation of what’s truly important: systemic adaptability, transparency, accountability, risk, capital and resources. I recently discussed the core-periphery model in a blog post, Crash Is King:

“Crashes reveal what’s core and what’s periphery because the core controls the destiny of the periphery. In systems terminology, the initial conditions set the parameters of options and the efficacy of various choices. The core’s initial conditions are considerably more constructive than the initial conditions of the periphery.

In network terms, the critical connections between nodes run through the core. This is not the case for the nodes. The dependency chains are asymmetric: each node looks stable and independent until push comes to shove. Everyone is dependent but some are less dependent than others.”

My point was that crises strip away what’s actually essential from claims of what’s essential, and reveal what assets are core and which are peripheral.

For example, vast tracts of fertile soil and fresh water river systems are key assets for growing and transporting food and providing fresh water. Long borders with potential enemies is a geopolitical liability.

These initial conditions set parameters that are difficult to overcome.

There are also parameters set by cultural, social, economic and political systems. Those which encourage adaptability and transparency are irreplaceable assets, those that impede adaptability and transparency are liabilities.

| The other point about the core-periphery model is that dependencies abound in the global system but when push comes to shove, the core has the means to survive the breakdown of global supply chains while the periphery does not.

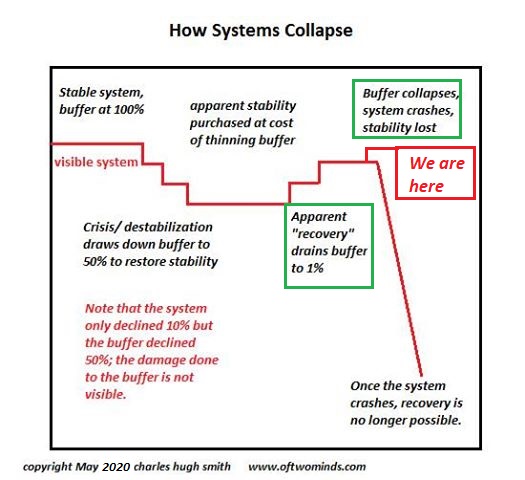

Global scarcities are reminding us that what’s truly important is the means to grow and distribute food, energy and fresh water to immense human populations. Growing / raising food and distributing it on an industrial scale requires enormous inputs of energy. Even largely self-sufficient regions depend on fertilizers derived from hydrocarbon inputs. Water is also energy-intensive as it generally requires massive investments in infrastructure to supply not just the daily needs of the human populace but agriculture and industry. Civilizations that fail to provide sufficient food and fresh water to their populations collapse. The collapse may start with political turmoil but it soon unravels the entire socio-economic system. As we revalue what’s truly important, a significant percentage of complexity will be revealed as not only non-essential but a huge drag on a system struggling to deliver essentials.A recent article illuminates the systemic weaknesses in complex, centralized, opaque hierarchies–weaknesses I have discussed in many of my books. Why Complex Systems Collapse Faster In other words, rigid, military-style hierarchies in which the decision-makers do not suffer personal consequences from their decisions are especially prone to collapse. |

Perhaps Ostrom’s advice is not so different from what the ancient Chinese philosopher Lao Tzu wrote in the Tao Te Ching: “rigidity leads to death, flexibility results in survival.”

In sum, a lack of transparency, skin in the game and accountability doom top-down complex systems to collapse.

Nassim Taleb of Black Swan and Antifragile fame recently noted the critical role of transparency in systemic resilience. He observed that “a system seems all the more dysfunctional when it is transparent.”

In other words, when we see all the petty squabbling, the clash of competing self-interests and the conflicts arising from advocacy, we reckon that system is dysfunctional and doomed.

But that is the healthy system, for what’s at stake is visible to all, as is the process of all the stakeholders negotiating some agreement on how to proceed.

Corruption requires opacity: backroom deals, insider trading, bribery, etc. cannot occur in the bright light of transparency, i.e. all critical information is available to all stakeholders.

We can add to Lao Tzu’s dictum on flexibility: Opacity leads to death, transparency results in survival.

Opaque hierarchical systems appear tranquil and well-managed because the conflicts, self-interest and corruption are hidden. But opacity and rigid hierarchies are systemic weaknesses. These systems cannot compete with transparent, more decentralized, adaptable systems in eras of crisis.

What is core to a system’s survival is two-fold: it must have the transparency, accountability (skin in the game) and flexibility described above, and the real-world resources to provide its own essentials.

This is scale-invariant: it describes households, villages, counties and countries.

How many times have we heard: “They broke up? But they were the perfect couple.” Indeed. It’s so much easier to hide problems and dysfunctions behind a happy-face facade of suppression.

The couple that is open about their negotiating difficult situations is the healthy relationship. The couple that hides their dysfunctional lack of communication and inability to find solutions that work for both people is the unhealthy relationship.

This is as true of nations as it is of couples. Systems that are transparent, accountable and adaptable have insurmountable selective advantages over opaque centralized hierarchies.

One important aspect of transparency is establishing value, which is reflected in the cost / discovery of price. If supply, demand, inputs, friction, insider dealing and risk are all opaque–hidden, misrepresented, manipulated –then it’s impossible to value anything properly.

Decisions made on inaccurate valuations cannot possibly be good decisions.

A global revaluation of systemic adaptability, transparency, risk and resources is accelerating. Those with the essentials of systemic adaptability (decentralized, accountable, antifragile, transparent) will survive and those without these essentials will collapse.

Those with the means to supply their own food, energy and water (what I call the FEW essentials) will survive, those who live or die on long dependency chains snaking through global rivals will not.

As I explain in my new book Global Crisis, National Renewal, the nation that downsizes its consumption to what’s available will survive, those which attempt to live beyond their means via financialization will collapse.

When there’s plenty of everything, it’s easy to confuse what’s essential with what’s not essential but perceived as valuable. When what’s truly essential is scarce, then what’s essential becomes clear and is repriced accordingly. What’s non-essential is also repriced accordingly.

Gold was plentiful in the early boom years of the California Gold Rush. What was scarce was eggs. How much gold will you trade for a few eggs? It depends on how hungry you are.

Tags: Featured,newsletter