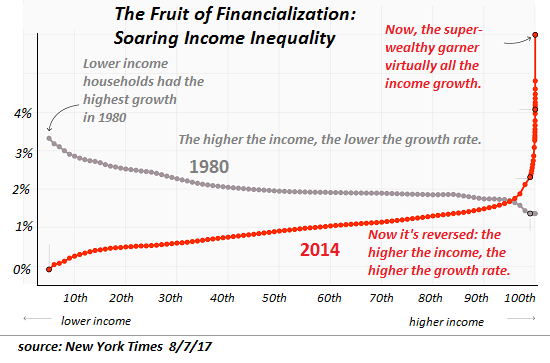

That which has failed is unsustainable, no matter how many trillions the Federal Reserve tosses against the tides of history. The Gulfs Between the Classes The Credibility Gap The Partnerships That Failed The Groups That Opted Out The Undermining of Effort Every one of these is a manifestation of institutional failure. The Gulfs Between the Classes (see chart of soaring inequality below) manifests a completely broken economic and social order, and the abject failure of core institutions (for example, the source of wealth inequality, the Federal Reserve). The Gulfs Between the Classes also reflects our pay-to-play political system, in which wealth buys political power and everyone else gets to watch a pantomime of democracy. Government agencies widen The

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

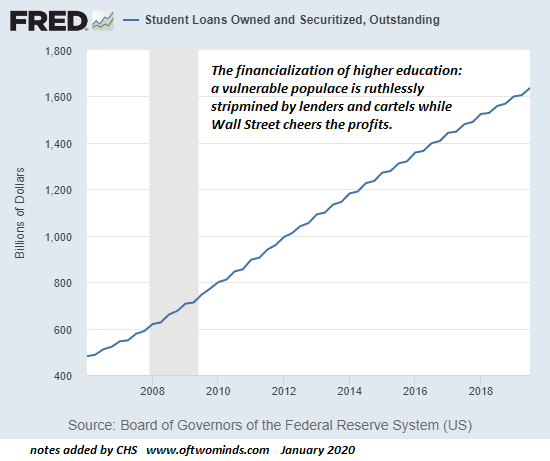

That which has failed is unsustainable, no matter how many trillions the Federal Reserve tosses against the tides of history. The Gulfs Between the Classes The Credibility Gap The Partnerships That Failed The Groups That Opted Out The Undermining of Effort Every one of these is a manifestation of institutional failure. The Gulfs Between the Classes (see chart of soaring inequality below) manifests a completely broken economic and social order, and the abject failure of core institutions (for example, the source of wealth inequality, the Federal Reserve). The Gulfs Between the Classes also reflects our pay-to-play political system, in which wealth buys political power and everyone else gets to watch a pantomime of democracy. Government agencies widen The Credibility Gap with bogus, rigged statistics and complexity thickets (“We have to pass the bill so that you can find out what is in it.”) designed to make accountability and transparency effectively impossible. The Partnerships That Failed include the alliances of various warring elites and the pantomime partnerships of elites and constituencies (“We pretend to obey and you pretend to listen to us.”) The Groups That Opted Out are as yet largely invisible because all the small business owners who closed down and stopped being Tax Donkeys are under the radar, and all the debt-serfs who have renounced their debts are carefully hidden by the appropriate bureaucracies, lest the enormity of the debt-serf opt-outs becomes visible. |

The Fruit of Financialization: Soaring Income Inequality |

| The Groups That Opted Out include those who have lost trust in the corporate media, the government’s statistical claims and the leadership of failing institutions.

When institutions have lost public trust and thus their legitimacy, the solution is fragmentation and decentralization so the unit size is reduced to the point where accountability and transparency can be enforced by the citizenry and/or members. Management author Peter Drucker (Post-Capitalist Society) noted that in the transition to a post-capital economy, legacy institutions in everything from higher education to healthcare are the wrong unit size, meaning that they are too large to be effective, accountable and transparent, as their sheer mass encourages processes and thickets insiders can use to avoid accountability and transparency. When fiat currencies fail, fragmentation and competition between transparently priced currencies will be the solution. The ideal solution is a spectrum of currencies ranging from bitcoin and other mined cryptocurrencies to privately issued gold-backed currencies, state-issued gold-backed currencies, local currencies intended for use in local economies, and my proposed labor-backed currency which I outlined in my book A Radically Beneficial World. That which has failed is unsustainable, no matter how many trillions the Federal Reserve tosses against the tides of history. The current travesty of a mockery of a sham system will fragment no matter how desperate the looters, parasites and predators are to maintain their swag. |

|

Tags: Featured,newsletter