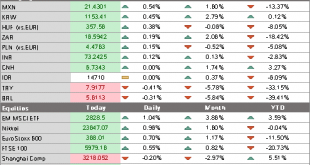

Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week The main data event this week is September retail sales Friday; ahead of that, we get inflation readings for September; Fed manufacturing surveys for October will start to roll out The account of the ECB’s September meeting added a layer of...

Read More »Dollar Slide Continues as US Fiscal Stimulus Remains Questionable

The dollar remains heavy; stimulus talks may or may not be dead; the White House is still sending mixed signals This is another quiet day in terms of US data; Canada reports September jobs data We got some more eurozone IP readings for August; following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield UK data came in significantly weaker than expected; Japan reported weak August real cash earnings and household...

Read More »A Hard Rain Is Going to Fall

The status quo is about to discover that it can’t stop the hard rain or protect its fragile sandcastles. You’ll recognize A Hard Rain Is Going to Fall as a cleaned-up rendition of Bob Dylan’s classic “A Hard Rain’s a-Gonna Fall”. Since the world had just avoided a nuclear conflict in the Cuban Missile Crisis, commentators reckoned Dylan was referencing a nuclear rain. But he denied this connection in a radio interview, stating: “…it’s just a hard rain. It isn’t the...

Read More »Dollar Remains Heavy as Markets Await Fresh Drivers

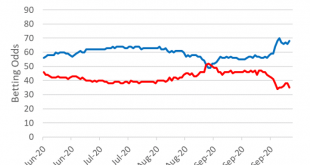

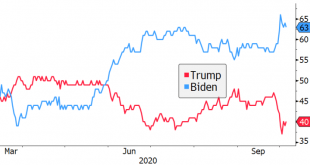

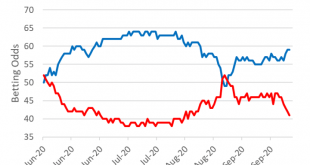

The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises Weekly jobless claims will be reported; like last week, there will be a quirk to this week’s initial claims;...

Read More »Dollar Softens and US Curve Steepens as Odds of Democratic Sweep Rise

The dollar remains under pressure; the US curve continues to steepen; a compromise on fiscal stimulus before the election still seems unlikely; this is another quiet day in terms of US data President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery; we expect the ECB to increase its PEPP in Q4 German factory orders came in much stronger than expected; Russia reports September CPI RBA delivered a dovish hold; the Australian...

Read More »Things Change

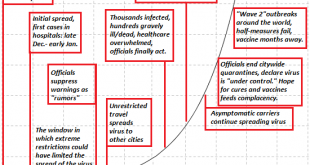

Things Change October 2, 2020 “Doing more of what’s hollowed out our economy and society” is a slippery path to ruin. Things change, supposedly immutable systems crumble and delusions die. That’s the lay of the land in the The Empire of Uncertainty I described yesterday. It’s difficult not to be reminded of the Antonine Plague of 165 AD that crippled the Western Roman Empire. The exact nature of the virus that struck down as many as one-third of the Empire’s...

Read More »Drivers for the Week Ahead

The US political outlook has been upended by recent developments; lack of a significant safe haven bid for the dollar so far is telling This is a very quiet week in terms of US data; FOMC minutes will be released Wednesday; there is a full slate of Fed speakers The eurozone has a fairly heavy data week; Brexit talks continue in London; UK has a heavy data week Japan has a fairly heavy data week; RBA meets Tuesday and is expected to keep policy unchanged; that same...

Read More »Dollar Remains Soft but Sterling Pounded by Brexit Risks

The dollar remains under pressure as market sentiment continue to improve; stimulus talks were extended Two major US airlines announced significant job furloughs starting today; US data for September will continue to roll out; weekly jobless claims will be reported The pound is underperforming as the flurry of optimism in the recent negotiations fades; final eurozone September manufacturing PMI was steady at 53.7 Bank of Japan quarterly Tankan report came in weaker...

Read More »The Urban Exodus and How Greatness Goes Bankrupt

The best-case scenario is those who love their “great city” will accept the daunting reality that even greatness can go bankrupt. Two recent essays pin each end of the “urban exodus” spectrum. James Altucher’s sensationalized NYC Is Dead Forever, Here’s Why focuses on the technological improvements in bandwidth that enable digital-economy types to work from anywhere, and the destabilizing threat of rising crime. In his telling, both will drive an accelerating urban...

Read More »The Empire of Uncertainty

Anyone claiming they can project the trajectory of the U.S. and global economy is deluding themselves. Normalcy depends entirely on everyday life being predictable. To be predictable, life must be stable, which means that there is a high level of certainty in every aspect of life. The world has entered an era of profound uncertainty, an uncertainty that will only increase as self-reinforcing feedbacks strengthen disrupting dynamics and perverse incentives drive...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org