The Fed’s rigged-casino stock market will be dragged to the guillotine by one route or another. The belief that the Federal Reserve and its rigged-casino stock market are permanent and forever is touchingly naive. Never mind the existential crises just ahead; the financial “industry” (heh) projects unending returns of 7% per year, or is it 14% per year? Never mind the details, the Fed has our back and since the Fed is forever, so too will be the gains for everyone playing the rigged games in the Fed’s casino. What makes this presumption so childishly naive is the tides of history are about to sweep away the era of central banks, their fiat currencies and their rigged casino markets. That the global citizenry might realize these are all forms of financial tyranny

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Fed’s rigged-casino stock market will be dragged to the guillotine by one route or another.

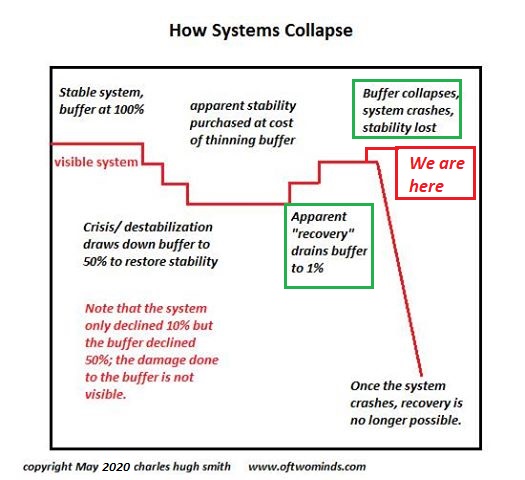

The belief that the Federal Reserve and its rigged-casino stock market are permanent and forever is touchingly naive. Never mind the existential crises just ahead; the financial “industry” (heh) projects unending returns of 7% per year, or is it 14% per year? Never mind the details, the Fed has our back and since the Fed is forever, so too will be the gains for everyone playing the rigged games in the Fed’s casino.

What makes this presumption so childishly naive is the tides of history are about to sweep away the era of central banks, their fiat currencies and their rigged casino markets. That the global citizenry might realize these are all forms of financial tyranny doesn’t occur to to the Financial Aristocracy, which has luxuriated in the neofeudal dominance of finance–the modern-era equivalent of Monarchy and the rights of royalty.

Under the guidance of the Financial Aristocracy, so-called democratic governance has mutated into totalitarian democracy, that is, a “democracy” in name only, a carefully managed simulacrum that props up a facade of “democracy” that is pure PR.

Under the guidance of the Financial Aristocracy, so-called democratic governance has mutated into totalitarian democracy, that is, a “democracy” in name only, a carefully managed simulacrum that props up a facade of “democracy” that is pure PR.

The Fed is busy planning a pivot to becoming “the people’s source of free money forever” to save itself from oblivion. The pivot is called FedNow, an instant-payment system which bypasses both the traditional private banking sector and Congressional control of distributing money.

With FedNow, the Fed will be able to create trillions of dollars out of thin air and distribute the trillions directly into household accounts at the Fed. The idea here is that an economy that is no longer financially viable can be propped up indefinitely by Fed free money; all we need to do is bypass the obsolete private banking sector (sorry about that, buckos) and the equally obsolete shards of totalitarian democracy (Congress, the presidency, etc.) and stave off the revolt with endless free money.

That endless free money stripped of the last vestiges of discipline will stoke an inflationary death spiral–well, we’ll worry about that tomorrow. The irony here is the Fed is only accelerating the demise of central banking, fiat currency and its rigged-casino stock market with its FedNow scheme to maintain its financial tyranny.

Alas, tyranny is still tyranny, feudalism is still feudalism, and history remains unkind to totalitarian regimes–even those which have morphed into a clever totalitarian democracy.

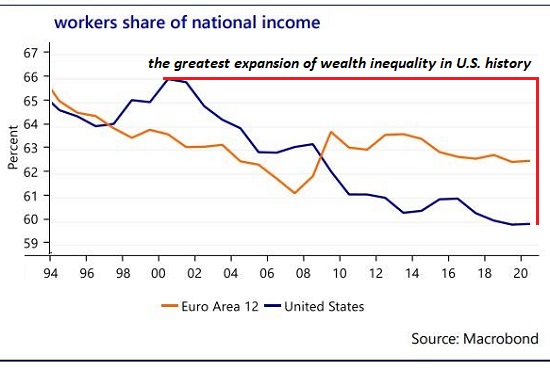

The Fed’s rigged-casino stock market will be dragged to the guillotine by one route or another: either a populist reform that dismantles the neofeudal financial tyranny of central banks and their soon-to-be-worthless fiat currencies, or the implosion of the entire corrupt neofeudal financial system of central banking, fiat currencies and rigged casino markets, all of which are nothing more than engines of inequality.

Tags: Featured,newsletter