Swiss Franc The Euro has fallen by 0.22% to 1.0942 EUR/CHF and USD/CHF, September 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil prices surged in the initial reaction to the unprecedented drone attack on Saudi Arabia facilities. Saudi Arabia may be able to restore around half of the lost production in a few days. Saudi Arabia and other countries, including the US, prepared to tap strategic reserves, oil...

Read More »FX Weekly Preview: Six Things to Watch in the Week Ahead

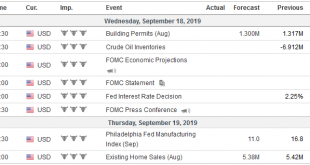

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter. United States The Federal Reserve’s meeting on September 18 is the most important calendar event in the week...

Read More »Cool Video: Thoughts on ECB

A few hours after the ECB announced a new package of monetary accommodation, I joined a discussion on CNBC Asia with Nancy Hungerford and Sir Jegarajah. Here is a clip of part of our discussion. I make two points. The first is about the euro’s price action. What impressed me about it was that the euro posted an outside up day, trading on both sides of the previous day’s range and closing above its high. When Sri and I were talking early in the Asian morning, there...

Read More »FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.19% to 1.0932 EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are digesting ECB’s actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July...

Read More »FX Daily, September 12: Focus on the ECB, while the Dollar Slips below CNY7.09

Swiss Franc The Euro has fallen by 0.13% to 1.0914 EUR/CHF and USD/CHF, September 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Some gestures in the US-China trade spat have given the market the reason to do what it had been doing, and that is taking on more risk. Equities are higher in Asia Pacific and opened in Europe higher before slipping. The MSCI Asia Pacific and the Dow Jones Stoxx 600 are advancing...

Read More »FX Daily, September 11: Dollar is Firm as ECB is Awaited

Swiss Franc The Euro has fallen by 0.31% to 1.092 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas...

Read More »FX Daily, September 10: Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.22% to 1.0933 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at...

Read More »FX Daily, September 9: Market Sentiment Still Constructive

Swiss Franc The Euro has risen by 0.52% to 1.0944 EUR/CHF and USD/CHF, September 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The improvement of investor sentiment seen last week is carrying over into the start of the new weeks. Global equities are firm as are benchmark yields. Asia Pacific equities advanced, except in Hong Kong, where Chief Executive Lam’s promise to formally withdraw the controversial...

Read More »FX Weekly Preview: Gaming the ECB and Putting the Cart Before Horse in the Brexit Drama

The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to...

Read More »FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org