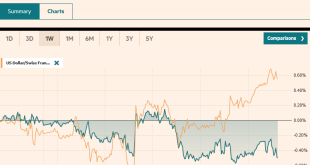

Swiss Franc The Euro has risen by 0.11% to 1.0873 EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The anticipated growth implications of the heightened tensions between the world’s two largest economies is dominating activity at the start of the new week. These considerations that drove the 2.6% drop in the S&P 500 before the weekend is carrying over into today’s...

Read More »FX Weekly Preview: The Week Ahead is not about the Week Ahead

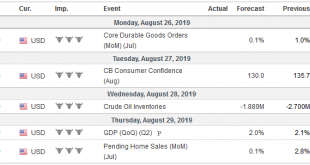

It’s the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China’s PMI, and the eurozone’s preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast. They are looking further afield. The next US tax increase on Chinese imports goes into effect on September 1, and Beijing has threatened to retaliate. The...

Read More »G7 to Deliver a Nothing Burger

A Bloomberg article about the weekend G7 meeting says, “multilateralism is dead.” An op-ed in the Financial Times suggests that the most important political alliance may be “rejuvenated” at the G7 meeting. The truth is likely found somewhere in between. Economic nationalism, personalities of (some) of the leaders are not conducive to deepening or broadening cooperation among the leading market economies. At the same time, the G7 is an expression of...

Read More »FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

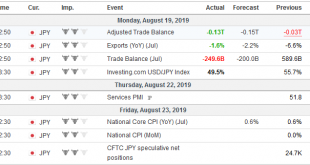

Swiss Franc The Euro has fallen by 0.07% to 1.0887 EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and...

Read More »FX Daily, August 22: Tick Up in EMU PMI Does Little, Waiting for Powell

Swiss Franc The Euro has risen by 0.17% to 1.0905 EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI....

Read More »FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

Swiss Franc The Euro has risen by 0.27% to 1.0882 FX Rates The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday’s losses and more. It was led higher by consumer discretionary, energy, and industrials. US shares are also trading firmer today,...

Read More »FX Daily, August 20: Marking Time Ahead of PMI and Powell

Swiss Franc The Euro has risen by 0.13% to 1.0856 EUR/CHF and USD/CHF, August 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell’s speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by...

Read More »FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Swiss Franc The Euro has risen by 0.27% to 1.0879 EUR/CHF and USD/CHF, August 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains....

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

Read More »FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.01% to 1.0841 EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week’s flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org