Derweil hält die Schwäche des Euro zum Franken weiter an. Aktuell notiert der Euro zwar mit 1,0634 wieder etwas höher als am frühen Morgen, als die Einheitswährung bei 1,0609 das Tagestief erreicht hatte. Unterhalb von 1,06 Franken hat die Gemeinschaftswährung letztmals im Sommer 2015 notiert. Der Dollar kostet aktuell etwas mehr mit 0,9807 Franken. Laut Händlern soll die Schweizerische Nationalbank (SNB) um das Tagestief herum interveniert haben, um zu verhindern,...

Read More »EUR/CHF: SNB does not find love in prices – Rabobank

The Swiss National Bank (SNB) has the mandate to maintain CPI inflation near 2% on a yearly basis but is currently running at just 0.2%. CHF’s strength is not welcomed by SNB, economists at Rabobank reports. Key quotes “The strong performance of the CHF can be associated with Switzerland’s robust fundamentals which ensure that the currency is considered by many investors to be store of value. While there have been a wide number of exogenous factors which have sparked...

Read More »USD/CHF Price Analysis: Greenback grinding up vs. Swiss franc, clings to 2020 highs

USD/CHF is slowly advancing printing fresh 2020 highs by a few pips. The rising wedge formations can limit the upside on USD/CHF. USD/CHF daily chart USD/CHF is printing new 2020 highs while the quote is trading below the 100/200-day simple moving averages suggesting an overall bearish momentum. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart After USD/CHF broke below the rising wedge pattern the market made a retest...

Read More »Création d’une page dédiée à la Monnaie

Cet post a pour but de vous informer de la création d’une page dédiée à la Monnaie. Vous la trouverez à cette adresse: https://lilianeheldkhawam.com/monnaie-dossier/ Monnaie et globalisation marchent main dans la main. Elles sont intimement liées à l’avènement du Nouveau Monde. C’est par la Monnaie que se décide l’avenir que ses créateurs voudront bien accorder à l’humain dans une société qu’ils veulent hautement rationalisée. Quelle place offriront-ils aux...

Read More »USD/CHF Price Analysis: Sellers catch a breath around 61.8% Fibonacci

USD/CHF stalls the previous day’s declines after breaking the weekly support line (now resistance). Late-December lows limit immediate upside, 50% Fibonacci can check the declines. Bearish MACD favors further weakness in the quote. USD/CHF clings to 0.9755 during the pre-European session on Wednesday. The pair snapped six-day winning streak on the break of an ascending trendline since February 03. However, 61.8% Fibonacci retracement of December 24-January 16 fall...

Read More »USD/CHF Price Analysis: Rising wedge can halt the bulls

USD/CHF created a rising wedge pattern suggesting potential exhaustion in the medium term. The level to beat for bears is the 0.9770 support. USD/CHF daily chart USD/CHF is pulling back down slightly from the 2020 highs while reintegrating Friday’s range. The spot is trading below the 100/200-day simple moving averages suggesting an overall bearish bias. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart USD/CHF is...

Read More »L’or de la Banque Nationale suisse

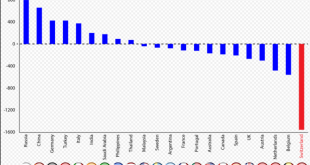

Note: Ce post est une erreur. Son contenu correspond en fait à la page dédiée à l’or suisse de la banque centrale. https://lilianeheldkhawam.com/lor-de-la-banque-nationale-suisse/ Cette erreur est intervenue dans le cadre de la création de la page sur la Monnaie, que je vous invite à visiter ici: https://lilianeheldkhawam.com/monnaie-dossier/ Avec mes excuses. LHK Change in Central Bank Gold Reserves by Country - Click to enlarge...

Read More »Grossbanken – Fünf valable Kandidaten für Rohner-Nachfolge als CS-Präsident

Urs Rohner, VR-Präsident der Credit Suisse. Bild: ZVG Nach der Absetzung von Tidjan Thiam als operativer Chef der Credit Suisse wurde von verschiedenen Seiten auch gefordert, dass VR-Präsident Urs Rohner bereits auf die kommende Generalversammlung hin seinen Hut nimmt, so etwa vom Stimmrechtsberater Ethos. Rohner will sich aber an der kommenden GV von Ende April für ein letztes Jahr noch einmal wählen lassen. Im Jahr 2021 sollte er dann altershalber zurücktreten. Die...

Read More »Credit Spy: Ende gut, alles gut?

Was ist es, was uns im Falle des Überwachungsskandals der CS so stark verstört hat? Mir fallen drei Punkte auf. Erstens die Tatsache, dass die Schweizer Grossbank offensichtlich einen eigenen internen geheimen Überwachungsdienst unterhält, der Arbeitnehmer auch ausserhalb des Arbeitsplatzes und ihrer Arbeitszeiten überwacht respektive bespitzelt. Zweitens ist es verstörend, dass sich der betreffende verdeckte Überwachungsmann, der einen Badge der CS hatte, das Leben...

Read More »USD/CHF trades at fresh 2020 highs above 0.9760 ahead of NFP

CHF struggles to find demand as a safe-haven on Friday. US Dollar Index pushes higher above the 98.50 mark. Nonfarm Payrolls in US is expected to come in at 160K in January. The USD/CHF pair closed the last four trading days in the positive territory and continued to edge higher on Friday to touch its best level since December 27th at 0.9772. As of writing, the pair was up 0.2% on the day at 0.9763. The sour market mood fails to help the CHF find demand as a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org