The first week of 2023 was a “bad news is good news” from the Wall St. perspective. Evidence of a declining economy should drive stock prices lower, but since markets are so distorted by counterfeit money rather than wages and profits, stocks and bonds can’t wait to cheer until those less fortunate are in a world of hurt! . Here are several headlines just today that suggest the global economy is heading into the soup! “Samsung Profits Plunge 69% as Global Chip Demand in ‘Full-fledged Ice Age.” Global demand for chips is down sharply as businesses are fearing a global recession. Sales were down US billion for the quarter for this, the largest chip maker in the world, with sales falling US billion in the quarter. “ISM Services Slumps into Contraction.”

Topics:

Jay Taylor considers the following as important: 6a.) Monetary Metals, Featured, News, newsletter

This could be interesting, too:

investrends.ch writes SIX liefert den Direktzugang nach Griechenland

investrends.ch writes LLB hält Gewinn 2025 trotz Übernahmekosten stabil

investrends.ch writes BB Biotech bestätigt Gewinn 2025

investrends.ch writes Edmond de Rothschild AM knackt die 100-Milliarden-Marke – fünftes Rekordjahr in Folge

| The first week of 2023 was a “bad news is good news” from the Wall St. perspective. Evidence of a declining economy should drive stock prices lower, but since markets are so distorted by counterfeit money rather than wages and profits, stocks and bonds can’t wait to cheer until those less fortunate are in a world of hurt! | |

Here are several headlines just today that suggest the global economy is heading into the soup!

|

|

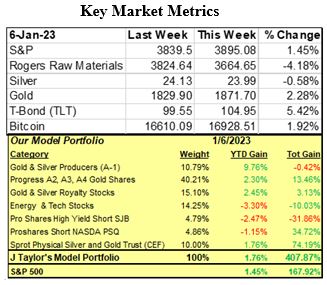

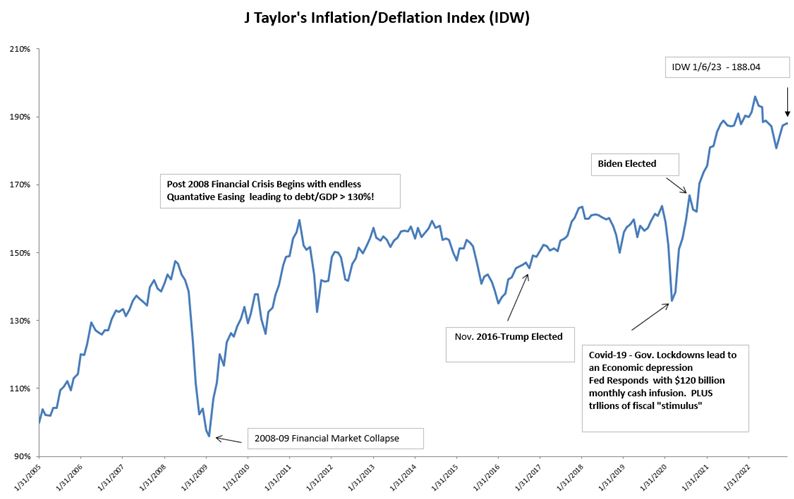

The index bottomed earlier last year and has been rising ever since, driven by slower payroll growth and declines in ISM manufacturing.

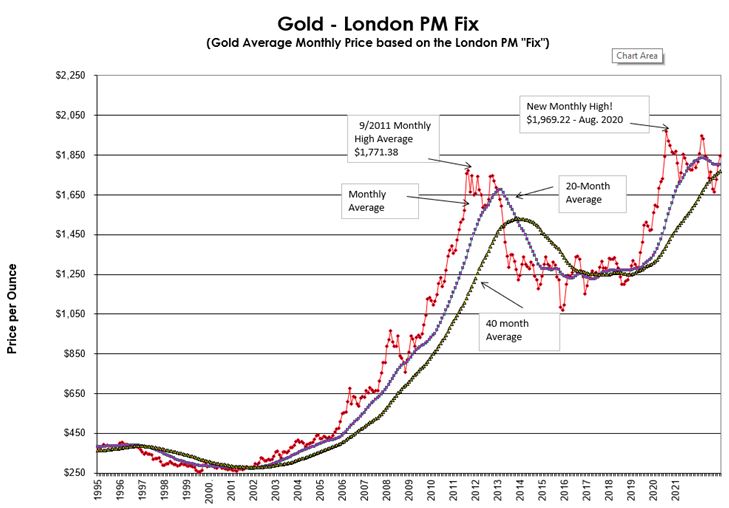

The economy is being helped a bit by lower oil and natural gas prices. But weather models are suggesting some brutally cold weather is heading our way in the northern hemisphere and there is little doubt in my mind that when that happens Putin will really turn the screws on Ukraine and Europe in general. The idea that inflation in terms of the CPI is behind us is in my view not yet well founded, though it is naturally moderating some with a slowing economy. But we have not even begun to feel the pain that is headed our way when the lagging effects of higher interest rates start to trigger massive unemployment. I also think the Fed’s resolve to nail inflation once and for all is real. Whether the Fed can actually stay the course, letting Fed Funds Rate hit 5% and stay there for a protracted period of time is questionable when real pain and suffering get under way. Wall Street wants to believe in a pivot and because it wants to believe, it believes! But the Fed knows that if they don’t clamp inflation down now and slam it really hard and also allow interest rates to rise to a level where the stock and bond market casino is put in its place and capital is allowed to be put to use via honest and market driving interest rates, the cancer of endless deficits and prospects for a hyper inflation will remain real. So we shall see which side wins. There are those—like Danielle DiMartino Booth, David Stockman, Keith Weiner, and Daniel Lacalle, who are sure the Fed will stay the course, while others—like Alasdair Macleod, Peter Schiff, James Turk, and John Rubino, think otherwise the Fed will cave before the inflation fighting job is completed. Either way, its bullish for gold and there appears to be little question but that gold is now breaking out. |

After the first week of 2023, the average gold price for the month of January is $1,846.69. That compares to the 20-month average of $1,802.24 and the 40-month average of $1,768.24. Jordan Roy-Byrne opined on Friday that “There is little that can stop Gold now. Gold has faced historic headwinds in the last 9 months, and yet it’s barely more than 10% from an all-time high!”

Tags: Featured,News,newsletter