As the Federal Reserve hikes its lending rate to a range of 0.25–0.50 percent, murmurs are heard around the world, with financial pundits predicting doom due to the increased pressures imposed on the cost structures of firms that are recovering from the pandemic lockdowns. The Federal Reserve is leader of the group of central banks around the world that are ostensibly directed by their respective countries to pursue stability and smooth functioning of their economies. The alleged legitimacy of central banks rests on three fundamental goals that central banks around the world share. The first goal is price stability, which is the belief that central banks should expand and contract the money supply in relation to actual demand and supply pressures from the economy.

Topics:

Vibhu Vikramaditya considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

As the Federal Reserve hikes its lending rate to a range of 0.25–0.50 percent, murmurs are heard around the world, with financial pundits predicting doom due to the increased pressures imposed on the cost structures of firms that are recovering from the pandemic lockdowns. The Federal Reserve is leader of the group of central banks around the world that are ostensibly directed by their respective countries to pursue stability and smooth functioning of their economies.

As the Federal Reserve hikes its lending rate to a range of 0.25–0.50 percent, murmurs are heard around the world, with financial pundits predicting doom due to the increased pressures imposed on the cost structures of firms that are recovering from the pandemic lockdowns. The Federal Reserve is leader of the group of central banks around the world that are ostensibly directed by their respective countries to pursue stability and smooth functioning of their economies.

The alleged legitimacy of central banks rests on three fundamental goals that central banks around the world share. The first goal is price stability, which is the belief that central banks should expand and contract the money supply in relation to actual demand and supply pressures from the economy. Goal number two is fueling macroeconomic growth prospects, which is done through lowering the cost of borrowing, which supposedly leads businesses to increase their investments, leading to increases in output and overall growth.

Finally, the last goal is performing countercyclical measures, which are actions that the central bank undertakes in order to offset the high unemployment rates that may result from falling output during a trough in the business cycle.

Price Stability

The role of the central bank in maintaining price stability in effect lies in controlling the value of money; i.e., not allowing a general inflation or a general deflation to take place. An index is created comprising a basket of goods that are weighted in terms of expenditures on them, and then their price movements are tracked as a proxy for changes in the general price level in the economy.

The increase or decrease in value of the index are judged alongside a constant percentage growth rule. When the value of the index increases or decreases more than the designated rate of constant growth, usually 2 percent, the central bank steps in with its monetary policy instruments to influence the value of money in the markets.

While the idea of preserving the value of money may be well intentioned, it suffers from a misunderstanding of the role rising and falling prices play in the market economy. Prices act as coordinating signals that convey information about important economic data scattered around in a decentralized manner. The rise in prices in a well-functioning market has a specific role: when an object becomes scarce in the market, rising prices are a signal to consumers to economize on it while at the same time pointing out a more profitable employment of resources to suppliers, who increase supply of the object until supernormal profits are all exploited, bringing down its price in the process.

Therefore, when the prices of goods in the basket of goods rise, the value of the index increases, providing the central bank with reasons to interfere in the market in order to offset the increases in price, but by doing so, central banks interfere in the market process. This prevents entrepreneurs from capitalizing on high-profit opportunities; if the rise in prices is caused by demand-pull inflation, the intervention also stops consumers from getting goods which would make them better off.

Macroeconomic Growth and Countercyclical Goals

Modern central banking traces ups and downs through the deviations of the actual growth rate of the economy from its long-run trend rate of growth. In other words, a growth-cycle upturn (downturn) is marked by growth higher (lower) than the long-run trend rate. The health of an economy is understood in terms of the closeness between its current growth rate and its projected growth rate based on long-term trends. Central banks also use other lagging and leading indicators such as consumer confidence surveys, weekly work time surveys, and the industrial production indices to gauge the current health of the economy.

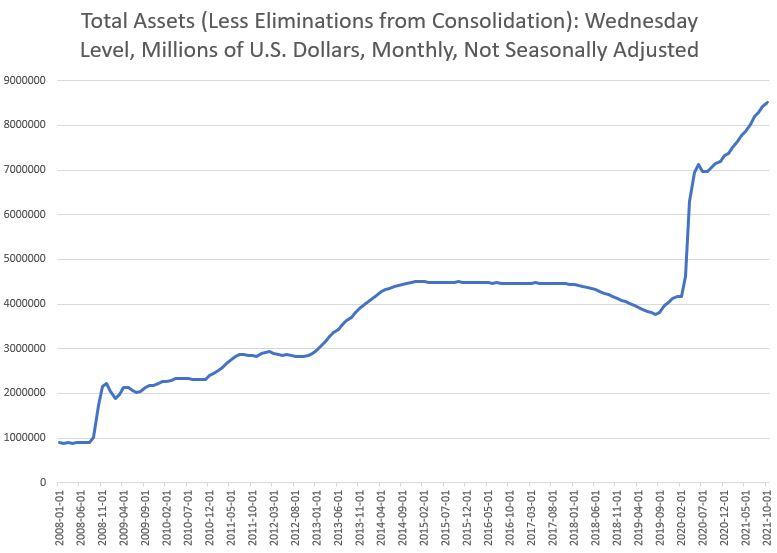

When the current growth level or the value of the indicators suggest that the economy needs to be stimulated, various monetary policy instruments are used to influence the demand and supply of money in the economy to accomplish the goal of bringing the economy back on track. In trying to lower the cost of borrowing for firms, the central banks also lower the cost of lending for commercial banks, which would then lower commercial banks’ own interest rates. The decrease in interest rates is supposed to lower the cost of borrowing for firms such that the return on an investment becomes marginally greater than its cost and thereby increase investment and output through the multiplier process.

But while at first glance such measures against falling output and spending may seem sound, they warrant a deeper look, as the actions of central bankers impact the economy disproportionately. The total spending in the economy consists of two parts, one being spending to support the structure of production and the other being spending on the final products. The spending on the structure of production consists of spending on capital investments to increase the productivity as well as scale of firms, and on circulating capital, which is used as input to produce outputs, while the spending on final products implies consumer spending on finished goods and services.

Firms often save a part of their profits and use this pool to finance their capital investments in the future. When firms resort to saving instead of spending, there might be falling output, but such a fall in output and spending is not a sign of bad health of the economy but merely a process that the economy needs to undergo that results in increased productivity, innovation, and efficiency in production due to lowered costs.

This efficiency results from changes in capital structures of firms as they change their machines or increase their scale. The process also results in an increased value of money, as the goods per unit of money spent increase.

A fall in output would soon taper off to a greater level of productivity and prosperity for the economy, but if the central bank intervenes with an easy money policy to reduce the cost of borrowing, it leads to Cantillon effects. Savers lose due to additional generation of artificial money, which lowers the value of their money, leading to inflation.

Conclusion

Easy money policies fuel unsustainable booms that eventually result in misallocation of capital, as capital investment is redirected in an unsustainable direction. Each firms makes its investments on the basis of comparison of costs and benefits. When the costs are artificially lowered through decreased interest rates, investments that were previously unprofitable now seem profitable, but since such profitability is not based on true underlying consumer demand, inflation soon increases as producers compete for scarce resources.

The increase in inflation shrinks the profit margins originally fueled by artificially low interest rates where an additional monetary push would again be needed to keep current investments from becoming unsustainable. Thus, we conclude that central banks create business cycles and distort market processes. Therefore, we should reexamine the need for central banks, since they are the source of a lot of economic ills.

Tags: Featured,newsletter