After a record year 2021, the venture capital (VC) market for blockchain investment is slowing down significantly in 2022 amid uncertain macroeconomic conditions and financial markets turmoil. In Q2 2022, VC investors scaled back cryptocurrency investments due to macroeconomic pressures, concerns about valuations and market volatility. Global funding fell and the number of mega-rounds of US0 million and up shrank, putting pressure on startup valuations and slowing down new unicorn startup minting, according to CB Insights’ State of Blockchain Q2 2022 report. Blockchain funding drops; unicorn minting slows down In Q2 2022, global funding fell 29% to US.5 billion, the first quarter-over-quarter (QoQ) drop in two years. Mega-round funding dropped steeply,

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain/Bitcoin, Featured, funding, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

After a record year 2021, the venture capital (VC) market for blockchain investment is slowing down significantly in 2022 amid uncertain macroeconomic conditions and financial markets turmoil.

In Q2 2022, VC investors scaled back cryptocurrency investments due to macroeconomic pressures, concerns about valuations and market volatility. Global funding fell and the number of mega-rounds of US$100 million and up shrank, putting pressure on startup valuations and slowing down new unicorn startup minting, according to CB Insights’ State of Blockchain Q2 2022 report.

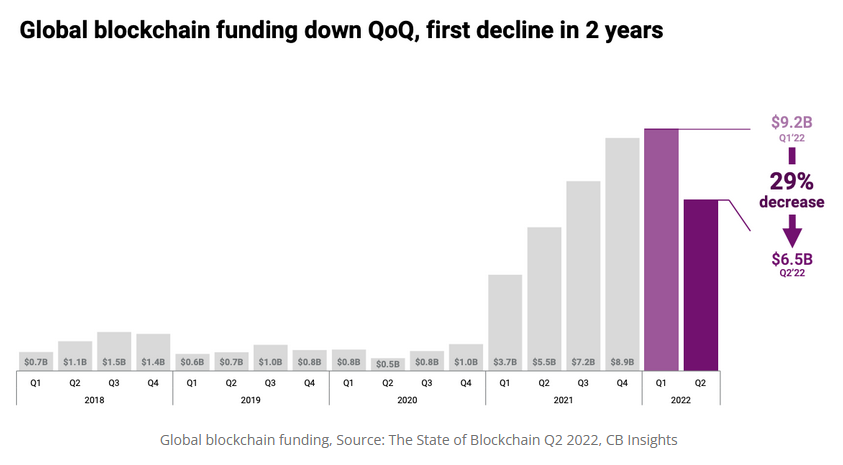

Blockchain funding drops; unicorn minting slows downIn Q2 2022, global funding fell 29% to US$6.5 billion, the first quarter-over-quarter (QoQ) drop in two years. Mega-round funding dropped steeply, decreasing 54% from US$5.6 billion in Q1 2022 to US$2.6 billion in Q2 2022. Amid declining funding, startup valuation took a toll with new unicorn births dropping from a record high of 16 in Q1 2022 to just eight in Q2 2022. The most valuable unicorn birth during the quarter was Seychelles-based crypto exchange KuCoin, which reached a US$10 billion valuation following a US$150 million funding round led by Jump Crypto. KuCoin is followed by Babel Finance from Hong Kong (US$2 billion) and Magic Eden from the US (US$1.6 billion). |

|

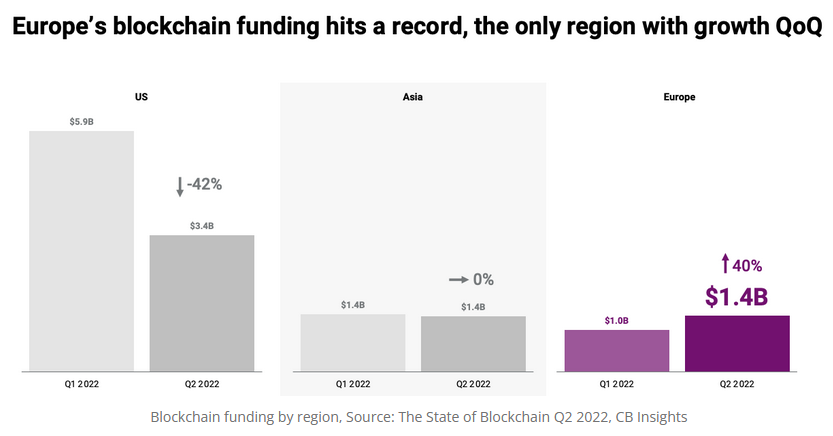

Record funding in EuropeLooking at geographical trends, the analysis found that Europe was the only region that recorded quarterly growth in blockchain venture funding and deals. In Q2 2022, European blockchain startups raised a total of US$1.4 billion through 106 deals, up 40% from Q1 2022’s US$1 billion. The figures put Europe well on track for a record breaking year 2022, the report says, given that European blockchain startups raised a total of US$3.5 billion through 273 rounds for the whole year 2021. Web3 and institutional crypto and custody services were favored segments in Q2 2022 with six of the top ten biggest deals in Europe going into startups in the two segments. These included Near Protocol, a decentralized application (DApp) platform and Ethereum competitor, MSquared, a network that allows metaverses to be used together, Elwood Technologies, a startup providing market access to leading crypto trading and liquidity venues through a single, integrated platform, and Coinhouse, a crypto solutions provider serving institutional investors. The analysis also found that although the US drove the global blockchain funding decline, falling 42% QoQ, the country maintained its leadership in blockchain funding, securing a total of US$3.4 billion in Q2 2022. The sum brought the total amount of funding raised by US blockchain startups in H1 2022 to US$9.3 billion. |

|

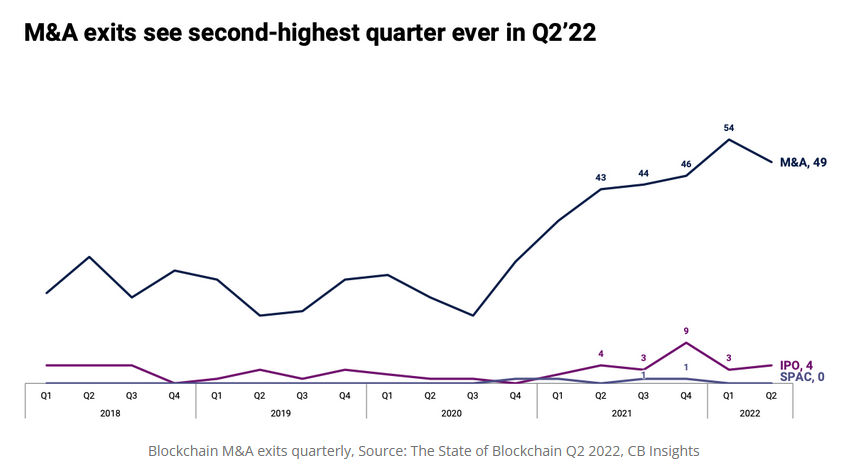

M&A exits on pace for a record yearIn Q2 2022, 49 blockchain merger and acquisition (M&A) deals were announced, the second-highest quarter ever. The amount brought the total number of M&A deals in H1 2022 to 103, a figure which indicates that 2022 could well be a record year for blockchain M&A exits. During the quarter, several prominent crypto lenders filed for bankruptcy, prompting market leaders to seek to acquire companies hurt by the crypto crash at a discount, the report notes. FTX, a crypto exchange and the world’s most valuable blockchain startup at an estimated US$32 billion valuation, acquired at least three startups this year, data from Crunchbase show, including Liquid Global, the developer of a crypto trading platform, Bitvo, a Canadian crypto exchange, and Good Luck Games, creator of the popular upcoming card auto battle game Storybook Brawl. Other companies, such as Bolt, Robinhood, and eBay, also acquired a crypto or NFT company in Q2 2022. Bolt’s US$1.5 billion acquisition of Wyre Payments, a company that provides retail and business customers exchange services, was the quarter’s largest M&A exit. Mobile-first brokerage Robinhood acquired crypto trading app Ziglu for a reported US$72.5 million, and global e-commerce company eBay bought UK-based NFT marketplace KnownOrigin. |

|

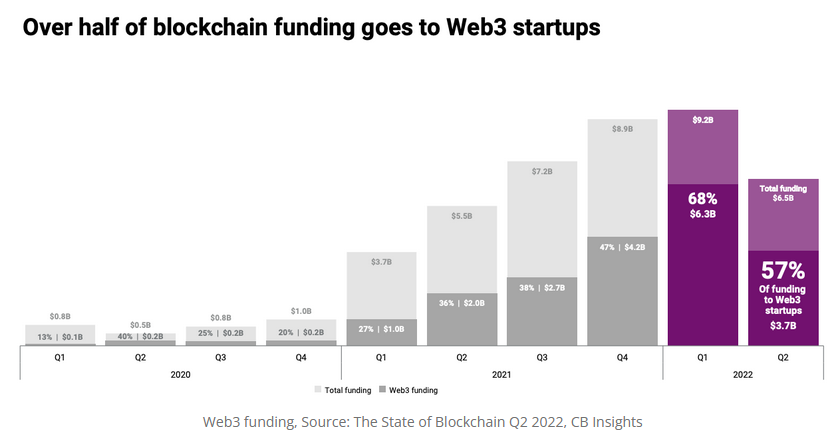

Web3, NFT, gaming and metaverse startups gain tractionThis year, investors’ interest and funding shifted away from centralized crypto exchanges and wallets toward Web3, non-fungible tokens (NFTs), gaming, decentralized finance (DeFi), and DApp infrastructure and development. In Q2 2022, Web3 accounted for over half of blockchain funding, totaling US$3.7 billion. The sum brings the total funding raised by Web3 startups in H1 2022 to US$10 billion, already matching 2021’s total. |

|

| Top Web3 deals in Q2 2022 included Circle’s US$400 million funding round, Near Protocol’s US$350 million Series C, Sky Mavis and Genies’ respective US$150 million Series C rounds, and MSquared’s US$150 million Series A.

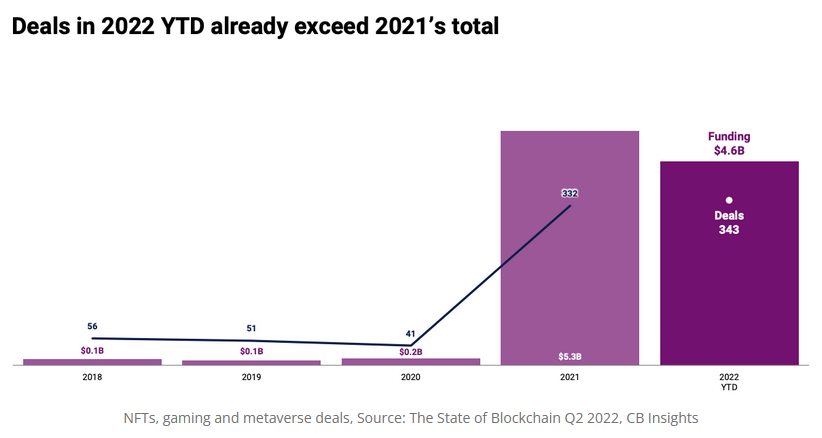

Web3 startups Genies, a platform that allows users to create personalized avatars and chat through their avatar; Magic Eden, an NFT Marketplace on Solana; and 0x, an open protocol that enables the peer-to-peer (P2P) exchange of assets on the Ethereum blockchain, reached unicorn status during the quarter. Besides Web3, NFT, gaming and metaverse was another segment that saw significant interest from investors this year, with startups in the sector raising a total of US$4.6 billion through 343 deals in H1 2022, figures that nearly surpass 2021’s totals. |

Tags: Blockchain/Bitcoin,Featured,funding,newsletter