PitchBook has released its Q4 2024 Crypto VC Trends Report, providing an overview of venture capital investment in the cryptocurrency sector. The report highlights key trends across blockchain infrastructure, Web3, decentralised finance (DeFi), and AI-driven decentralised systems. Crypto venture funding saw a modest recovery in the fourth quarter, increasing by 13.6% compared to the previous quarter. Deal value rose from US$2.2 billion in Q3 to US$2.5 billion in Q4....

Read More »Swiss Bitcoin App Relai Raises US$12M Funding, Eyes MiCA License for EU Growth

Swiss-based cryptocurrency app Relai has secured US$12 million in funding to drive its expansion across Europe. The investment was led by ego death capital with participation from Plan B Bitcoin Fund, Timechain, and Solit Group. The heavily oversubscribed funding round will enable Relai to enhance its platform, streamline the Bitcoin buying process, and educate users on the benefits of the crypto as a savings tool. Relai also shared its plans to obtain the Markets in...

Read More »Schweizer Bitcoin Startup Relai schliesst $4.5M Finanzierungsrunde ab

Relai, die Schweizer Bitcoin-App, gibt eine Investitionsrunde in Höhe von 4,5 Millionen US-Dollar bekannt, die von ego death capital angeführt wird. Weitere Investoren sind Timechain, Cabrit Capital und Lightning Ventures. An der Investitionsrunde beteiligten sich auch der Hauptinvestor von Relai, Redalpine, und der Seed-Stage-Investor Fulgur Ventures, die beide erneut investierten. In Juni 2021 hatte Relai deren Series A (2.5Mio CHF) abgeschlossen und letzten Mai...

Read More »The State of the German Blockchain Ecosystem

Despite a global venture capital (VC) pullback, shrinking valuations and public market turmoil, Germany’s blockchain VC funding market remained stable this year, with companies in the space securing a total of US$218 million across 20 deals year-to-date (YTD), just US$37 million short of 2021’s US$255 million, a new report by CV VC, a Swiss VC and private equity firm specialized in cryptocurrency and blockchain solutions, shows. The German Blockchain Report, released...

Read More »Total Funding to Portuguese Fintech Companies Surpasses EUR 1B Mark

In 2022, the Portuguese fintech ecosystem entered a new stage of development, marked by greater maturity of the sector, continued innovation through partnerships and a dynamic venture capital (VC) market, a new report by industry trade group Portugal Fintech, in collaboration with KPMG, Visa and law firm Morais Leitao, claims. The Portugal Fintech Report 2022, released in October, shows a resilient fintech industry that has continued to grow, innovate and attract...

Read More »BlackRock’s Fintech Bets Span Lending, Wealthtech, Crypto and More

BlackRock, one of the world’s largest asset managers, has been actively investing in the fintech industry over the past decade, participating in large rounds of financing across a broad range of segments, from payments and lending, to wealthtech and cryptocurrency, a new analysis by fintech-focused research firm WhiteSight shows. The report, which delves into the investment firm’s fintech moves, shows that BlackRock has been a prolific fintech investors, dipping its...

Read More »neon’s Crowdfunding Campaign Reaches CHF 5 Million on Its First Day

Swiss neobank neon’s crowdfunding campaign reached CHF 5 million of its CHF 10 million target with more than 2,000 investors participating on the first day of the campaign. The campaign, which runs from October 25 to 31, is offering two to 250 non-voting shares priced at CHF 200.00 per share. The company aims to sell a total of 50,000 shares. According to the campaign page, neon’s recent milestones include hitting 130,000 users, generating CHF 3.5 million in revenue...

Read More »Crypto Financial Product Provider 21.co Raises US$25M at Unicorn Valuation

Crypto solutions provider 21.co has raised a US$25 million round led by Marshall Wace at a US$2 billion valuation, making it Switzerland’s largest crypto unicorn. The round, which included investors, such as Collab+Currency, Quiet Ventures, ETFS Capital and Valor Equity Partners was the company’s first raise in over two years. 21.co is a collection of companies, the largest of which is cryptocurrency exchange-traded products (ETPs) issuer 21Shares. The platform is...

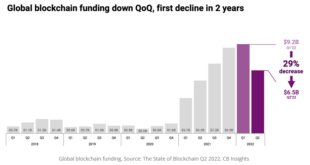

Read More »Global Blockchain Funding Dip; Mega-Rounds Shrink

After a record year 2021, the venture capital (VC) market for blockchain investment is slowing down significantly in 2022 amid uncertain macroeconomic conditions and financial markets turmoil. In Q2 2022, VC investors scaled back cryptocurrency investments due to macroeconomic pressures, concerns about valuations and market volatility. Global funding fell and the number of mega-rounds of US$100 million and up shrank, putting pressure on startup valuations and slowing...

Read More »Swiss Blockchain-Insurtech Jarowa Raises CHF 12.4 Million Series A for Europe Expansion

JAROWA is a Swiss digital marketplace and transaction platform for insurance companies, property managers, and leasing companies to manage their trusted service providers and digital orders more efficiently. JAROWA has successfully closed its Series A funding round, led by Eos Venture Partners, a strategic venture capital fund focused on InsurTech. The proceeds will be used to further expand JAROWA’s offering throughout Europe. Andreas Akeret, JAROWA CEO, stated,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org