A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news. Yet, in the very same data release as the PCE, some other accounts importantly tied to labor, personal income, they slip unnoticed under the radar even though what they show is far more meaningful than either of the above. . We’re focused entirely on those that don’t matter and miss the one(s) which does. . By “we”, I mean, of course, mainstream analysis and commentary, modern day Economics. The bond market isn’t fooled. Not only

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, economy, Featured, Federal Reserve/Monetary Policy, inflation, Markets, newsletter, PCE, Personal Income, personal spending, real personal income excluding transfer receipts, Recession, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

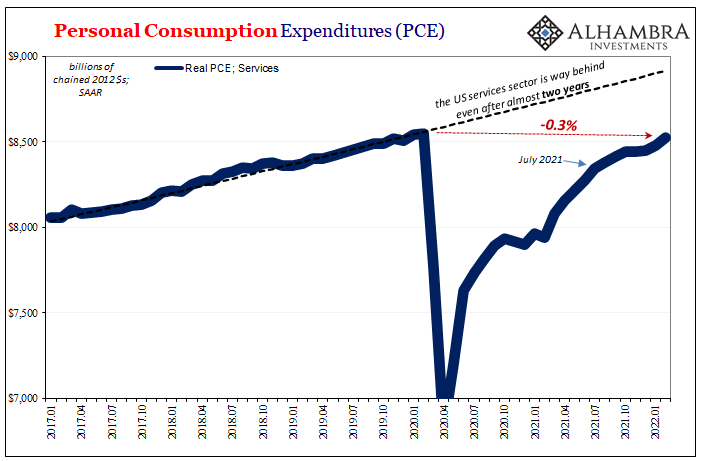

| A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news.

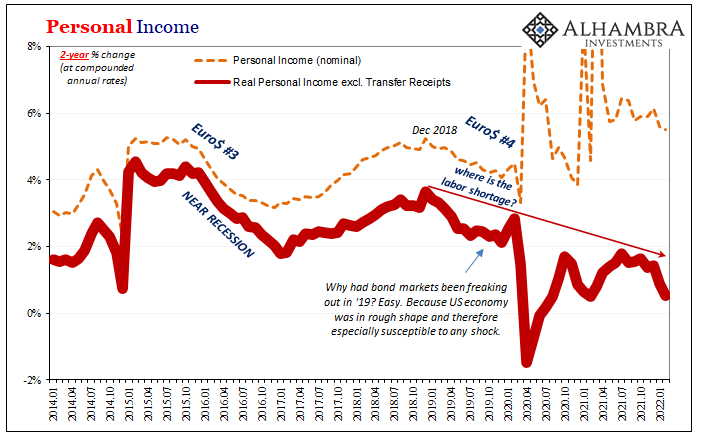

Yet, in the very same data release as the PCE, some other accounts importantly tied to labor, personal income, they slip unnoticed under the radar even though what they show is far more meaningful than either of the above. |

|

| We’re focused entirely on those that don’t matter and miss the one(s) which does. | |

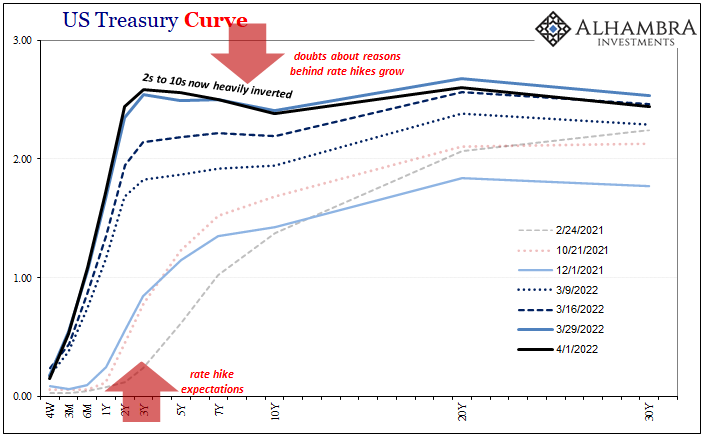

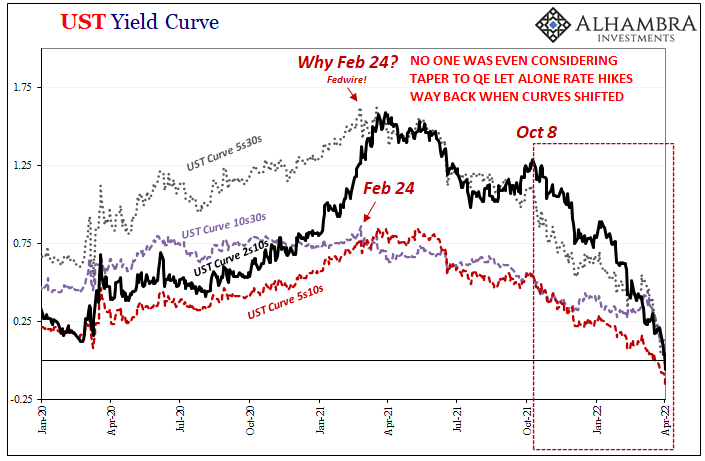

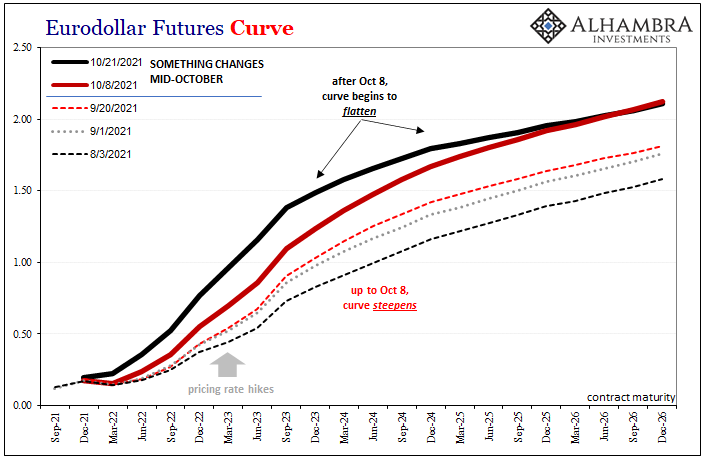

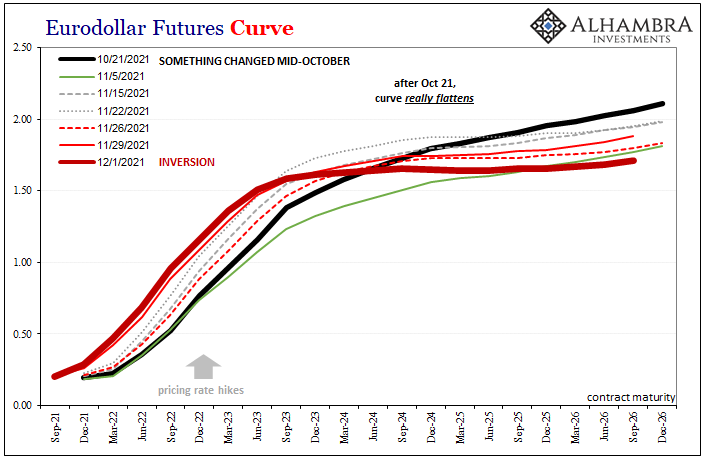

| By “we”, I mean, of course, mainstream analysis and commentary, modern day Economics. The bond market isn’t fooled.

Not only do we have the inventory flood arriving in October to bolster the macro case for curves (along with the real money, collateral case), there’s maybe more importantly an income claim to such rapidly gaining pessimism, too. |

|

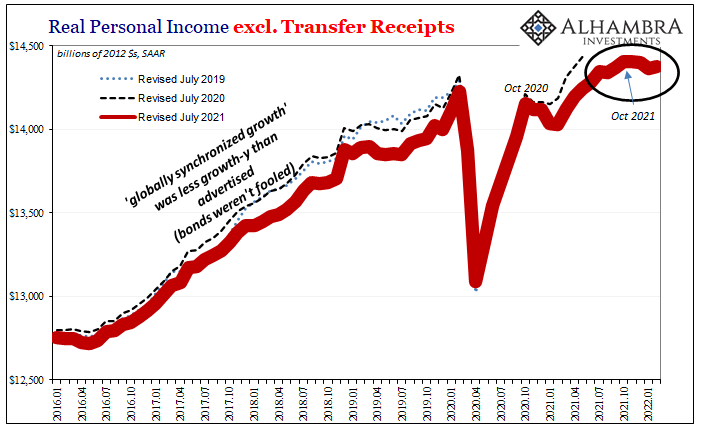

| Like inventory, it has also to do with the supply shock effect.

More Americans are working, as the payroll reports show, and more earned income is being generated, yet it’s not enough to keep up with the artificial surge in prices. According to the BEA, Real Personal Income excluding Transfer Receipts has declined since…October. A string of negative months in this same account is used by the NBER to help declare recessions. |

|

| Pay more, get less. Get paid more, it buys less.

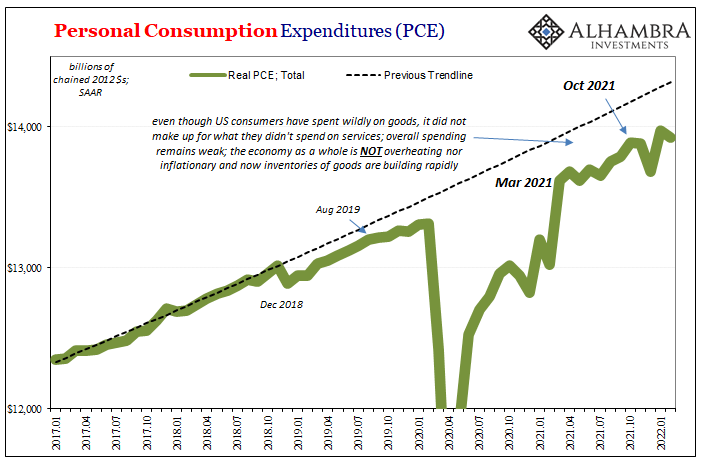

Simple relationships which form the basis for demand destruction. And it only takes some time before the second order effects begin to overshadow those first. As the inability to keep up with especially oil prices (gasoline) wears on discretionary spending, it begins to have a psychological impact, too. Not only do consumers as workers fall further behind, they compound the problem in macro terms by cutting back – destroying demand – as they themselves grow understandably angry and increasingly cautious. |

|

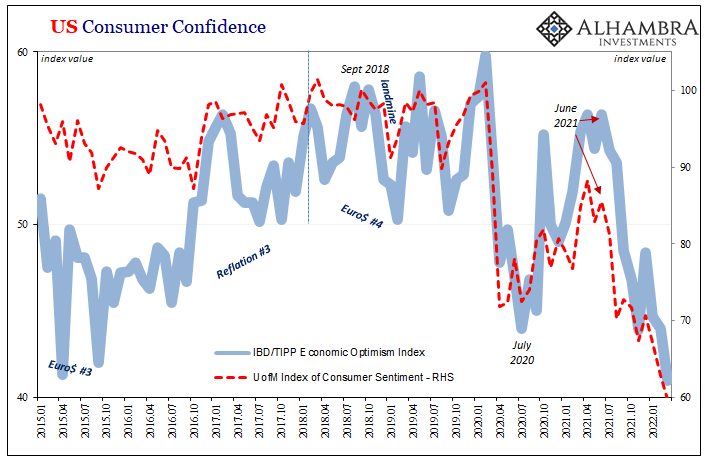

| In that sense, we’ve already seen the second order really begin to bloom.

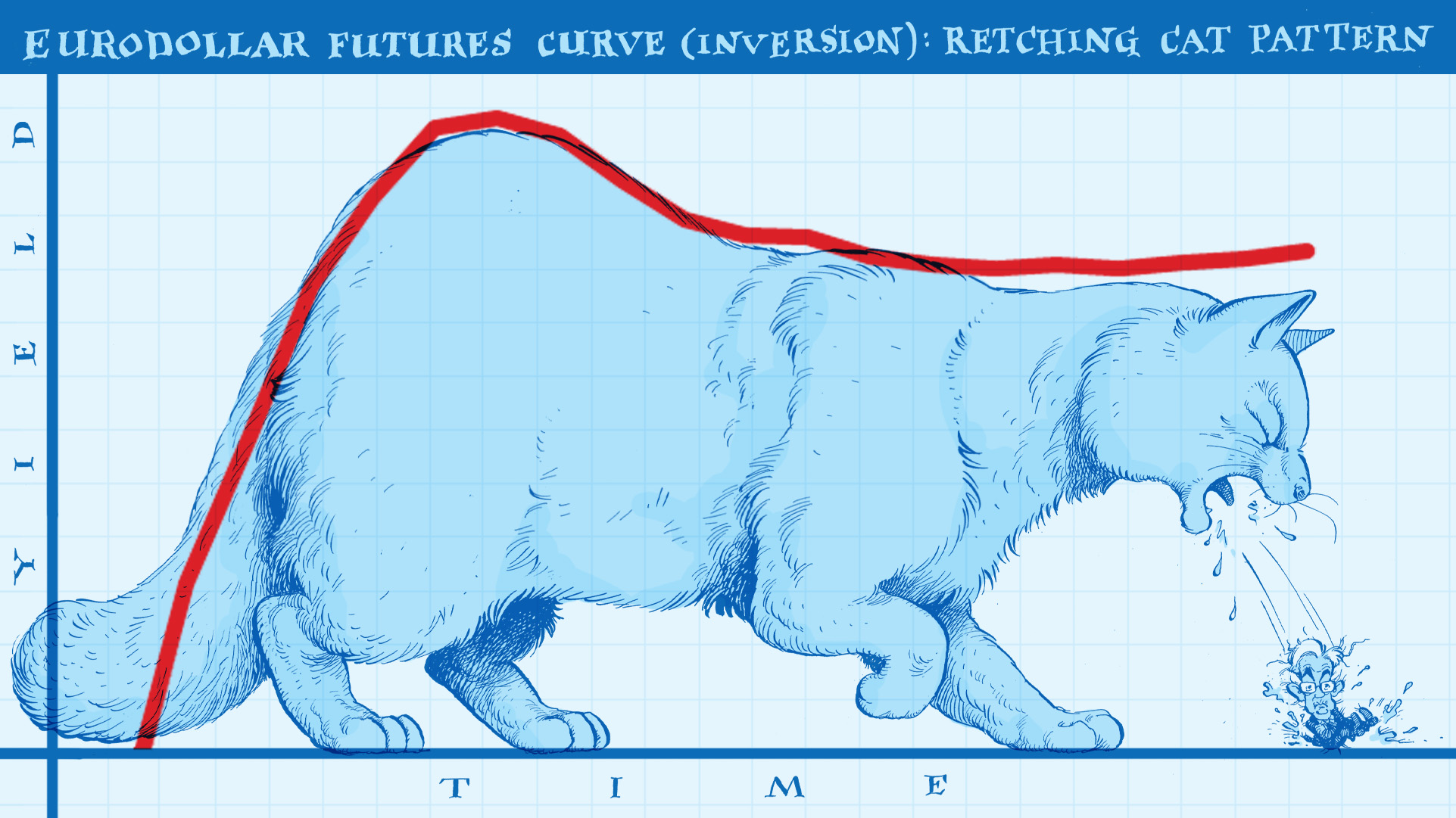

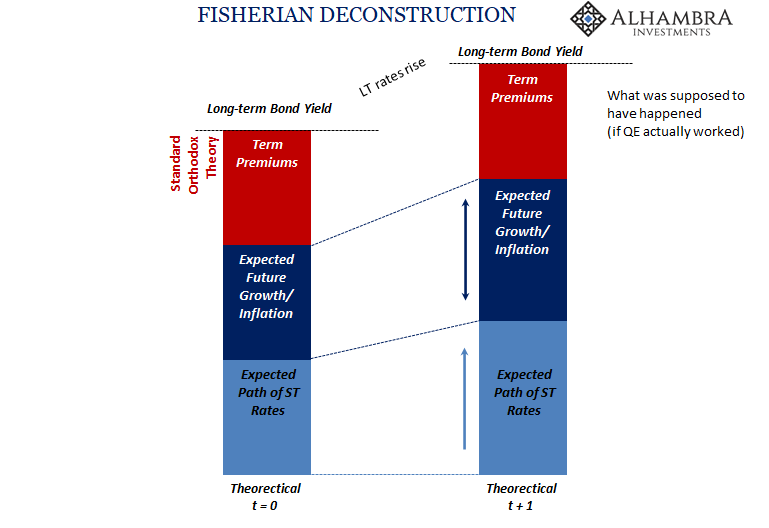

With that sort of economic backdrop, flattening and now inverted curves well into their historic recession watch only make sense. The Fed and its rate hike panic does not. In grounded markets, logic and honest assessment are more than a requirement. In the puppet theater of non-money monetary policy, irrationality is practically invited. |

Tags: Bonds,currencies,economy,Featured,Federal Reserve/Monetary Policy,inflation,Markets,newsletter,PCE,Personal Income,personal spending,real personal income excluding transfer receipts,recession,U.S. Treasuries,Yield Curve