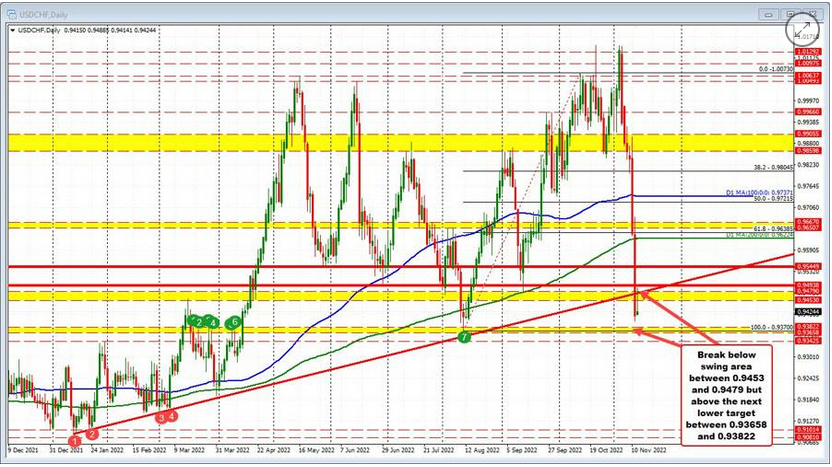

SNB’s Jordan is on the wires saying that: He sees weaker growth in 2023 than this year. SNB still has credibility that inflation will moderate Inflation has broadened Sees limited 2nd round wage effects in Switzerland There is a great probablility that SNB will need to further tighten monetary policy. Nominal appreciation of the franc helps guard against inflation The SNB stands ready to BUY OR SELL the keep the franc fx rate appropriate to steer inflation to target level May hike in December but the decision will be data dependent THe USDCHF fell sharply last week, and in the process fell below the 100/200 day MAs, swing areas (see yellow areas in the chart above) and an upward sloping trend line (see green numbered circles). The last swing area broken was

Topics:

Greg Michalowski considers the following as important: 1) SNB and CHF, Central Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

SNB’s Jordan is on the wires saying that:

- He sees weaker growth in 2023 than this year.

- SNB still has credibility that inflation will moderate

- Inflation has broadened

- Sees limited 2nd round wage effects in Switzerland

- There is a great probablility that SNB will need to further tighten monetary policy.

- Nominal appreciation of the franc helps guard against inflation

- The SNB stands ready to BUY OR SELL the keep the franc fx rate appropriate to steer inflation to target level

- May hike in December but the decision will be data dependent

THe USDCHF fell sharply last week, and in the process fell below the 100/200 day MAs, swing areas (see yellow areas in the chart above) and an upward sloping trend line (see green numbered circles).

The last swing area broken was between 0.9453 to 0.9479. The upward sloping trend line is between those levels. In trading today, the price did move above those levels but has rotated back lower and trades near it’s lows for the day.

|

On the downside, the next swing to get to and through comes in at 0.93658 to 0.93822. The last swing low from August bottomed at that level (there are other swing levels in that area – see green circles). Move below, increases the bearish bias for the pair. Of note, is that this currency pair (unlike most others vs the USD) has seen more volatile up and down moves in 2022 (starting in March/April). As a result, be aware that the price action can turn and run the other way. |

|

| Looking at the daily chart of the EURCHF, it moved lower last week and moved back below the 100 day MA at 0.9764 on Friday. Today, the price briefly moved above that MA line, but quickly reversed lower. There is a swing level support at 0.97065. Move below is more bearish. |

Tags: central-banks,Featured,newsletter