As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day. It has been, sadly, fourteen long years and only incremental signs of progress are visible toward more completely understanding what happened on August 9, 2007, why what followed did follow, as well as how it came to be this way in the first place. . Getting through those is required first before ever tackling what next to do to fix this mess. In

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Arthur Burns, august 15 1971, august 9 2007, Bretton Woods, currencies, economy, Featured, Federal Reserve/Monetary Policy, gold exchange standard, Markets, Money, Money Supply, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day.

It has been, sadly, fourteen long years and only incremental signs of progress are visible toward more completely understanding what happened on August 9, 2007, why what followed did follow, as well as how it came to be this way in the first place. |

|

| Getting through those is required first before ever tackling what next to do to fix this mess.

In the latter’s regard, this brings up our second major remembrance: half a century since August 15, 1971. This was the day fifty years ago next Sunday on which President Nixon “closed the gold window” and thus condemned the world to pure fiat; at least in what has survived as the conventional view. And it is wrong, insofar as what function Nixon had performed fifty Augusts ago was pure perfunctory and insignificant. Yet, in what most people know and claim to remember, this “end of Bretton Woods” explains to them the world they have lived within. One in which central banks have been set free to become Lords of all money creation – the fiat-ness of the gold-free system which sprung up out of the absence of gold exchange. |

|

| The ways in which this common view as to August 15, 1971, are wrong – dead wrong – therefore explain quite a lot about August 9, 2007, as well as the fourteen August 9th’s which so far have followed in too much the same fashion.

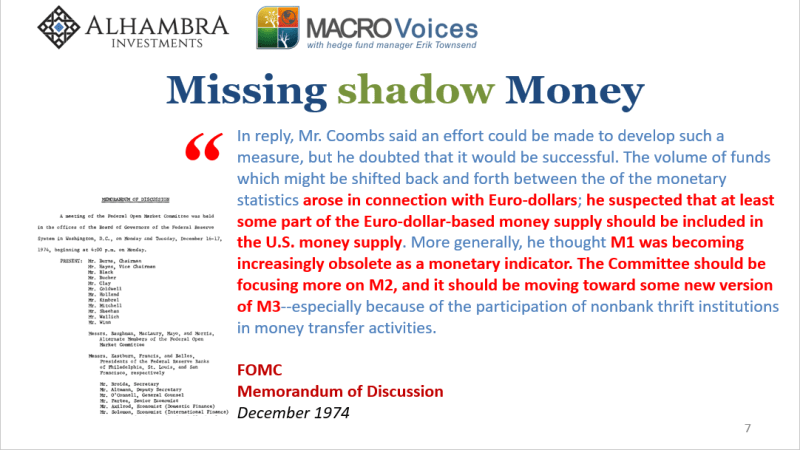

Let’s start by reviewing what those fiat bastards had to say at the time; if the Federal Reserve was about to become the most powerful force in the economic and financial universe, its officials must’ve had quite a lot to say about the final breakdown of gold-exchange. Except, no. At the FOMC meeting held on July 27, 1971, two weeks prior, the Memorandum of Discussion mentions “gold” all of two times in its 86 pages – and these MoD’s are mere summaries of the conversations rather than actual transcripts. With the entire postwar monetary edifice allegedly on the brink of collapse, you’d think – you’ve been led to believe – this was some Earth-shattering development requiring deliberate and deliberately lengthy preparations by the very institution we keep hearing was and is at the central nexus of all these things. And on those two occasions when gold was brought up, one was to note the continued rise in the secondary market price (gold had been two-tiered for several years, already a clue) while the other to reference what the French were doing and what international authorities might do (swaps) in response (another common refrain, and another clue). The same for the FOMC meeting held the month before, on June 29, 1971; again, “gold” shows up exactly twice and each in the same way as the latter mention cited immediately above. |

|

| “Bretton Woods” doesn’t come up anywhere in either.

OK, but what about the FOMC gathering on August 24? Nine days after the action of August 15, Federal Reserve Chairman Arthur Burns demanded an unusual change in the manner of the discussion. Typically, in addition to the FOMC’s various voting members and branch Presidents there are throngs of staff members and lower-level persons of varying usage (legal, research, etc.) At the start, Burns immediately asked that only the executive members and whatever few staff directly related to the discussion remain. And then they spent the vast majority of the time talking about…the federal government’s deficit and prospects for it to be controlled. Lost to the sensationalizing of August 15, 1971, is the fact gold/dollar convertibility wasn’t actually high on anyone’s agenda – you don’t have to take my word on it, research the President’s statement as well as read for yourself in the MoD I’m summarizing here. Even contemporary media accounts were focused, as they should have been, on the absurd central planning failures just waiting within the details (wage and price controls, among several other really, really bad ideas). Gold was really an afterthought. It had come to be seen and accepted that the inflationary disaster was itself the summary line items of Treasury’s budget. Money supply? Much trickier problem. It was at the bottom of Page 12 where the MoD indicates that once Chairman Burns had said his peace about Nixon’s “new” economic plan, including only once mentioning gold, he then opened up the floor for discussion among the remaining executive membership. Over the next several pages, up to Page 16, the summary notes only the topics about government deficits and the attempted wage and price actions. Nothing about gold or the international monetary system, at least not until the end of Page 16 when what followed from there was a disorderly stream of unorganized thoughts surrounding Europeans and swap lines, jumbled concern about the viability of capital controls versus market expectations which might become embedded within a floating rate currency regime. The FOMC had to vote on an increase in swap lines with the National Bank of Belgium (a $100mm raise to $600mm total) as well as another with the Swiss National Bank ($400mm more raising the ceiling to $1bln).

No cooperation was found “and the exchange markets were reopened yesterday on an every-country-for-itself basis.” This is the common viewpoint about August 15, 1971; up until then, Bretton Woods was troubled but still working out as a reasonable economic framework. Nixon’s action a drastic surprise, therefore assumed as a momentous paradigm alteration. But was it? I mean, Great Inflation for one thing and for another there were then any number of ways to have realized the manner in which the system (the international system) effectively functioned had little or nothing to do with gold-exchange. But you can see how, from the incompetent standpoint of the Federal Reserve’s naïveté, it might’ve seemed, to them, a total shot in the dark. For the Fed, this was a shock…but it should not have been, not even close, if anyone there was up to the task. |

|

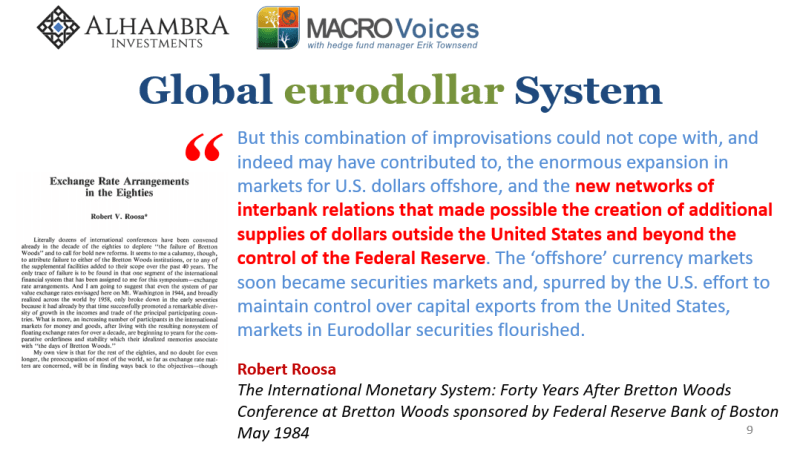

| Again, any number of clues as to this state of affairs. I’ve documented so many over the years, including recently in one sordid tale of Italian, Swiss, and Japanese (selling UST’s!) eurodollar usage demonstrating perfectly exactly these things.

In addition, here’s another huge clue from the July 1971 FOMC MoD, again just two weeks before the “demolished with one stroke.” Officials had grown very concerned with, get this, the growing sense monetary policy might not be working out so well, and thus might be missing something substantial – right down to its foundations – especially given the economic climate.

Central banks, we’re always told, control the money supply. Something about a currency monopoly (even though history shows this isn’t true). In July 1971, just before “the end of Bretton Woods”, Chairman Arthur Burns begins one very serious policy discussion in parallel with others (Treasury’s new economic plan) each having to do with an economic disaster having first been brought up by running away inflation. You don’t even need to connect all these dots; just one or two would suffice. And the one at the Fed (above) begins with: hey, we don’t really control the money supply. |

|

| The Fed had not “printed” all those “dollars” let loose upon the entire planet, and it wouldn’t print the massive flood still coming by which to sustain the Great Inflation – not just the consumer price affronted domestic economy, all over the world. Nixon’s actions, from convertibility to idiotic wage and price controls, all of it in reaction to the same thing here which was a systemic, seemingly secular economic imbalance traced back first to some really basic problems in money.

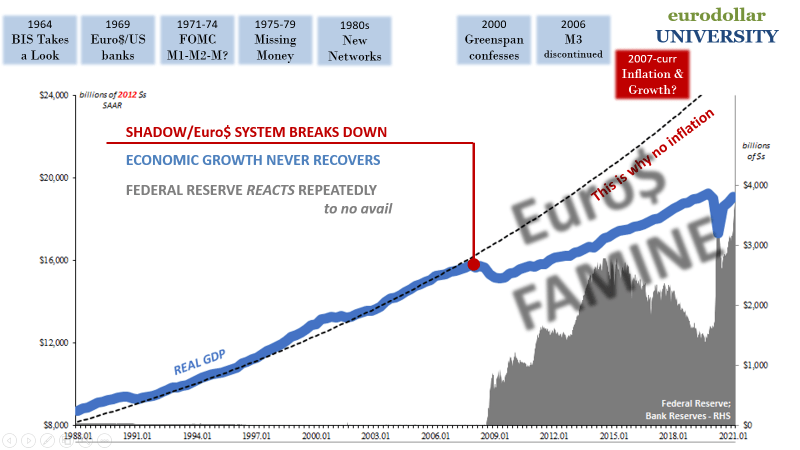

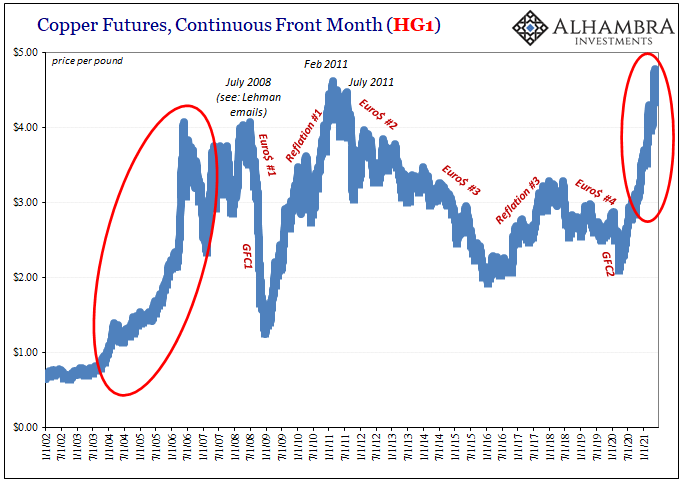

This should sound familiar, for at the opposite bookend was August 9, 2007. You see, the plain truth is that long before any of these Augusts the money for the international system had been tasked as bank-centric; not central bank-centric. |

. |

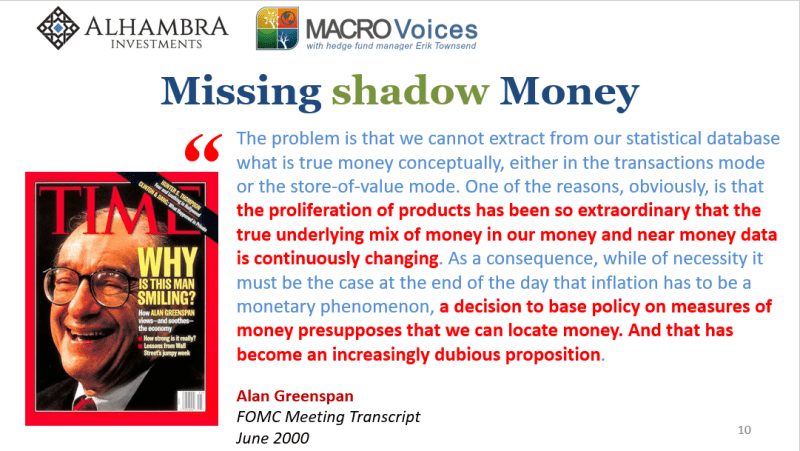

In between, into the early eighties, the Fed merely gave up on money because its staff first had come to realize there was no point; they would never be able to catch up to this “proliferation of products.”

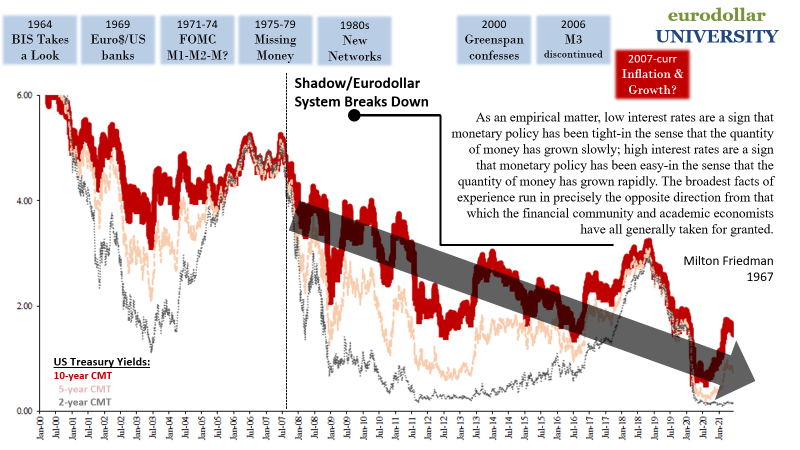

Instead, central banks abandoned their traditional roles in order to attempt a workaround; if monetary policy couldn’t have money – remember, all they could actually control was the level of bank reserves – then it would mutate into an influence-policy which sought to manipulate expectations exclusively; including those of the banks who did the actual global (euro)dollar printing.

The Fed had come to believe it wouldn’t need to know the nitty gritty monetary details; indeed, as I’m chronicling here, this was a constant problem by the early seventies already, instead they’d show banks the way (interest rate targeting) and then let them sort out the money for it.

It only seemed to work (the Great “Moderation”) so long as the way forward was more money, more money, more money. Once the money got shut off by the banks, what then? What use “monetary” policy trying to influence from afar?

That question would be answered perfectly, disastrously on August 9, 2007.

The sole reason we are still talking about it – aside from the general nature of historical significances – is that central banks remain in the same confused state when it comes to actual money during the current Euro$ Famine as they had been in the opposite way of the monetary Great Inflation. Big money imbalances and the central bank facing each unable to correct them for really pitiful reasons of incompetence.

In each case, central banks held out, stubbornly adhering to otherwise obviously outdated approaches long past the point when doing so only contributed much to sustaining the problem as well as making it worse. August 15, 1971, hadn’t been the thing, it was merely one more symptom neatly tied to a much larger and more significant truth.

Time merely the proof.

The August 15, 1971, myth perpetuates the wrong ideas about how the monetary system functions. It is entirely understandable and sympathetic as to why the public, for the few who do think about such things, continues to believe what they believe about that day. Fiat and all that.

The central bank omniscience was eventually tacked on under Greenspan even though he consistently admitted what the Federal Reserve had actually become – not a monetary agency by any stretch. The combination quickly became the still widely believed: Don’t Fight The Fed.

August 9 should have shattered any such idea, but it was overshadowed (eventually; GFC and all that first) by QE of all things. Even in the early seventies it was more widely known that bank reserves were nothing more than the one thing the FOMC could control. Whether or not that was useful or useful money, the fifty years in between have demonstrated underneath the myths and surviving fiat shorthands.

On these anniversaries, we use them to make the same appeal: don’t take their, or my, word for it. There is an entirely different worldview to be “discovered”, one that actually makes comprehensive sense of not just the history before August 9, but as much the profound substance of the 21st century world and all in it. It consistently matches observation with theory, for once, incorporating the true nature of what have, for many good reasons, become these memorable anniversaries.

Ben Bernanke, like Aristotle, is not an idiot. He, like many of those who came before him as well as all who have followed, was never what you thought he was. Bank reserves, like rubber ducks, do not really belong in the context of “fiat.”

Tags: Arthur Burns,august 15 1971,august 9 2007,Bretton Woods,currencies,economy,Featured,Federal Reserve/Monetary Policy,gold exchange standard,Markets,money,Money Supply,newsletter