The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB. WHAT ELSE CAN THE SNB DO? The SNB meets quarterly in March, June, September, and December. At the March 19 meeting, the SNB took a series of measures to help mitigate the impact of the pandemic. Whilst SNB officials have always said that rates could be cut further, we do not think the bank will go more negative. For now, we expect policymakers to continue focusing on the exchange rate with its ongoing intervention program. Here, we look at several macro moves that the SNB could make this week and in the coming months if needed. 1. Tweak its

Topics:

Win Thin considers the following as important: 1) SNB and CHF, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB.

WHAT ELSE CAN THE SNB DO?

The SNB meets quarterly in March, June, September, and December. At the March 19 meeting, the SNB took a series of measures to help mitigate the impact of the pandemic. Whilst SNB officials have always said that rates could be cut further, we do not think the bank will go more negative. For now, we expect policymakers to continue focusing on the exchange rate with its ongoing intervention program. Here, we look at several macro moves that the SNB could make this week and in the coming months if needed.

1. Tweak its language – LIKELY NOW, LIKELY IN H2. In its March policy statement, the bank noted that “In these exceptional circumstances, the SNB’s expansionary monetary policy is more necessary than ever for ensuring appropriate monetary conditions in Switzerland.” We expect the bank to underscore that expansionary policies will remain in place for the foreseeable future. At the December meeting, it said the currency “remains highly valued,” which is its code phrase for talking down the franc. At the March meeting, Governor Jordan said that it was “even more highly valued.” Further jawboning on the exchange rate seems likely given rising deflation risks.

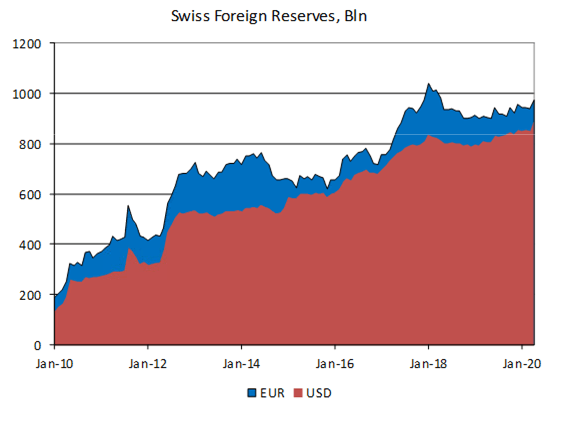

2. Tweak its FX intervention – POSSIBLE NOW, POSSIBLE IN H2. At the March meeting, the SNB said that it “is intervening more strongly in the foreign exchange market to contribute to the stabilisation of the situation.” Foreign reserves were around €938 bln in March and rose to €972 bln in April. We expect another rise in May. Given recent strength in the franc, there is a risk of a stronger intervention message from the SNB at this meeting.

3. Tweak existing liquidity facilities and other macroprudential policies – POSSIBLE NOW, POSSIBLE IN H2. The SNB introduced a new COVID-19 refinancing facility March 25 that would allow banks to obtain cheap liquidity from the central bank. The SNB also deactivated the countercyclical capital buffer, while the Swiss Financial Market Supervisory Authority (FINMA) introduced a temporary exclusion of deposits held at central banks from the calculation of banks’ leverage ratio until January 1, 2021. With the SNB reluctant to go more negative, we think this is the route to take to loosen monetary conditions further.

4. Tweak existing exemptions to negative rates – POSSIBLE NOW, POSSIBLE IN H2. At the March meeting, the SNB announced that starting April 1, the threshold factor for exempting sight deposits from negative interest rates would be raised from 25 to 30. This move was meant to help Swiss banks there were struggling under the negative rate regime. Another adjustment to the threshold factor is certainly possible for the struggling financial sector.

| 5. Deeper negative interest rates – VERY UNLIKELY AT ANY TIME. SNB was amongst the first of the major central banks to go negative, back in December 2014 to -0.25%. It went deeper into negative rates with a 50 bp cut in the policy rate to the current -0.75% at the same time that it abandoned the Swiss franc cap (see below) in January 2015. The bank has warned that rate cuts are still in its toolbox, but we do not believe the Swiss economy is built to withstand even more negative rates. Why not? The financial sector is a large part of the Swiss economy. This sector is already weakened from years of negative rates, and so the last thing banks need is more negative rates that would further harm profitability and distort lending and borrowing incentives.

6. Repeg the Swiss franc -VERY UNLIKELY AT ANY TIME. After the disastrous decision in January 2015 to abandon the floor, the SNB is unlikely to go down this road again. Recall that the SNB initially put a floor under EUR/CHF at 1.20 in September 2011 due to concerns about the deflationary impact of a strong franc. Ongoing appreciation pressures saw the SNB’s foreign reserves balloon from around €500 bln in September 2011 to €661 bln in January 2015 from ongoing EUR purchases. The SNB had unlimited resources to defend the floor and yet abandoned it in January 2015. Why? There has been no clear-cut answer but many theorize that the SNB was simply too uncomfortable with its ever expanding balance sheet. Yet reserves have continued to rise as SNB purchases continue and stand at EUR972 bln at the end of April. |

Swiss Foreign Reserves, 2010-2020 |

| ECONOMIC OUTLOOK

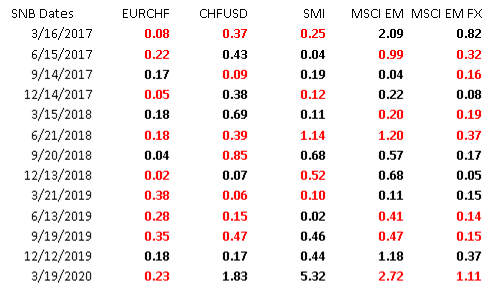

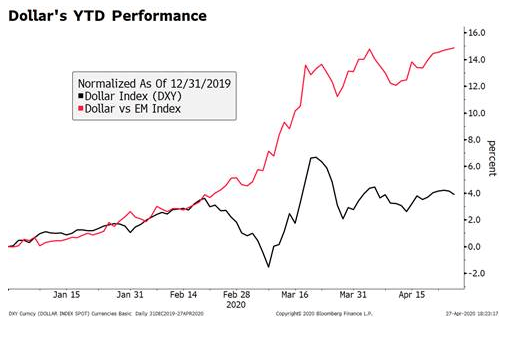

The Swiss economy is in recession. New economic forecasts will be issued by the SNB at this meeting. The OECD sees -7.7% contraction in 2020 followed by 5.7% growth in 2021 and compares to the IMF’s earlier forecast for -6.0% contraction in 2020 followed by 3.8% growth in 2021. Q1 GDP came in weaker than expected, contracting -2.6% q/q and -1.3% y/y. With the lockdown only now beginning to be lifted, Q2 is likely to show further contraction, with Blomberg consensus currently at -10.2% q/q. Consensus sees 6.1% q/q growth in Q3, but that clearly depends on how the reopening progresses. The SNB meets even as deflation is deepening. May CPI fell -1.3% y/y vs. -1.1% in April. This nearly matches the low of -1.5% seen back in September 2015. Both the OECD and IMF are forecasting a return to inflation in 2021 after deflation in 2020. However, inflation is likely to undershoot the SNB’s 2% target through 2022. As such, we see no risk that the SNB will remove any stimulus before then. INVESTMENT OUTLOOK Safe haven status and ongoing global risks have kept the Swiss franc outperforming this year. So far in 2020, CHF is up 1.8% vs. USD and is the best performing major. Same goes for CHF vs. EUR, up 1.6% and the best performer again. After trading last month at the lowest level since mid-2015 near 1.05, EUR/CHF spiked up above 1.09. That was the highest level since December but has since eased back as geopolitical risks have picked up. The last major retracement objective from the May-June rise comes in near 1.066 (62%) and a break below would target that may low near 1.05. The Swiss franc has tended to weaken on recent SNB decision days. In 2019, CHF weakened against EUR on 3 of the 4 SNB decision days. In 2020, CHF has weakened vs. EUR on the only SNB decision day so far. Against USD, CHF also weakened on 3 of the 4 SNB decision days in 2019 but strengthened after the most recent meeting in March. |

Swiss equities continue to outperform within MSCI World after a solid 2019. In 2019, MSCI Switzerland was up 27.2% compared to 25.8% for MSCI World. So far this year, MSCI Switzerland is -4.7% compared to -5.5% YTD for MSCI World. This outperformance should continue, as our DM Equity model has Switzerland at a VERY OVERWEIGHT position.

Swiss bonds are underperforming within DM. The yield on 10-year local currency government bonds is +9 bp YTD. This is ahead of only the worst performer Portugal (+11 bp bp) and tied with Spain (+9 bp). This underperformance is largely due to the fact that the SNB was already running negative rates before the pandemic hit. While other central banks moved to zero rates this year and pushed yield curves lower, the Swiss curve was already pinned down in negative territory.

Our latest DM sovereign ratings model update saw Switzerland’s implied rating remain firmly in AAA territory. Switzerland’s score worsened along with the rest of the DM credits, but it remains the best in DM and at 9.2 remains far from the 30 threshold for AA credits.

Tags: Articles,developed markets,Featured,newsletter