Extremes become more extreme right up until they reverse, a reversal no one believes possible here in the waning days of 2020. The absolutely last thing anyone expects is a collapse of all the asset bubbles, i.e. a deflation of assets that reverses the full 20 years of bubble-utopia since 2000. The consensus is universal: assets will continue to loft ever higher, forever and ever, because the Fed has our back, i.e. central banks will create trillions out of thin air without any consequence other than assets lofting ever higher. This research paper from the San Francisco Federal Reserve begs to differ. Here is an excerpt from Longer-Run Economic Consequences of Pandemics (San Francisco Federal Reserve) “Measured by deviations in a benchmark economic statistic,

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Extremes become more extreme right up until they reverse, a reversal no one believes possible here in the waning days of 2020.

The absolutely last thing anyone expects is a collapse of all the asset bubbles, i.e. a deflation of assets that reverses the full 20 years of bubble-utopia since 2000. The consensus is universal: assets will continue to loft ever higher, forever and ever, because the Fed has our back, i.e. central banks will create trillions out of thin air without any consequence other than assets lofting ever higher.

This research paper from the San Francisco Federal Reserve begs to differ. Here is an excerpt from Longer-Run Economic Consequences of Pandemics (San Francisco Federal Reserve)

“Measured by deviations in a benchmark economic statistic, the real natural rate of interest, these responses indicate that pandemics are followed by sustained periods–over multiple decades–with depressed investment opportunities, possibly due to excess capital per unit of surviving labor, and/or heightened desires to save, possibly due to an increase in precautionary saving or a rebuilding of depleted wealth. Either way, if the trends play out similarly in the wake of COVID-19 then the global economic trajectory will be very different than was expected only a few months ago.”

Allow me to translate: wars launch 20-year booms of rebuilding, pandemics launch 20 years of deflation. Oops! Not only do wars destroy physical assets that must be rebuilt, they also tend to kill off a consequential percentage of the labor force, generating a labor shortage that pushes up wages.

So capital wins funding the rebuilding and labor wins because workers are scarce and in demand: win-win baby! Pandemics are considerably less warm and fuzzy, especially Covid-19. Pandemics are like neutron bombs, they leave the built environment intact so there’s no impetus to invest.

Unlike the Black Death that decimated the human workforce from China to Europe in the 1350s, Covid disproportionately takes the lives of the elderly, most of whom have already left the workforce. So the Covid pandemic’s reduction of the workforce is too modest in scale to create labor scarcities consequential enough to push wages higher.

In other words, lose-lose: capital earns low returns in a low-demand environment and labors’ wages stagnate in this low-demand economy.

Cue 20 years of asset deflation. Bu-bu-but the Fed is omnipotent, godlike in its powers! The Fed can push stocks to the moon, never mind history, fundamentals or reality!

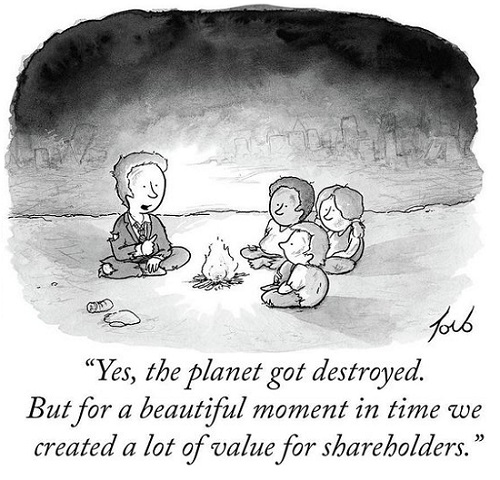

Yes, well, um, fantasies are nice, and delusions are fun, but reality inevitably intrudes and diminishing returns on the Fed’s neofeudalist feast for the super-wealthy are about to grab markets by the throat, regardless of what the Fed bleats.

There are a couple of funny little things called reversion to the mean, bubble-symmetry and non-linear dynamics that the Fed doesn’t actually control (gasp!) because they are not fully controllable by human policies. Statistical outliers / extremes have a preternatural propensity to reverse, regardless of human manipulation (recall that the way of the Tao is reversal.)

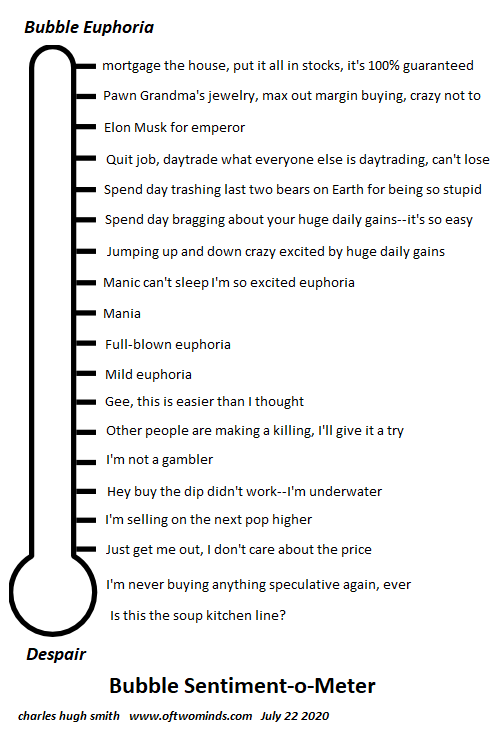

And these reversals are not “buy the dip” wiggles; they completely reverse the entire bubblicious move to the stars via bubble-symmetry: so markets that go from 1,000 to 30,000 retrace all the way back down to 1,000, no matter how many humans shout, scream, plead and whine “that’s not possible!”

| Oh yes it is. Hubris weighs heavily on our faith in the “right” human policies to work magic forever and ever. So as long as the Fed follows the “right policy” and continues printing trillions of dollars out of thin air and buying bonds (and whatever else needs to be bought up to loft markets higher) then Dow 100,000 is in the bag.

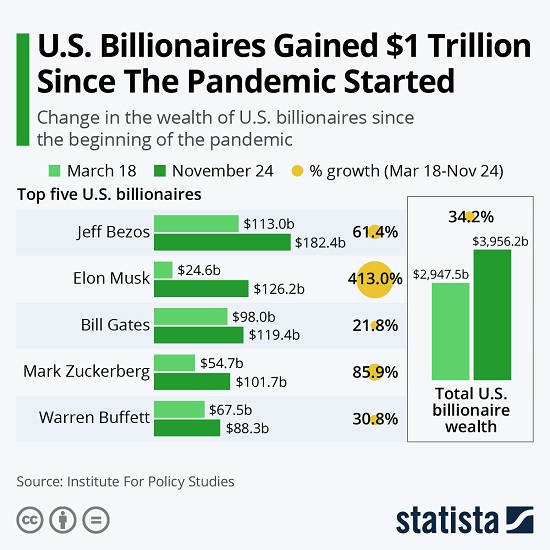

Or not. The idea that human don’t control everything is anathema to a technocrat elite, and so when the inevitable reversal crashes assets, everyone will rush around looking for the human-action cause of the disaster and the human-action fix, so we can get back on track to Dow 100,000. But the search for causes will be in vain, for extremes pendulum swings reach a limit and then swing back, eventually reaching the opposite extreme minus a bit of friction, which is minimal in a frictionless financial sector of printing trillions with keystrokes. If you want evidence that the pendulum has swung as far as it can go, ponder this chart of billionaire wealth jacked higher by the Fed and its central bank cronies: |

|

| Can 20 years of asset deflation be compressed into a mere two years? Absolutely. The global financial system has been running a 20-year experiment in extremes that’s close to producing interesting results.

Extremes become more extreme right up until they reverse, a reversal no one believes possible here in the waning days of 2020. If we could measure hubris, it would be near-infinite. and the reversal of that near-infinite extreme will be one for the ages. |

Tags: Featured,newsletter