It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way. We’ve seen all this before, repeatedly. Part of the denial is about the nature of these things. The eurodollar’s squeeze is, at its root and most clearly at its beginning, a disinflationary pressure on industry. It is pernicious in its own methodology, but also because it allows the official narrative this space for what sounds like a plausible rebuff.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, economy, Euro$ #4, Europe, Featured, Federal Reserve/Monetary Policy, France, Germany, industrial production, Italy, Markets, newsletter, NIRP, QE, Recession

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way.

We’ve seen all this before, repeatedly. Part of the denial is about the nature of these things. The eurodollar’s squeeze is, at its root and most clearly at its beginning, a disinflationary pressure on industry.

|

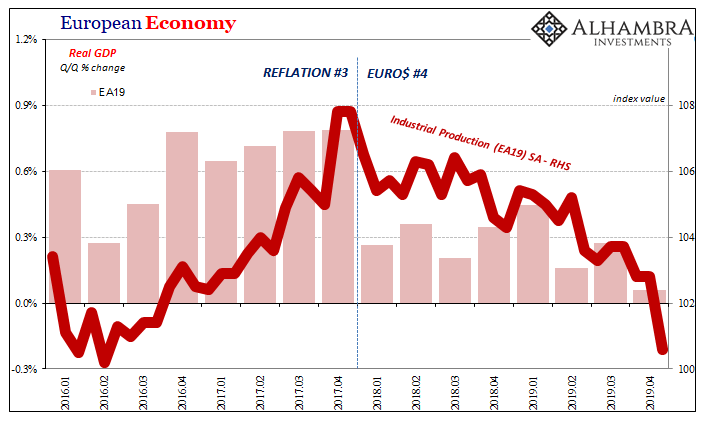

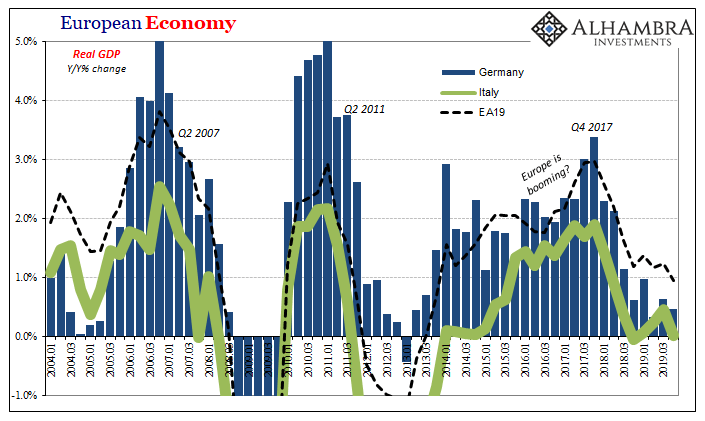

It is pernicious in its own methodology, but also because it allows the official narrative this space for what sounds like a plausible rebuff. Who cares about industry! The modern economy is a services-based system. It isn’t good that a manufacturing recession may be developing, but hardly any cause for serious concern. Just a bunch of cross currents and headwinds. What we keep seeing instead is that industrial setbacks are the precursor. Once the industrial sectors take on water, the entire economy gets dragged under the waves. Eventually. The squeeze unlike the shock takes its bitter time. This goes for Germany and Europe. The bellwether segment of that bellwether economy has already proved itself, and is proving itself yet again. And all during the fourth quarter of last year when, we constantly have been told, the world was turning around and rebounding. The labor market on the strength of undeterred services economies would keep all afloat. What if it’s not this way at all? Eurostat revised European GDP today coming alongside the release of initial reports from national economic agencies on various national GDP numbers. For Europe, EA19, growth in Q4 came in a little lower than previous thought. Instead of basically zero growth last quarter over the one before, +0.094% (Q/Q), it is now calculated to be that much closer to zero, +0.059%. |

European Economy, 2016-2019 |

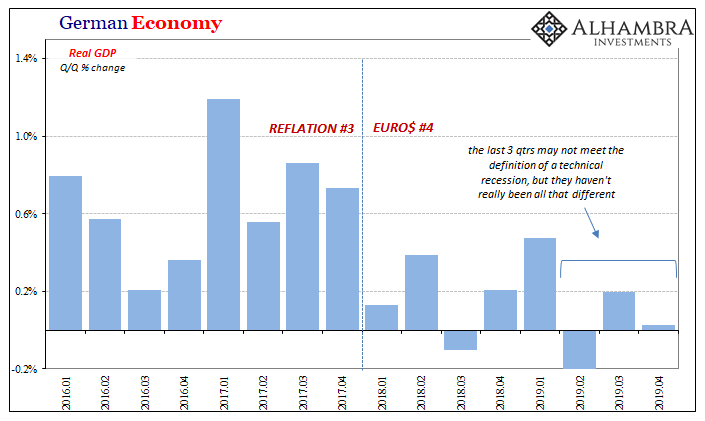

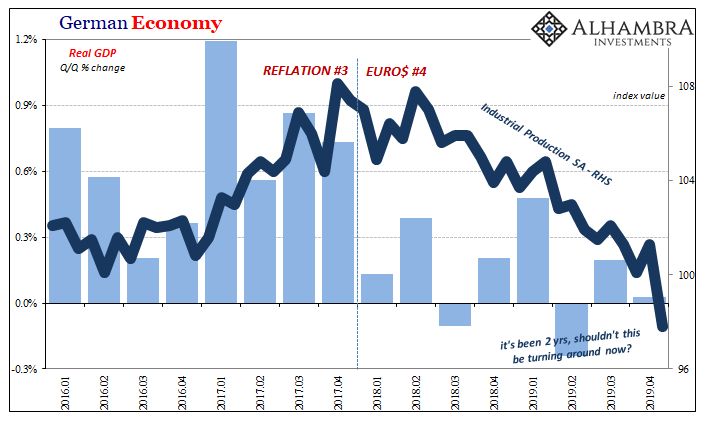

| One reason why is how Germany keeps managing to avoid a “technical recession” even though for the last three quarters running there has been no growth whatsoever. Three quarters, nine months of less than nothing.

According to deStatis, German GDP managed another plus sign, the second in a row, but just barely. Quarter-over-quarter, GDP was up an amount indistinguishable from zero (statistically the same as a small minus). At +0.028%, it keeps the minus sign off the front pages even though real GDP in Q4 was lower than it was in Q1. Yes, you read that right. It may not be a recession, according to convention, but is it really any different? |

German Economy, 2016-2019 |

German Economy, 2016-2019 |

|

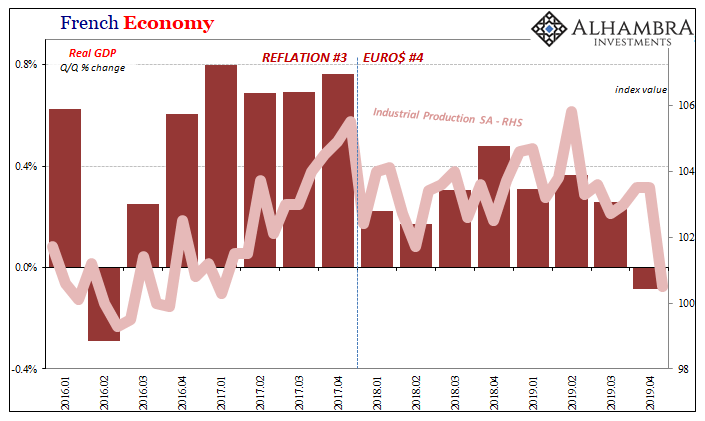

| Europe’s largest economy is actually the good news out of the bunch. Over in number two, France, there actually was a negative number for Q4. It wasn’t a big one, of course, but, unfortunately, it does track all-too-well with the way things seem to be going (in the evidence and data, if not the narrative and sentiment).

Whereas Germany has been taking an escalator downward, it appears France has for its economy a set of stairs. They both end up in the same place, though, and that’s the point. |

French Economy, 2016-2019 |

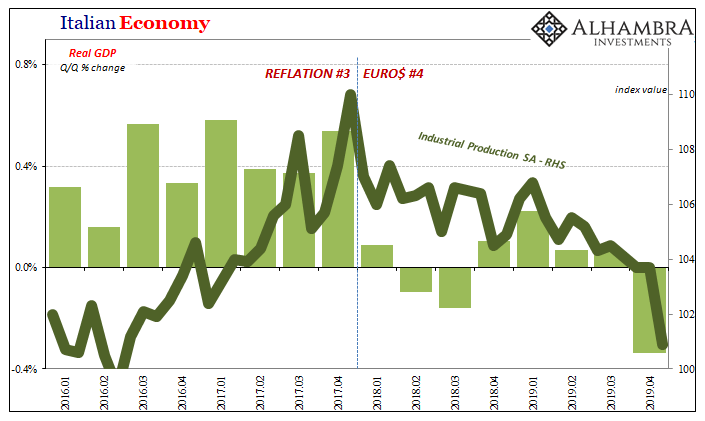

| Taking a look at number three, Italy, a substantial, undeniable minus for Q4. The Italian economy will never be mistaken for Japan in the eighties, but after the initial stumble into Euro$ #4 in early 2018 it did appear for a time over the interim that Italy might “decouple.” For a few quarters, growth accelerated modestly.

Commentary surrounding that acceleration was anything but modest, which is why many people have been surprised at the level of weakness in Italy and throughout Europe over the final three, six, or nine months of last year. |

Italian Economy, 2016-2019 |

| All of it stands in direct contrast to how it is “supposed” to have gone (and, thus, how it might go from here). Germany wasn’t supposed to spread. Industry doesn’t matter. The fourth quarter was the first bright spot. That’s what we were told.

The data and evidence, across a very broad cross-section, demonstrates conclusively again they really have no idea what they are talking about. Therefore, they have no idea what they are doing, either. QE and NIRP-ier NIRP. Two years in, we are still getting to the bottom of this in more ways than one. Unfortunately, if Europe isn’t there then what might that mean for the rest of the globally synchronized world? Factor in recent dollar signals and it all adds up in the direction of more of Euro$ #4. And all of this before COVID-19. |

European Economy, 2004-2019 |

Tags: currencies,economy,Euro$ #4,Europe,Featured,Federal Reserve/Monetary Policy,France,Germany,industrial production,Italy,Markets,newsletter,nirp,QE,recession