EUR/CHF is trading at 33-month lows near 1.0759. The US added Switzerland to its current manipulators’ list. The SNB removed the cap on the euro on Jan. 15, 2015. Five years after the Swiss National Bank (SNB) shocked the financial markets by abandoning the euro cap, the Swiss Franc is trading at 33-month highs against the single currency. The EUR/CHF pair dropped to 1.0759 on Tuesday, the lowest level since April 2017 and was last seen trading at 1.0766. Tuesday’s slide was likely triggered by the US’ decision to add Switzerland to its watchlist of currency manipulators. The US move will likely discourage the SNB from taking steps to limit the upside CHF. Also, the Franc is trading at 33-month highs even with negative rates. The central bank’s official interest

Topics:

Omkar Godbole considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, EUR/CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- EUR/CHF is trading at 33-month lows near 1.0759.

- The US added Switzerland to its current manipulators’ list.

- The SNB removed the cap on the euro on Jan. 15, 2015.

| Five years after the Swiss National Bank (SNB) shocked the financial markets by abandoning the euro cap, the Swiss Franc is trading at 33-month highs against the single currency.

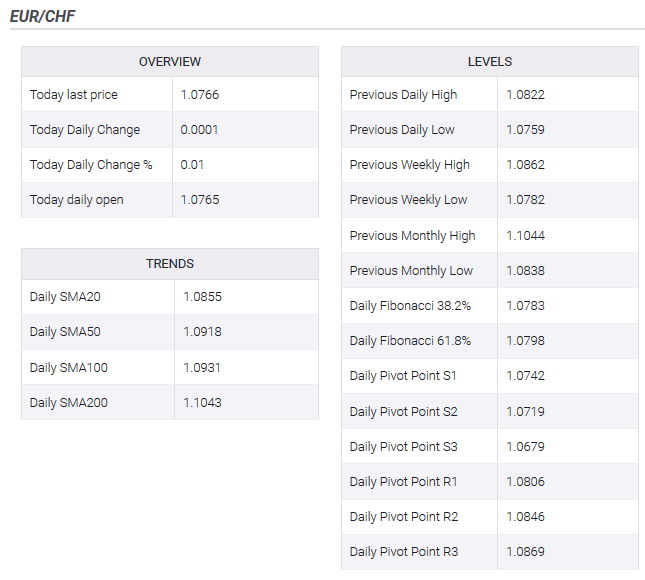

The EUR/CHF pair dropped to 1.0759 on Tuesday, the lowest level since April 2017 and was last seen trading at 1.0766. Tuesday’s slide was likely triggered by the US’ decision to add Switzerland to its watchlist of currency manipulators. The US move will likely discourage the SNB from taking steps to limit the upside CHF. Also, the Franc is trading at 33-month highs even with negative rates. The central bank’s official interest rate currently stands at -0.75%. If the bank attempts to normalize its policy, it risks further CHF appreciation. Essentially, the SNB is stuck between a rock and a hard place. SNB abandoned cap in January 2015 On the 15th of January 2015, the Swiss National Bank suspended the minimum exchange rate of CHF 1.20 per euro and reduced its sight deposit interest rate by 50 basis points at -0.75%. The cap was introduced in September 2011. |

Technical levels |

Tags: EUR/CHF,Featured,newsletter