USD/CHF is under pressure in Asia as US index futures are flashing red.

The pair has created a bear flag or a bearish continuation pattern on the 4-hour chart.

USD/CHF is currently trading at 0.9364, representing a 0.38% drop on the day, having failed to chew through offers around 0.94 during the overnight trade.

The anti-risk CHF is drawing bids in Asia, possibly tracking the S&P 500 futures, which are currently signaling risk aversion with a 2.25% drop.

From a technical perspective, the pair’s bounce from Monday’s low of 0.9182 to 0.94 has taken the shape of a bear flag, a bearish continuation setup, on the 4-hour chart.

A break below 0.93 (lower end of the flag) would confirm an end of the recovery rally and revival of the bearish trend from recent highs above

Articles by Omkar Godbole

SNB can leverage its balance sheet if needed, Schlegel says

January 19, 2020The Swiss National Bank (SNB) retains the ability to wage currency market interventions if necessary, Martin Schlegel, one of the SNB’s alternate governing board members, said on Wednesday, according to Bloomberg.

Key quotes

The balance sheet is the result of our monetary policy. That means that if we need to loosen monetary policy we still have the room to expand the balance sheet.

There is no alternative to the SNB’s negative interest rate, currently at minus 0.75%.

The US on Tuesday added Switzerland to its watch list of currency manipulators, squeezing out whatever little room the SNB had to intervene in the FX markets to stall the rally in franc. As a result, markets put a bid under the franc, sending it to its strongest in nearly three years against the

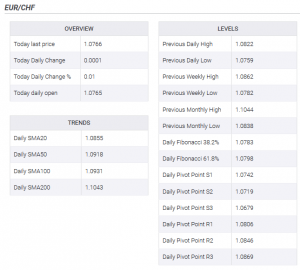

EUR/CHF Price Analysis: Attempting corrective bounce amid oversold conditions

January 16, 2020EUR/CHF is looking oversold, as per key daily chart indicator.

The hourly chart is reporting a triangle breakout.

A corrective bounce to the 5-day average hurdle could be in the offing.

EUR/CHF is looking to regain some poise from three-year lows reached on Wednesday.

The pair is currently trading at 1.0775, representing marginal gains on the day, having hit a low of 1.0742 yesterday. That was the lowest level since April 2017.

The bounce could be extended further, as the 14-day relative strength index (RSI) is hovering well below 30 for the first time since August 2018, indicating extreme oversold conditions.

EUR/CHF, Daily chart(see more posts on EUR/CHF, ) – Click to enlarge

Further, the hourly chart shows a descending triangle breakout and a bullish

EUR/CHF: Franc at 33-month high five years after SNB removed the cap

January 15, 2020EUR/CHF is trading at 33-month lows near 1.0759.

The US added Switzerland to its current manipulators’ list.

The SNB removed the cap on the euro on Jan. 15, 2015.

Five years after the Swiss National Bank (SNB) shocked the financial markets by abandoning the euro cap, the Swiss Franc is trading at 33-month highs against the single currency.

The EUR/CHF pair dropped to 1.0759 on Tuesday, the lowest level since April 2017 and was last seen trading at 1.0766.

Tuesday’s slide was likely triggered by the US’ decision to add Switzerland to its watchlist of currency manipulators. The US move will likely discourage the SNB from taking steps to limit the upside CHF.

Also, the Franc is trading at 33-month highs even with negative rates. The central bank’s official interest

US Treasury adds Swiss Franc back to its currency watch list – Bloomberg

January 14, 2020The US Treasury on Monday added Swiss Franc (CHF) back to its currency watch list and urged Switzerland to adjust its macroeconomic policies to more forcefully support domestic economic activity, according to Bloomberg.

The Treasury report released Monday said:

Despite borrowing costs for the Swiss government being among the lowest in the world, fiscal policy remains underutilized, even within the constraints of Switzerland’s existing fiscal rules.

The Swiss Franc is currently trading at 0.9705 against the US dollar, having gained 0.2% on Monday. The Swiss currency is less than 1% away from the 15-month high of 0.9665 reached last week.

Related posts: Pound to Swiss Franc forecast: Investors flock to the CHF, will the

Read More »EUR/CHF technical analysis: Bounces up from key support, eyes Oct. 17 high

October 28, 2019EUR/CHF is looking north, having bounced up from key MA support.

The 4-hour chart indicators are also reporting bullish conditions.

EUR/CHF is better bid at 1.1030 press time and could challenge the Oct. 17 high of 1.1059 in the next 24 hours.

The 4-hour chart shows, the currency pair has bounced up from the 50-period moving average (MA). That ascending (bullish) technical line has emerged as strong support in the last eight days.

The strong bounce from the key MA support is backed by an above-50 reading on the relative strength index.

As a result, further gains could be seen, possibly toward 1.1059, as said earlier.

The bullish case would be invalidated if the spot finds acceptance below the 4-hour chart 50-candle MA, currently at 1.1008.

EUR/CHF, 4-hour chart,

Read More »EUR/CHF risk reversals hit highest since May on call demand

September 22, 2019EUR/CHF risk reversals have jumped to the levels last seen in May.

Risk reversals indicate the demand for call options is rising.

Risk reversals on EUR/CHF (EURCHF1MRR), a gauge of calls to put, jumped to the highest level since May on Friday, indicating the investors are adding bets to position for a rally in the common currency.

The one-month risk reversals rose to -0.75, the highest level since May 10.

The negative print indicates the implied volatility premium for the put options is still higher than that for the call options.

The gauge, however, has risen from -1.05 to -0.75 this month, meaning the volatility premium for puts has dropped or the demand for the call options has increased. EUR/CHF is currently trading at 1.0963, having dropped 0.37 percent on

-637194909152513960-300x130.png)

-637147386339434788-300x130.png)

-637078290921470787-300x122.png)