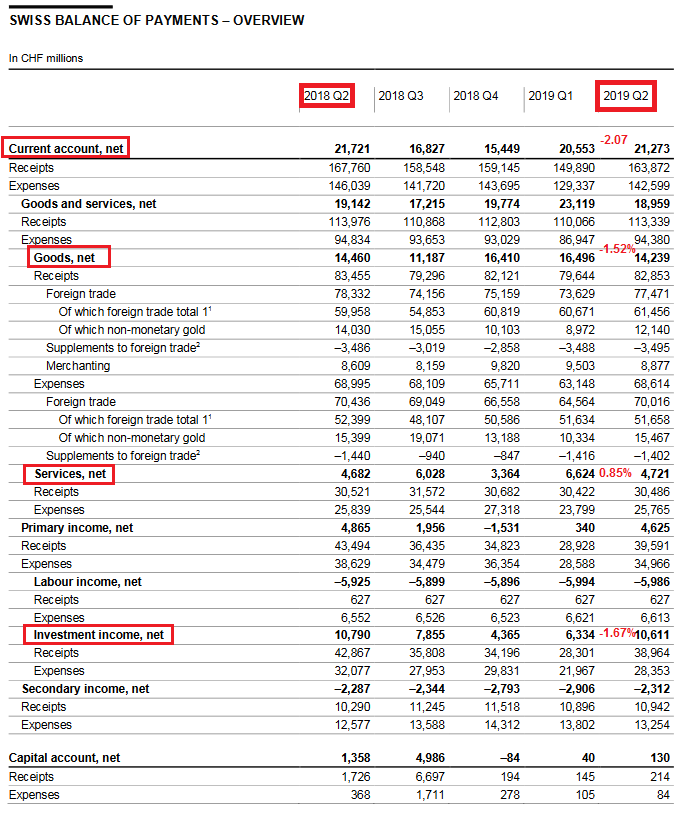

Current Account Key figures: Current Account: Down 2.07% against Q2/2018 to 21.3 bn. CHF of which Goods Trade Balance: Minus 1.52% against Q2/2018 to 14.24 bn. of which the Services Balance: Plus 0.85% to 4.72 bn. of which Investment Income: Minus 1.67% to 10.61 bn. CHF. Current Account Switzerland Q2 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge Financial account The following is from the official press release and gives more details on the other parts of the financial account. Net acquisition of financial assets The assets side of the financial account registered a total net acquisition of CHF 11 billion (Q2 2018: net

Topics:

Swiss National Bank considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter, Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, Switzerland International Investment Position

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Current AccountKey figures: Current Account: Down 2.07% against Q2/2018 to 21.3 bn. CHF

|

Current Account Switzerland Q2 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

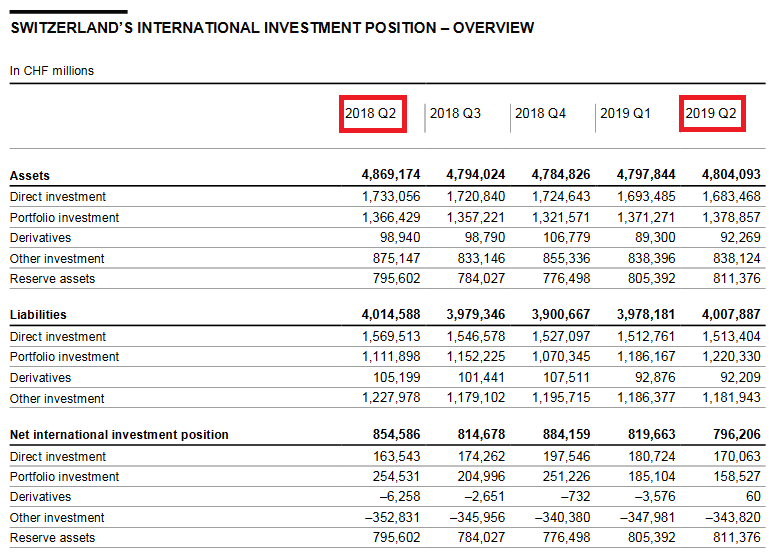

Financial accountThe following is from the official press release and gives more details on the other parts of the financial account.

|

Switzerland Financial Account, Q2 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

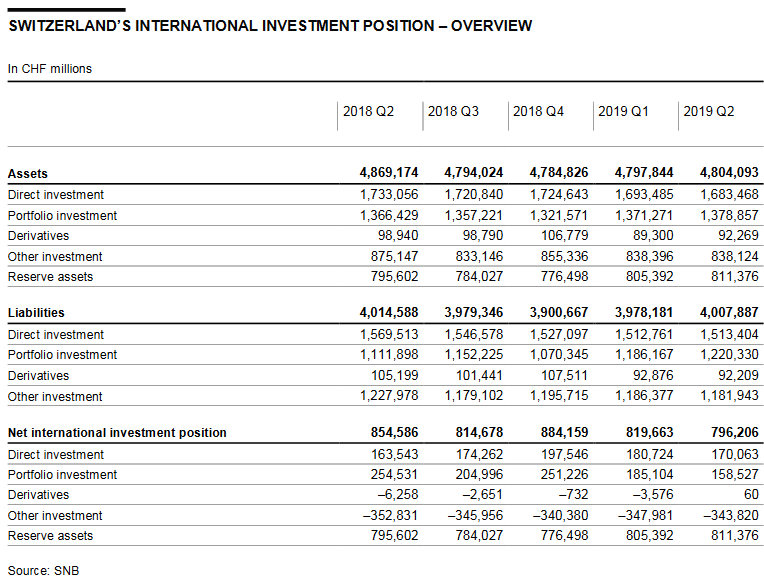

Switzerland’s International investment positionAssetsStocks of assets were up slightly, by CHF 6 billion to CHF 4,804 billion compared with the first quarter of 2019. Revaluations due to price and exchange rate changes moved in opposite directions, largely offsetting each other. On the one hand, all components recorded valuation losses on assets in foreign currency; on the other, prices on foreign stock exchanges rose, resulting in valuation gains for portfolio investment and reserve assets. Portfolio investment recorded an increase of CHF 8 billion to CHF 1,379 billion and reserve assets rose by CHF 6 billion to CHF 811 billion. Stocks of derivatives were up CHF 3 billion to CHF 92 billion. Other investment stocks, by contrast, were unchanged at CHF 838 billion – exchange rate losses were offset by financial account transactions. Direct investment stocks declined by CHF 10 billion to CHF 1,683 billion. LiabilitiesOwing to revaluations, stocks of liabilities rose by CHF 30 billion overall to CHF 4,008 billion. Valuation gains driven by increases on the Swiss stock exchange significantly outweighed foreign exchange losses, as only a small proportion of liabilities is held in foreign currency. Portfolio investment accounted for all the valuation gains; stocks grew by CHF 34 billion to CHF 1,220 billion. Transactions also contributed to this increase, as non-resident investors purchased equities of resident issuers. However, statistical changes partly offset the rise; in previous quarters, the stocks reported by reporting institutions were too high, and this was corrected in the quarter under review. Direct investment stocks grew by CHF 1 billion to CHF 1,513 billion. Here, statistical changes offset the foreign exchange losses and transaction-related reduction. Stocks of other investment receded by CHF 4 billion to CHF 1,182 billion, and stocks of derivatives by CHF 1 billion to CHF 92 billion. Net international investment positionGiven that stocks of liabilities (up CHF 30 billion) showed a more pronounced increase than stocks of assets (up CHF 6 billion), the net international investment position fell by CHF 24 billion to CHF 796 billion. |

Switzerland International Investment Position, Q2 2019(see more posts on Switzerland International Investment Position, ) Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position