There’s been an unusual level of honesty coming out of Liberty Street of late. Not total honesty but certainly more than the usual nothing denials and dismissals. If you don’t immediately recognize the reference, that’s the street in NYC where FRBNY and its Open Market Desk resides. What is supposed to be the moneyed centered of the universe. After all, as Ben Bernanke famously threatened in November 2002, that’s the printing press. Or is it? In my own conversations and from I’ve been reading in the media since early last week, for once there is widespread skepticism. Not about the printing press, at least not yet, but for the first time serious questions are being asked about what the Fed can and does actually do. And I fully believe that’s why we are starting

Topics:

Jeffrey P. Snider considers the following as important: 7) Markets, currencies, economy, Featured, Federal funds, Federal Reserve/Monetary Policy, global dollar shortage, ioer, jay powell, Liquidity, Markets, newsletter, office space, overnight repo operation, Repo

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| There’s been an unusual level of honesty coming out of Liberty Street of late. Not total honesty but certainly more than the usual nothing denials and dismissals. If you don’t immediately recognize the reference, that’s the street in NYC where FRBNY and its Open Market Desk resides. What is supposed to be the moneyed centered of the universe. After all, as Ben Bernanke famously threatened in November 2002, that’s the printing press.

Or is it? In my own conversations and from I’ve been reading in the media since early last week, for once there is widespread skepticism. Not about the printing press, at least not yet, but for the first time serious questions are being asked about what the Fed can and does actually do. And I fully believe that’s why we are starting to see some honesty. |

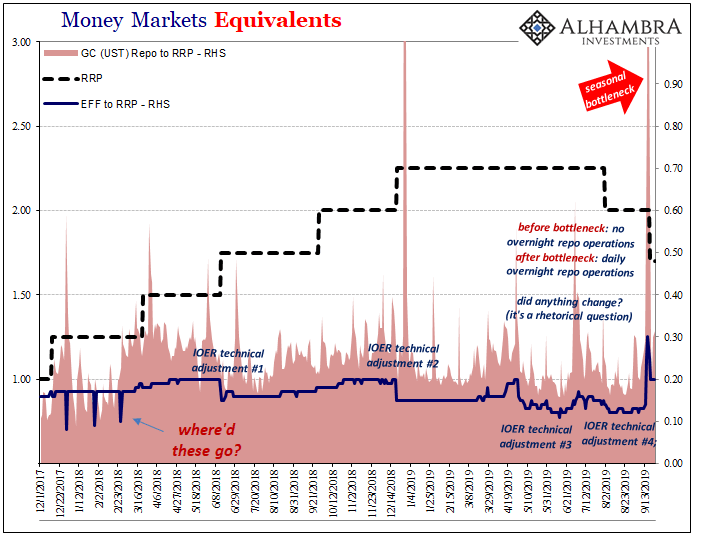

Money Markets Equivalents, 2017-2019 |

| Under a system of expectations management, moneyless monetary policies, whichever central bank, the Fed included, absolutely depends upon the financial media to do the heavy lifting. It’s not the Open Market Desk at FRBNY which truly matters here, it is the PR ability of the combined institution.

The US central bank needs to get everyone back to unquestionably following “Don’t fight the Fed”, and it needs the press to herd the financial public (and economic actors, too) in that direction. If that requires more forthrightness since there is obviously things going wrong, then whatever it takes. What’s happening in repo and to a lesser extent fed funds only raises uncomfortable questions moving the opposite way. And that view extends to these overnight repo operations which aren’t going so well. The world isn’t ending; it’s not that kind of abnormality. But things aren’t settling back down, either. Not really. |

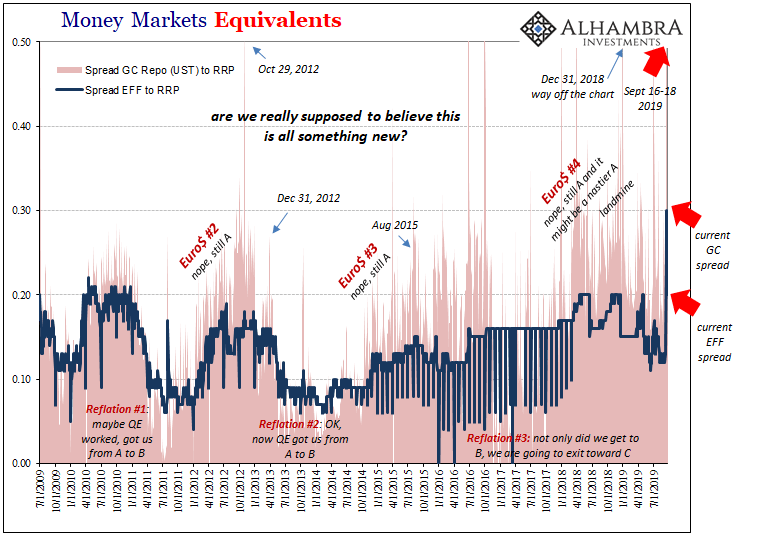

Money Markets Equivalents, 2009-2019 |

| Because the repo rumble showed up and at the worst possible moment, the FOMC has been under pressure to do…something. While downplaying it in public, there was no doubt some kind of response was required. You could almost hear their dilemma being discussed in DC while all this went down: we have to do something, but what if the thing we end up doing just confirms we really are powerless and leaves everyone with the impression we really don’t know what we are doing?

Which, more and more, it has. Money rates aren’t like they were early last week, if only because the seasonal bottleneck ran its course. Instead, they are back to where things stood before the whole episode erupted. |

. |

And that’s bad.

In other words, before last week: no overnight repos, elevated GC repo and fed funds. After last week: daily overnight repos, scheduled term repos, elevated GC repo and fed funds. The only thing that changed was the overnight repos – which means they haven’t accomplished a damn thing.

And so we are back to the original promise. Asking ourselves and of our officials, what is liquidity here? Because it doesn’t seem you know enough about it to make a comprehensive determination let alone make it right. As I wrote a few days ago, the President of FRBNY is suddenly, honestly, and publicly interested in what happened to the dealers.

This is nothing more than the equivalent of officials being publicly shamed by a week of fed funds and repo blowing up in their faces, and being forced to admit the smallest chance that maybe, possibly, perhaps they don’t speak the language after all. QE and bank reserves might not have been what you were told.

It’s a question the man heading up the branch where the Open Market Desk is situated shouldn’t have to ask. Here’s another one today (thanks M. Simmons):

Former Federal Reserve policy maker Narayana Kocherlakota says that while the recent disruptions in U.S. money markets won’t undermine the central bank’s ability to achieve its goals, they underscore that something is wrong with the plumbing of the financial system.

Not completely honest, though. Admitting that something is wrong in the plumbing of the world’s monetary system while at the same time confessing authorities don’t know what it is (he says it must be regulations) totally undermines the first part of his statement. Like Jay Powell, Kocherlakota says it ultimately will have no bearing on monetary policy. Subprime is always contained, though, isn’t it.

Here’s the thing; how would either of them know? Current or former policymaker, doesn’t matter. They can’t even figure out what’s wrong. Further, they are, for once, confirming in words as well as deeds that they don’t really know how it works, is supposed to work, or when it doesn’t work. That’s all the overnight repo operation has thus far accomplished; it raises all those questions – and in the financial media – that the Fed needs to just go away so that it can get back to what it believes is effective modern monetary policy.

And that isn’t money.

I used the JAWS meme for Europe recently, and while that would fit (need a bigger boat) the repo market and fed funds in one sense, it doesn’t quite encompass the whole paradigm and complete nature of what’s both at stake and at issue. Instead, this one is definitely Office Space and the Bobs (the media) sitting directly across from Jay Powell, frustrated and finally point-blank asking him:

It ain’t liquidity. Sure isn’t money. Repo, fed funds, or much of anything else.

Tags: currencies,economy,Featured,federal funds,Federal Reserve/Monetary Policy,global dollar shortage,ioer,jay powell,Liquidity,Markets,newsletter,office space,overnight repo operation,repo