In early September, the Institute for Supply Management (ISM) released figures for its non-manufacturing PMI that calmed nervous markets. A few weeks before anyone would start talking about repo, repo operations, and not-QE asset purchases, recession and slowdown fears were already prevalent. It hadn’t been a very good summer to that end, the promised second half rebound failing to materialize being more and more replaced by central banker backpedaling here as well as elsewhere. If the manufacturing sector is cause for concern, it is the services sector which confirms it as well as the greater fears evident when weakness can be so widespread. The ISM had reported that its manufacturing PMI fell below 50 in August for the first time in several years. The

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, economy, Featured, Federal Reserve/Monetary Policy, ism non-manufacturing, newsletter, PMI, Recession, services

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| In early September, the Institute for Supply Management (ISM) released figures for its non-manufacturing PMI that calmed nervous markets. A few weeks before anyone would start talking about repo, repo operations, and not-QE asset purchases, recession and slowdown fears were already prevalent. It hadn’t been a very good summer to that end, the promised second half rebound failing to materialize being more and more replaced by central banker backpedaling here as well as elsewhere.

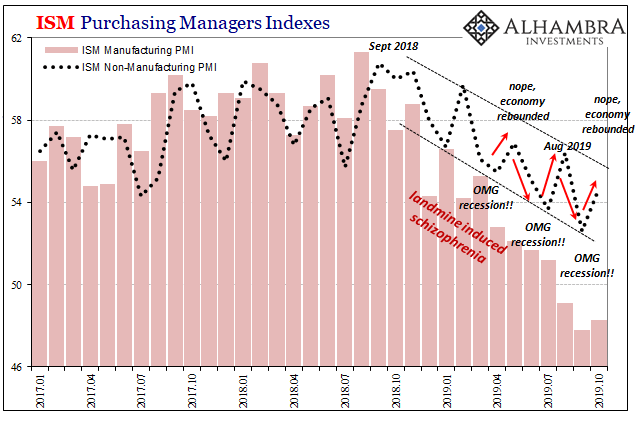

If the manufacturing sector is cause for concern, it is the services sector which confirms it as well as the greater fears evident when weakness can be so widespread. The ISM had reported that its manufacturing PMI fell below 50 in August for the first time in several years. The non-manufacturing PMI had already been reported weak in July, also a multi-year low, so markets were looking for some more direction as to which way the economy might be leaning. Is there underlying strength, or is the manufacturing contraction merely the precursor? According to September’s update for the month of August, the ISM non-manufacturing index rallied on the biggest jump in business activity since early 2008. It was widely heralded as the former, as a sign of that second half rebound and how the bottom of the slowdown must’ve finally been reached. One rate cut seemed almost like it had been enough insurance, as was widely written.

|

ISM Purchasing Managers Indexes, 2017-2019 |

| You have to wonder if the inappropriate idea of randomness has infected economic commentary and analysis and not just financial and econometric modeling; that each individual monthly figure is taken in isolation without regard to prior changes; as if the only thing that matters is the monthly change.

How in the world does everyone not notice the very distinct, completely obvious monthly pattern? You have to try really hard not to see it. It’s pretty well established how if the services PMI falls one month it will almost certainly “rebound” the next. What’s changed, of course, is how since last September that monthly noise has carved out an obvious descending inclination. Even for August’s “calming” estimate, it was simply the month in which it would be the PMI’s turn to rise. In other words – not a rebound! Since what followed in September was another new low, somehow written up as an “unexpected” new low, the rebound in August was quickly forgotten because it wasn’t really a rebound. Recession fears were sparked anew when they never should’ve disappeared to begin with. Sure enough, though, it happened all over again this week as if everyone just forgot about how it all went down last month (and the month before, and the month before). |

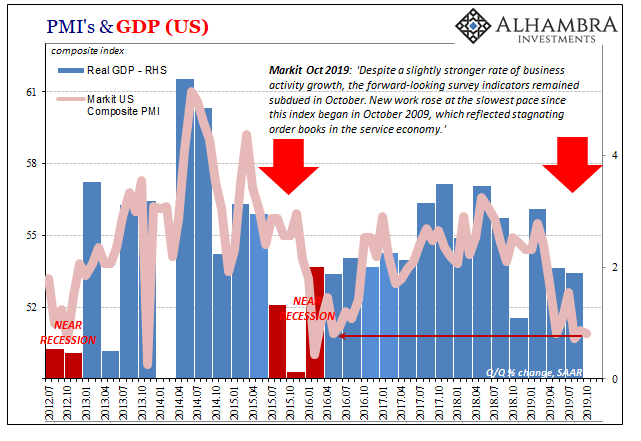

US PMI's & GDP, 2012-2019 |

According to estimates released earlier this week, surprise, surprise, after registering yet another new low in September the index “rebounds” once more for October just in the nick of time. The ISM says its non-manufacturing index increased from 52.6 two months ago to 54.7 last month.

It had especially this week further allayed recession fears – re-allayed? – at least as far as media commentary is concerned. The unnecessarily schizophrenic media has again swung toward the “resilient” US economy led by “robust” consumer spending predicated on an impenetrably “strong” labor market.

The data came after strong a U.S. employment report on Friday.

“On top of Sino-U.S. trade issues, the market is reacting to signs of U.S. economic strength at the moment,” said Kyosuke Suzuki, director of foreign exchange at Societe Generale.

Gotta love the typical credentialed Economist. Recognizing them instead as the “up” months within a clear downward trend doesn’t quite suggest what every Economist says it does. In many ways, it was the same as last Friday’s payroll report which was actually pretty concerning – the same low rate of growth as back in 2012 which had convinced then-Federal Reserve Chairman Ben Bernanke his FOMC had better try a third round of QE – yet somehow had been turned around in the media as reflecting towering strength.

That comparison, one of persistently heightened downside risks rather than the reduced fear view, is more consistent with a broad survey of economic data, including these sentiment surveys. IHS Markit, for example, its service sector PMI was reported to have fallen slightly to a revised 50.9 during last month. The subcomponents suggested even more entrenched problems across a broad range of factors:

U.S. service providers reported a further slowdown in business activity growth in October, as new business stagnated and export demand dropped further. The marginal expansion was the weakest since early-2016 and resulted in the sharpest decrease in workforce numbers since December 2009.

Those factors are more consistent with a growing downturn which, thinking about it honestly, indicates increased recession risks especially since the services sector will make or break the economy.

Rather than being refuted by the ISM’s estimates, those are actually consistent with the idea. If you look at the index for more than just individual monthly swings.

The post You Have To Try Really Hard Not To See It appeared first on Alhambra Investments.

Tags: economy,Featured,Federal Reserve/Monetary Policy,ism non-manufacturing,newsletter,PMI,recession,services