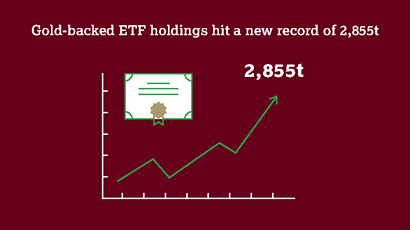

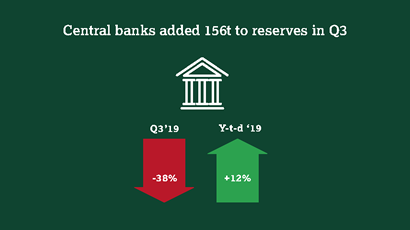

Gold demand grew modestly to 1,107.9 tonnes (t) in Q3 thanks to the largest ETF inflows since Q1 2016 ◆ A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3 ◆ Global central bank buying remained healthy but significantly lower than the record levels of Q3 2018 ◆ Central banks added 156.2t to reserves in Q3. Year to date, central banks have purchased 547.5t on a net basis, 12% higher y-o-y. The -38% monthly y-o-y decline was partly due to Q3 2018 being the highest quarter of net buying in our records. Gold-backed ETF Holdings hit a new record - Click to enlarge ◆ There was a surprising drop in gold bullion coin and bar demand as unusually retail bullion buyers used higher prices to take profits. ◆ The

Topics:

Mark O'Byrne considers the following as important: 6a) Gold & Bitcoin, 6a.) GoldCore, Daily Market Update, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| Gold demand grew modestly to 1,107.9 tonnes (t) in Q3 thanks to the largest ETF inflows since Q1 2016

◆ A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3 ◆ Global central bank buying remained healthy but significantly lower than the record levels of Q3 2018 ◆ Central banks added 156.2t to reserves in Q3. Year to date, central banks have purchased 547.5t on a net basis, 12% higher y-o-y. The -38% monthly y-o-y decline was partly due to Q3 2018 being the highest quarter of net buying in our records. |

Gold-backed ETF Holdings hit a new record |

| ◆ There was a surprising drop in gold bullion coin and bar demand as unusually retail bullion buyers used higher prices to take profits.

◆ The high 50% drop in demand was driven by the gold price according to the World gold Council as “retail investors took the opportunity to lock in profits rather than making fresh purchases” ◆ GoldCore did not see any drop in demand for gold coins and bars. Rather July and August were near record highs for us with demand reaching levels last seen in 2013. However, this was largely due to strong demand from our primary UK and Ireland markets due to concerns about Brexit ◆ The gold price continued to rally, reaching new multi-year highs. The gold price rose by 5% during Q3, finding sustained support around US$1,500/oz. The primary factors behind this price momentum continued to be ongoing geopolitical tensions, concerns of a slowdown in economic growth, lower interest rates and the level of negative yielding debt. |

Central banks added 156t to reserces in Q3 |

Has Germany Increased Its Gold Reserves For The First Time In 21 Years? |

Tags: Daily Market Update,Featured,newsletter