The likelihood of active FX intervention by the US authorities remains low but is increasing and the Trump administration can be expected to continue to pressure the Fed to cut rates. The Trump administration has been focusing on the US’s trade deficit with some of its main trading partners such as China and Germany. A strong dollar is exacerbating this deficit and has visibly exasperated President Trump. Indeed, the Fed’s broad dollar index was recently back close to its December 2016 high. In response, and in a break with his predecessors, Trump has adopted an avowedly mercantilist approach to improving the trade balance. In the near term, the Trump administration is likely to put further pressure on the Fed to

Topics:

Luc Luyet considers the following as important: 5) Global Macro, currency manipulation, Dollar overvaluation, Featured, Macroview, newsletter, The United States, US forex intervention

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

The likelihood of active FX intervention by the US authorities remains low but is increasing and the Trump administration can be expected to continue to pressure the Fed to cut rates. The Trump administration has been focusing on the US’s trade deficit with some of its main trading partners such as China and Germany. A strong dollar is exacerbating this deficit and has visibly exasperated President Trump. Indeed, the Fed’s broad dollar index was recently back close to its December 2016 high. In response, and in a break with his predecessors, Trump has adopted an avowedly mercantilist approach to improving the trade balance. In the near term, the Trump administration is likely to put further pressure on the Fed to cut rates in a bid to weigh on the value of the US dollar. The Trump could also find other ways to talk down the US dollar. But we still see a high bar for any further kind of FX intervention, as it would be politically costly (if applied to US allies), probably inefficient (unless sustained for a long period of time) and run the risk of sparking retaliation. |

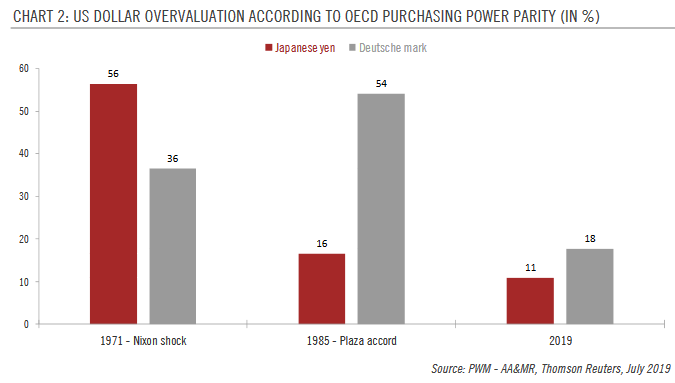

US Dollar Overvaluation According to OECD Purchasing Power Parity, 1971-2019 |

Nonetheless, tariffs (or even the threat of tariffs) may be used to pressurise countries into not depreciating their currencies relative to the greenback. The Americans could propose bilateral trade deals that include clauses on the exchange rate. Interestingly, clauses in the recent US-Mexico-Canada (USMCA) trade deal shows its willingness to consider offsetting currency manipulation and undervaluation through measures such as import duties.

But to be successful, currency interventions usually need to be coordinated with other central banks and the US policy mix would have to be synchronised to achieve the goal of restraining the dollar. A dovish Fed and a slowdown in US economic activity as the US fiscal stimulus fades may help on the latter point. In any case, the fundamental overvaluation of the US dollar should be a key hurdle to any further significant appreciation.

Tags: Currency manipulation,Dollar overvaluation,Featured,Macroview,newsletter,US forex intervention