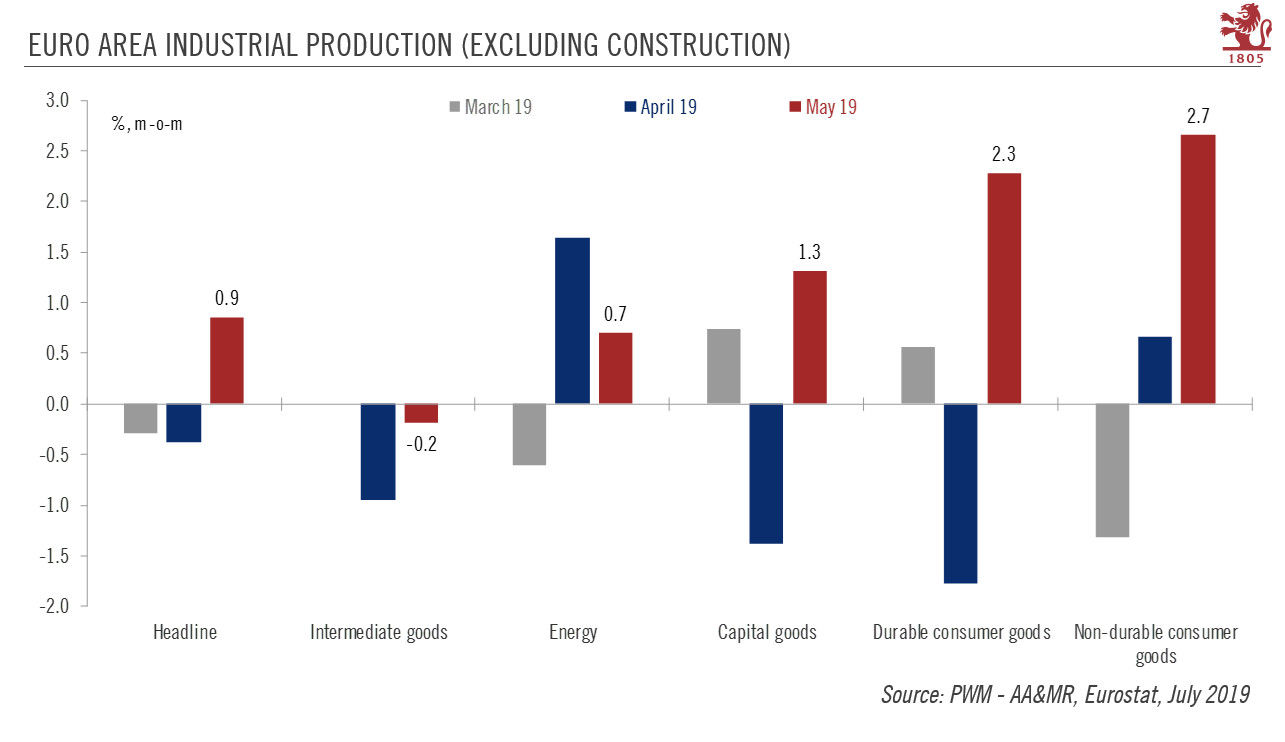

Industrial production rebounded in May. But a closer look shows that the improvement was narrowly spread, and euro area manufacturing faces numerous challenges ahead. After two consecutive months of contraction, euro area industrial production (IP, excluding construction) rose by 0.9% month on month (m-o-m) in May, above consensus expectations. Production of consumer goods surged in May. Output of capital goods and energy also increased. However, output of intermediate goods slipped. While the monthly print was solid, a closer look at the sectoral breakdown reveals that the improvement in May was sporadic. Indeed, the jump in industrial production was driven almost entirely by just two sectors, pharma and autos.

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, euro area growth, euro area industrial production, euro area manufacturing, Featured, Macroview, manufacturing outlook, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Industrial production rebounded in May. But a closer look shows that the improvement was narrowly spread, and euro area manufacturing faces numerous challenges ahead.

After two consecutive months of contraction, euro area industrial production (IP, excluding construction) rose by 0.9% month on month (m-o-m) in May, above consensus expectations. Production of consumer goods surged in May. Output of capital goods and energy also increased. However, output of intermediate goods slipped. While the monthly print was solid, a closer look at the sectoral breakdown reveals that the improvement in May was sporadic. Indeed, the jump in industrial production was driven almost entirely by just two sectors, pharma and autos. Pharma production rose sharply in Germany, France and Spain for reasons that are difficult to explain. The surge may be related to a sharp, one-off increase in demand from the UK ahead of the Brexit deadline on 29 March. If so, demand for pharma products is at risk of reverting to mean in the coming months. May’s rise in auto production was largely a reaction to the sharp fall in April. While the May surge is positive news, euro area car registrations in June fell by almost 7% m-o-m, leaving the gain for Q2 at 1.7% quarter over quarter (q-o-q) – significantly lower than in Q1, suggesting limited short-run prospects for the sector. |

Euro Area Industrial Production, MoM 2019 |

Annual growth in IP remained negative in May (-0.5%) and the percentage of manufacturing sectors in negative territory year on year rose again that month. To avert negative IP growth over the whole of Q2, IP will need to be at least flat in June. Meanwhile, the latest euro area manufacturing surveys continued either to move sideways (Markit purchasing manager indexes) or lower (Ifo, European Commission surveys).

Weakness in global demand and trade uncertainties are likely to continue dampening the outlook for euro area manufacturing for the next few quarters at least. Risks of a no-deal Brexit have increased of late, pointing to continued uncertainty. Furthermore, the threat of tariffs still hangs over EU car exports to the US.

The main risk for our euro area growth outlook is a spill over of manufacturing weakness to domestic demand. Manufacturing’s problems have not yet led to a decline in employment growth in the sector, but business surveys indicate that hiring intentions are weakening. As long as overall manufacturing employment continues to grow, the impact of sluggish industrial production on the health of the euro area economy may be contained. Still, one will need to keep an eye on job data in manufacturing over the coming months.

Tags: euro area growth,euro area industrial production,euro area manufacturing,Featured,Macroview,manufacturing outlook,newsletter