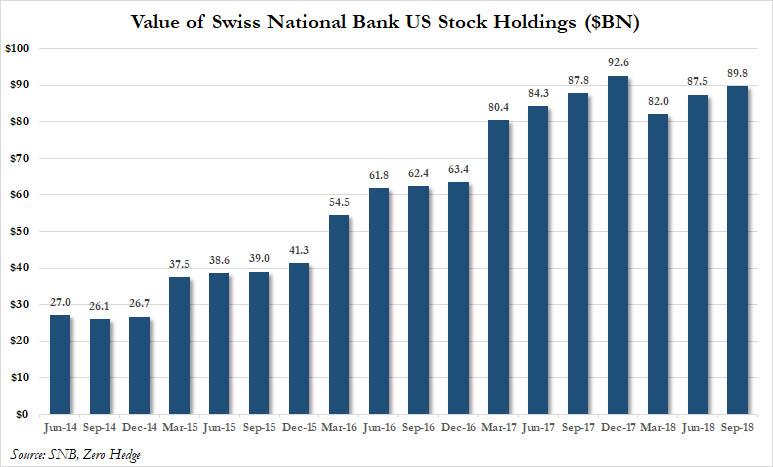

SNB US Stock Holdings In the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB’s US listed long holdings rose by over billion to billion, but all of this was due to the price appreciation as the central bank sold around bn of equities in Q3. This compares to purchases during 1H18 of around bn. SNB US Stock Holdings, Jun 2014 - 2018(see more posts on SNB US Stock Holdings, ) - Click to enlarge SNB Holdings Alas, it did not sell enough, and as the next chart showed, some of the SNB’s top holdings would be the stocks that ended up getting hammered the most in the fourth

Topics:

Tyler Durden considers the following as important: 1) SNB and CHF, Featured, newsletter, SNB US Stock Holdings, Swiss National Bank, Swiss National Bank Stock

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

SNB US Stock HoldingsIn the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB’s US listed long holdings rose by over $2 billion to $90 billion, but all of this was due to the price appreciation as the central bank sold around $7bn of equities in Q3. This compares to purchases during 1H18 of around $6bn. |

SNB US Stock Holdings, Jun 2014 - 2018(see more posts on SNB US Stock Holdings, ) |

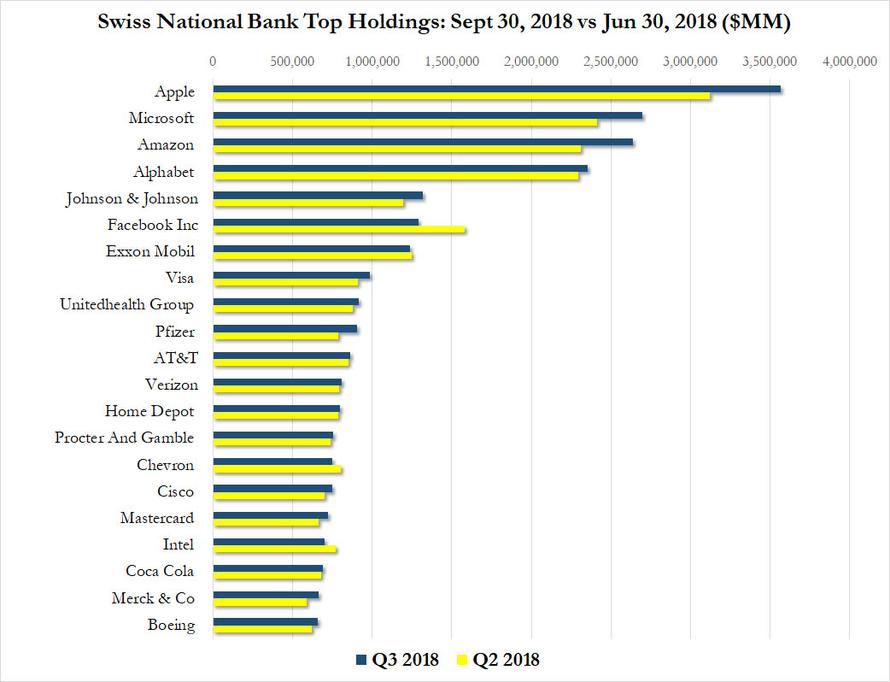

SNB HoldingsAlas, it did not sell enough, and as the next chart showed, some of the SNB’s top holdings would be the stocks that ended up getting hammered the most in the fourth quarter. Why “alas”? Because the central bank which is one of the biggest investors in US stocks (in order to depress the value of the Swiss Franc) reported today that it had ran upa loss of 15 billion francs ($15.3 billion) in 2018 as a result of the global stock market rout hitting its equity holdings, resulting in the biggest annual loss since the 2015 franc revaluation and the third biggest loss on record. |

SNB Holdings(see more posts on SNB Holdings, ) |

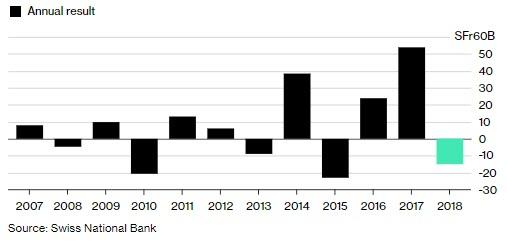

Swiss National BankAs is well known, equities – Apple, Microsoft, Amazon, Alphabet, and Facebook are 5 of the SNB’s top 6 positions – make up 20% of the SNB’s massive holdings of foreign currencies. That was a problem in a quarter when U.S. and European stock benchmarks tumbled, while the franc gained against most of its G-10 peers, leading to a 16 billion-franc loss on that portfolio alone. And, as Bloomberg notes, with a mountain of foreign exchange which at 729 billion francs exceeds the size of Switzerland economy, the central bank is at risk of big swings when markets get turbulent. The good news – for the hedge fund which can just print more money any time it needs it – is that any profit or loss has no bearing on monetary policy, which is determined more by the strength of the franc. The currency’s rally against the euro at the end of last year damped price pressures, with data on Wednesday showing that core inflation rose just 0.3% in December. The franc’s strength left its mark on the SNB’s holdings of foreign currency, which dropped 2.7% in December, the biggest slide since 2012, according to Bloomberg. |

Swiss National Bank, YoY 2007 - 2018(see more posts on Swiss National Bank, ) |

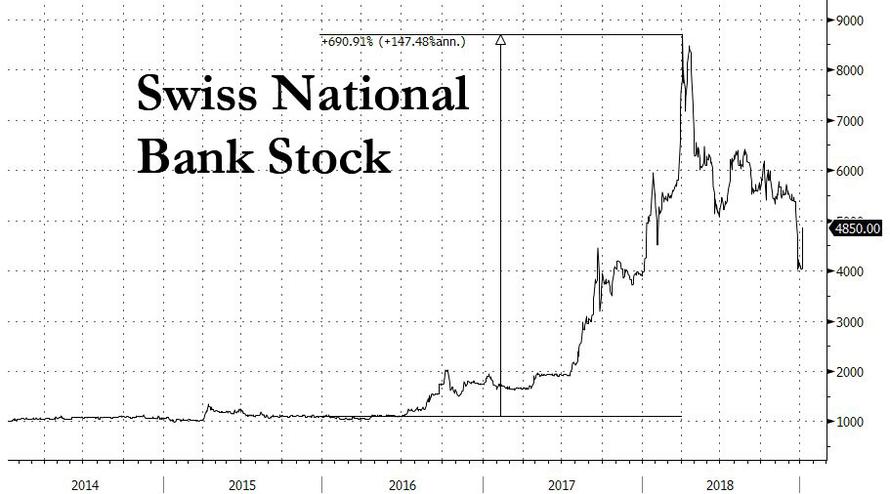

Swiss National Bank StockOf course, that the Swiss central bank is the world’s largest risk-free hedge fund is only one part of its mystique: unusually among central banks, the SNB not only trades as a public company, but its shareholders receive a dividend (and face no downside when it suffers a loss). As Bloomberg notes, the biggest proportion of shares is held by public institutions, including cantonal governments and cantonal banks. There are also some 2,000 private investors, whose voting rights are very limited. Ironically, in a time when everyone has been obssessing with the rise and fall of bitcoin, few have noted that the stock of the Swiss National Bank rose almost 700% from the start of 2016 through its April 4 all time high of CHF 8600. In addition to its massive equity losses, the SNB also recorded a loss of 300 million francs on on its gold holdings and a net result of 2 billion on its Swiss franc position, which would in Europe’s bizarro NIRP world, also includes income from the negative interest it charges on sight deposit accounts as savers pay the central bank for the privilege of, well, saving. |

Swiss National Bank Stock, 2014 - 2018(see more posts on Swiss National Bank Stock, ) |

Tags: Featured,newsletter,SNB US Stock Holdings,Swiss National Bank,Swiss National Bank Stock