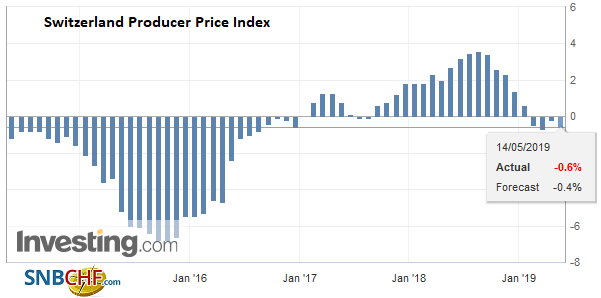

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued? 14.05.2019 – The Producer and Import Price Index remained unchanged in April 2019

Topics:

George Dorgan considers the following as important: 2) Swiss and European Macro, Featured, newsletter, Switzerland Producer Price Index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued?

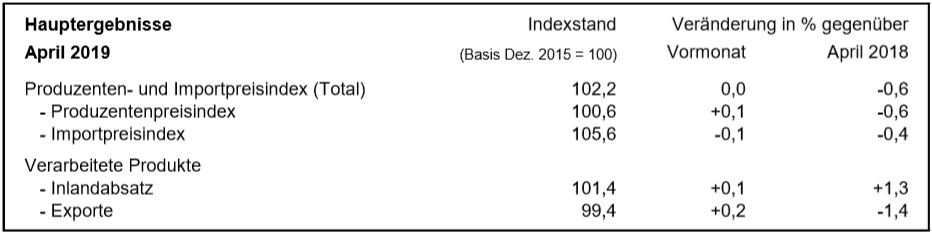

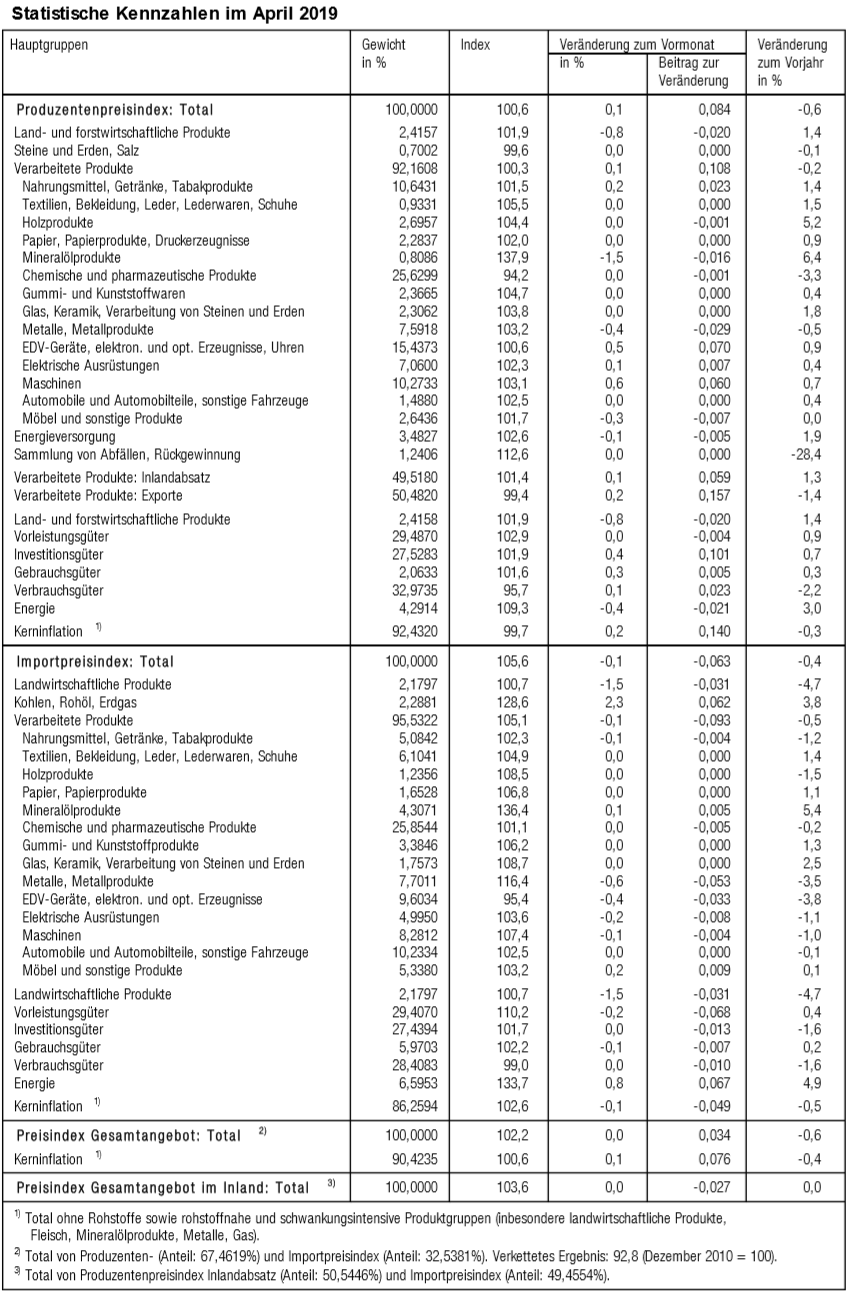

| 14.05.2019 – The Producer and Import Price Index remained unchanged in April 2019 compared with the previous month. The index stood at 102.2 points (December 2015 = 100). Higher prices were seen in particular for petrol and machinery, while diesel and heating oil became cheaper. Compared with April 2018, the price level of the whole range of domestic and imported products fell by 0.6%. These are some of the findings from the Federal Statistical Office (FSO). |

Switzerland Producer Price Index (PPI) YoY, April 2019(see more posts on Switzerland Producer Price Index, ) Source: Investing.com - Click to enlarge |

Download press release: The Producer and Import Price index remained stable overall in April 2019

German Text:

Produzenten- und Importpreisindex bleibt im April 2019 insgesamt stabil14.05.2019 – Der Gesamtindex der Produzenten- und Importpreise blieb im April 2019 gegenüber dem Vormonat unverändert. Sein Stand beträgt 102,2 Punkte (Dezember 2015 = 100). Höhere Preise zeigten insbesondere Benzin und Maschinen, billiger wurden Diesel und Heizöl. Im Vergleich zum April 2018 ging das Preisniveau des Gesamtangebots von Inland- und Importprodukten um 0,6% zurück. Dies geht aus den Zahlen des Bundesamts für Statistik (BFS) hervor. Für den Anstieg des Produzentenpreisindexes gegenüber dem Vormonat waren vor allem sonstige nicht wirtschaftszweigspezifische Maschinen und Uhren verantwortlich. Billiger wurden hingegen Rohmilch sowie Metalle und Metallhalbzeug. Tiefere Preise gegenüber dem März 2019 registrierte man im Importpreisindex insbesondere für Diesel und Heizöl. Billiger wurden auch Metalle und Metallhalbzeug. Preiserhöhungen zeigten dagegen Benzin sowie Erdöl und Erdgas. |

Tags: Featured,newsletter,Switzerland Producer Price Index