Key developments in 2018 The current account surplus for 2018 was CHF 71 billion, CHF 26 billion more than in the previous year. Changes in primary income (labour and investment income) had the greatest impact: Whereas one year earlier an expenses surplus of CHF 9 billion was recorded, owing to exceptionally large expenses for direct investment receipts in 2017, in the year under review there was a receipts surplus amounting to CHF 3 billion. The receipts surplus in goods trade increased by CHF 7 billion to CHF 57 billion. This was attributable mainly to higher receipts from merchanting. The receipts surplus from trade in services rose by CHF 2 billion to CHF 20 billion. Secondary income (current transfers)

Topics:

George Dorgan considers the following as important: 1) SNB and CHF, Featured, newsletter, SNB Press Releases, Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, Switzerland International Investment Position

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Key developments in 2018

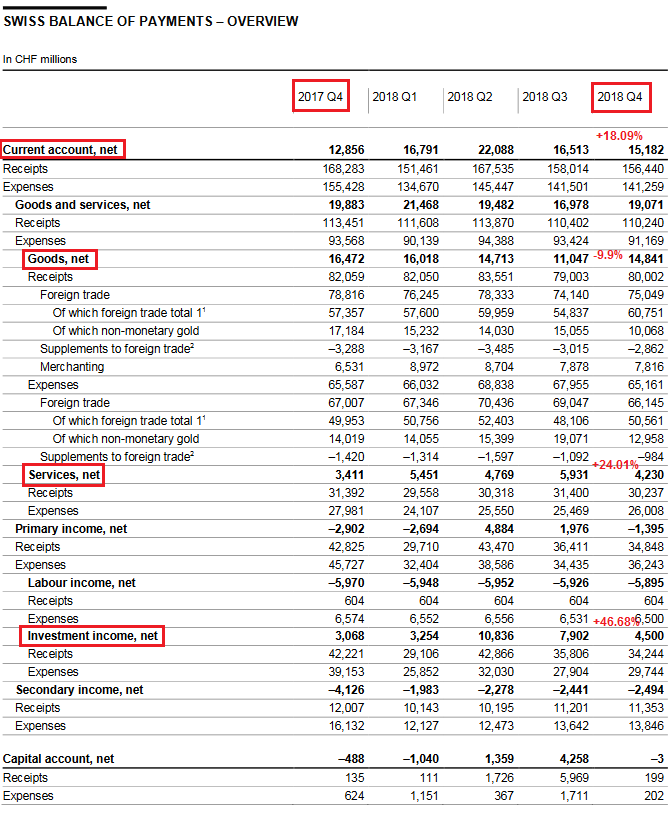

The current account surplus for 2018 was CHF 71 billion, CHF 26 billion more than in the previous year. Changes in primary income (labour and investment income) had the greatest impact: Whereas one year earlier an expenses surplus of CHF 9 billion was recorded, owing to exceptionally large expenses for direct investment receipts in 2017, in the year under review there was a receipts surplus amounting to CHF 3 billion. The receipts surplus in goods trade increased by CHF 7 billion to CHF 57 billion. This was attributable mainly to higher receipts from merchanting. The receipts surplus from trade in services rose by CHF 2 billion to CHF 20 billion. Secondary income (current transfers) registered a decrease in net expenses by CHF 4 billion to CHF 9 billion. In 2017, exceptionally high claims payments abroad by resident reinsurance companies had been recorded under this item.

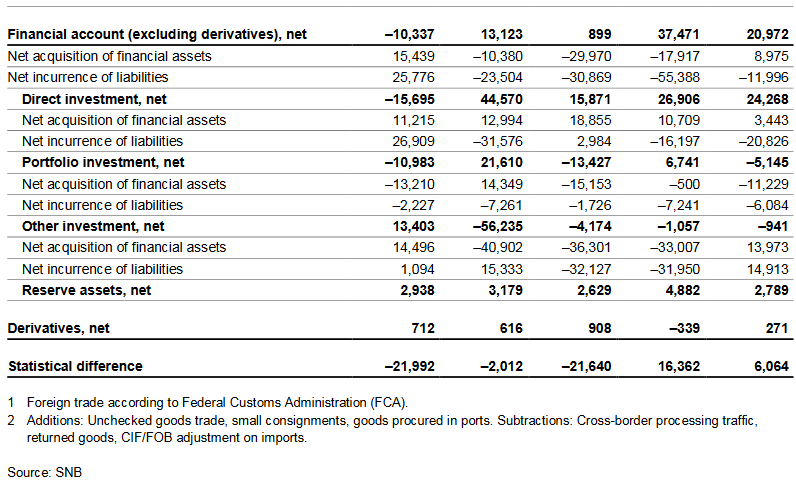

In the financial account, reported transactions showed a net reduction in 2018, for both assets (CHF 49 billion) and liabilities (CHF 122 billion). The main factor affecting the financial account was the impact of tax reforms under the Tax Cuts and Jobs Act in the US. In the context of the reforms, foreign-controlled finance and holding companies domiciled in Switzerland reduced their balance sheets. This was reflected in the financial account through, first, a net reduction in assets (other investment), as companies scaled back their lending to non-residents; and, second, through a net reduction of liabilities (direct investment) because non-resident parent companies withdrew equit y capital fro m companies in Switzerland.

However, the US tax reforms were not the only factor affecting the financial account; other transactions, too, had an impact. On the assets side, like other investment, portfolio investment too recorded a net reduction in assets, as investors in Switzerland so ld equit y securities and debt securities issued by non-residents. Direct investment, by contrast, saw a net acquisition of assets because companies in Switzerland reinvested their earnings abroad, as well as granting loans to their subsidiaries. On the liabilities side, not only direct investment, but also other investment and portfolio investment registered a net reduction. In the case of portfolio investment, this was due to foreign investors selling Swiss shares. In the case of other investment, both the SNB and commercial banks reduced their liabilitiestowards non-residents. The financial account, including derivatives, reported a positive balance of CHF 74 billion.

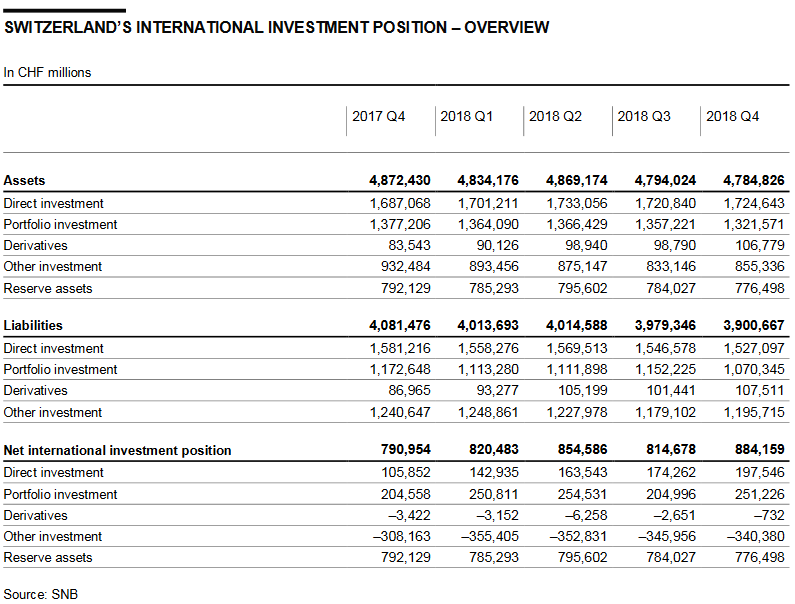

In the international investment position, stocks of both assets and liabilities contracted in 2018. Assets declined year-on-year by CHF 88 billion to CHF 4,785 billion, and liabilities by CHF 181 billion to CHF 3,901 billion. In both cases, the decrease was partly a reflection of the transaction figures reported in the financial account (net reduction of assets/net reduction of liabilities), and partly the result of valuation losses from the sharply falling prices on global stock markets. Since liabilities decreased more markedly than assets, the net international investment position increased by CHF 93 billion to CHF 884 billion.

Current AccountKey figures:Current Account: Up 18% against Q4/2017 to 15.2 bn. CHF

|

Current Account Switzerland Q4 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

Financial accountNet acquisition of financial assetsOverall, the assets side of the financial account registered a net acquisition of CHF 9 billion (Q4 2017: net acquisition of CHF 15 billion). The other investment item recorded a net acquisition of CHF 14 billion, the same as in the year-back quarter – the SNB increased its claims abroad, as did finance and holding companies. This was partly offset by a reduction in amounts due to banks from foreign customers. Portfolio investment showed a net reduction of CHF 11 billion (Q4 2017: net reduction of CHF 13 billion), as resident investors sold both equity securities and long-term debt securities of non-resident issuers. Direct investment and reserve assets posted a net acquisition of CHF 3 billion each (Q4 2017: net acquisitions of CHF 11 billion and CHF 3 billion, respectively). Net incurrence of liabilitiesOverall, the liabilities side of the financial account registered a net reduction of CHF 12 billion (Q4 2017: net incurrence of CHF 26 billion). The largest reduction was recorded by direct investment, at CHF 21 billion (Q4 2017: net incurrence of CHF 27 billion), with parent companies abroad withdrawing equit y capital fro m their Swiss subsidiaries. In addit ion, there was a reduction in liabilities under intragroup lending, although this was partly offset by parent companies abroad reinvesting their earnings in their Swiss subsidiaries. Portfolio investment also registered a net reduction; it amounted to CHF 6 billion (Q4 2017: net reduction of CHF 2 billion) and resulted from sales by foreign investors of equity securit ies fro m resident issuers. Other investment posted net incurrence totalling CHF 15 billion (Q4 2017: net incurrence of CHF 1 billion) as a result of resident banks increasing their liabilities to banks abroad (interbank business). However, companies also increased their liabilities abroad. This was partly offset by the fact that the SNB reduced its liabilities abroad. Financial account balanceThe financial account balance came to CHF 21 billion (Q4 2017: CHF –10 billion). It is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrences of liabilities plus the balance from derivatives transactions. The financial account balance corresponds to the change in the net investment position resulting from cross-border investment |

Switzerland Financial Account, Q4 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q4 2018 Source: snb.ch - Click to enlarge |

Switzerland’s International investment positionAssetsStocks of assets declined by a total of CHF 9 billion to CHF 4,785 billion compared with the third quarter of 2018. This was mainly the result of valuation losses caused by sharply falling prices on international stock exchanges. The impact was felt in portfolio investment in particular and partly also in reserve assets. Stocks of portfolio investment fell by CHF 36 billion to CHF 1,322 billion. This decrease would have been even more pronounced were it not for the significant offsetting effect of statistical adjustments. These adjustments arose out of newly available information from reporting institutions. Stocks of reserve assets contracted by CHF 8 billion to CHF 776 billion. Direct investment assets increased by CHF 4 billion to CHF 1,725 billion as a result of transactions recorded in the financial account. Likewise, transactions were behind the CHF 22 billion increase in other investment to CHF 855 billion. Derivatives increased by CHF 8 billion to CHF 107 billion. LiabilitiesStocks of liabilities contracted by CHF 79 billion to CHF 3,901 billion. This was mainly attributable to the substantial valuation losses under portfolio investment as a result of the sharply falling prices on the Swiss stock exchange. Stocks of portfolio investment fell by CHF 82 billion to CHF 1,070 billion. Direct investment liabilities decreased by CHF 19 billion to CHF 1,527 billion. However, in contrast to portfolio invest ment, this decrease was almost entirely transaction-based (net reduction of liabilities). Stocks of other investment rose by CHF 17 billion to CHF 1,196 billion, also driven by transactions recorded in the financial account. Derivatives increased by CHF 6 billion to CHF 108 billion. Net international investment positionSince stocks of liabilities (down CHF 79 billion) showed a more pronounced decline than stocks of assets (down CHF 9 billion), the net international investment position rose by just under CHF 70 billion to CHF 884 billion. |

Switzerland International Investment Position, Q4 2018(see more posts on Switzerland International Investment Position, ) Switzerland International Investment Position - Q4 2018 Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position