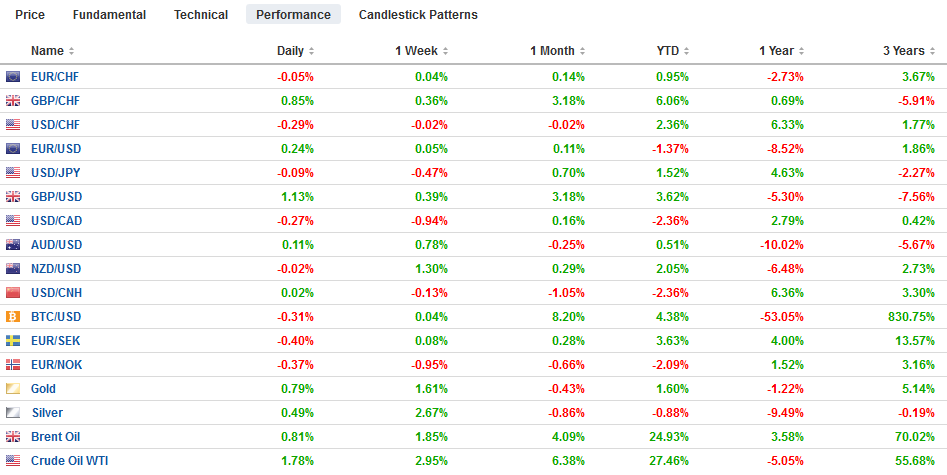

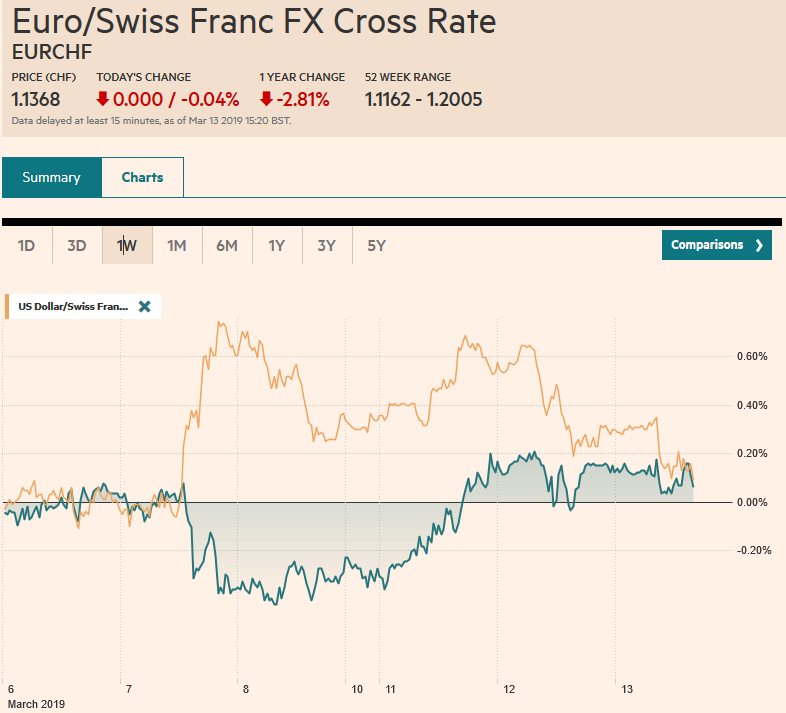

Swiss Franc The Euro has fallen by 0.04% at 1.1368 EUR/CHF and USD/CHF, March 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Brexit drama continues to command attention. A vote on leaving without an agreement will be held today, and if that fails, there will be a vote tomorrow on an extension. Meanwhile, the first increase in headline US CPI in four months failed to impress as the year-over-year pace fell to 18-month lows. Today’s import prices are part of the inflation picture, especially the non-oil component, which may give insight into consumer goods inflation. Equity markets are giving back some of yesterday’s gains. Recall several Asian

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, MXN, newsletter, NZD, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.04% at 1.1368 |

EUR/CHF and USD/CHF, March 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The Brexit drama continues to command attention. A vote on leaving without an agreement will be held today, and if that fails, there will be a vote tomorrow on an extension. Meanwhile, the first increase in headline US CPI in four months failed to impress as the year-over-year pace fell to 18-month lows. Today’s import prices are part of the inflation picture, especially the non-oil component, which may give insight into consumer goods inflation. Equity markets are giving back some of yesterday’s gains. Recall several Asian equity markets gapped higher on Tuesday. The Shanghai and the Kospi’s gaps were filled. The Nikkei and Hong Kong’s were entered by not closed. Taiwan’s Taiex did not enter its gap and instead moved higher. Europe’s Dow Jones Stoxx 600 is off marginally for a second day. The S&P 500 may again be stalling near 2800. The US 10-year note yield slipped through 2.60% for the first time this year yesterday but is back above it now. While most benchmark yields are slightly softer, poor data and the spillover from the US took Australian and New Zealand 10-year yields five and seven basis points lower, respectively today. Their respective currencies are also the weakest today, off about a quarter of a percent through the European morning. Sterling rose from around $1.3050 in early Asia to about $1.3150 in the European morning, which is about where it stalled in European afternoon and US yesterday. Emerging market currencies are little changed and mostly +/- 0.25%. |

FX Performance, March 13 |

Asia Pacific

The Bank of Japan’s two-day meeting begins tomorrow. The economic backdrop is not particularly favorable. Earlier today, Japan reported a 5.4% decline in February core machine orders. The median Bloomberg forecast was for a 1.5% decline. The series is supposed to offer a 6-9 month lead on capital expenditures. The report plays into expectations that the BOJ may lower its assessment for output and exports. There was also an upside surprise. The tertiary index (service sector) rose 0.4% in January. A 0.3% decline was expected. The weakness in December though was more pronounced than initially reported, and it was revised to -0.5% from -0.3%.

Westpac’s consumer confidence measure for Australia fell 4.8% decline in March to its lowest level since the end of Q3 2017. Next week Australia’s February employment report is due. The erosion of consumer confidence has taken place despite the fact that the labor market is holding up well. New Zealand reported a 9.5% decline in house sales in February after a 2.5% decline in January.

For the second time in a few days, the Hong Kong Monetary Authority was forced to intervene to support the Hong Kong dollar’s floor. The operation was bigger than last week’s at about HKD3.925 bln (~$500 mln) compared with HKD1.51 bln (~$192 mln). More intervention may be seen. The intervention drains local liquidity, pushing up rates, and drawing funds back into the HKD.

While trade data from many countries in Asia continue to disappoint, there are a couple of upbeat reports today that are consistent with ideas that there is an economic rebound underway that should help lift trade volumes down the road. South Korea reported a sharp drop in the unemployment rate to 3.7% from 4.4% in January, which matches the low from February 2018. Singapore reported that January retail sales rose 0.2% for a year-over-year pace of 7.6%. The median forecast called for a 2.6% year-over-year rate after a revised 5.8% decline in December (revised from -6.0%).

The Australian dollar recovered toward $0.7100 yesterday after testing $0.7000 last week. It is finding support near $0.7050 today. The downside continues to seem the path of least resistance. The New Zealand dollar is also trading heavier after a three-day bounce. An option for about NZD210 mln at $0.6825 expires today. The dollar has been confined to a quarter of a yen range today below JPY111.40 through the European morning. Although the 20-day moving average has been repeatedly frayed on an intraday basis, the dollar has not closed below it (~JPY111.10 today) since the end of January.

Europe

Brexit dominates the focus in Europe. The Withdrawal Bill lost by 149 votes yesterday. This was as close to the Sunday Times survey of a 150 vote loss as imaginable. Some MPs want to support a two-month delay to prepare to leave with no deal. Today’s vote in Parliament is expected to rule out such a course. Assuming this is indeed the case, then tomorrow’s vote will be to seek an extension. We still see risk that postponing the March 29 leave date may also not secure majority support, even if it is not the odds on favorite scenario.

From the EC’s vantage point the UK has only three options. It can leave with no deal on March 29. It can ask for an extension, which requires a unanimous vote of support among the other EU members, and no doubt, the UK will have to explain why it wants an extension. The length of the extension will also be debated. Third, the UK can revoke Article 50, but this seems the most unlikely of the three.

Overshadowed by Brexit, Chancellor of the Exchequer Hammond is to unveil the Spring budget today. While debt sales may be projected to rise by a quarter to GBP123 bln, there are about GBP100 bln that will mature. That would leave the net new supply at its lowest level in 17 years, according to reports.

January industrial production in the eurozone bounced back after a dismal end of 2018. France, Italy, and Spain reported better than expected national figures last week, while Germany disappointed. The aggregate rise of 1.4% was above expectations and is most welcome after a 0.9% drop in December and a 1.7% collapse last November.

The euro has recovered a little more than a cent from last week’s ECB-induced drop below $1.12. It briefly poked through $1.13 yesterday, perhaps helped by the gyrations against sterling, but has stayed just below there today. The single currency is in less than a quarter cent range today. The chunky option expirations today may continue to limit the action. There is an option for 1.6 bln euros at $1.13 and another for 1.8 bln euros at $1.1250. Tomorrow there is another one billion euro option at $1.1250 that rolls off. The 20-day moving average is near $1.1315, and the euro has not closed above it since March 4. Sterling is in a broader range of almost a cent today but well within yesterday’s range. The intraday technicals suggest that it has run out of steam near $1.3150.

America

Observers generally agreed that the soft core CPI figures reinforced the Fed’s wait-and-see posture (patience), but expectations for Fed policy have not changed. Consider that at the end of last week, the January 2000 Fed funds futures contract implied an average effective Fed funds rate of 2.345%. Now it implies 2.34%. Today, the US reports producer prices. The headline rate of PPI is forecast to slip to 1.9% from 2.0%, due to the base effect as a 0.2% gain is expected month-over-month. The core rate is expected to be unchanged at 2.6%. Separately, import prices, excluding energy may have declined for the second consecutive month in February, and this plays into fears of new disinflation in the US. January durable goods orders are to be reported as well. This may be a mixed report as it may be difficult to extend the 1.2% gain in December. Orders excluding aircraft and defense goods likely ticked up after a 1% decline at the end of last year. Separately, January construction spending may have rebounded from the 0.6% decline in December. Still, poor weather risks a disappointing report.

The first two legs of this week’s coupon auctions have been well received. Both the three and 10-year offering saw higher bid coverage. Indirect bidders took down a bit more of both offerings than previously and accepted lower yields. Today, Treasury will sell $16 bln 30-year bonds.

Canada’s economic calendar is clear today. Mexico reports January industrial output figures. A 0.1% increase is anticipated. It would be the first gain in four months. The US dollar has softened against the Canadian dollar since the contrasting employment reports at the end of last week. The greenback is stabilizing near the 38.2% retracement of this month’s run-up that is found by CAD1.3340. A break signal a test on CAD1.33. Initial resistance is around CAD1.3420. The Mexican peso has also strengthened in recent days. It is trying to extend its three-day rally. The US dollar may find support near MXN19.25. The high for the week in around MXN19.52.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Featured,MXN,newsletter,NZD