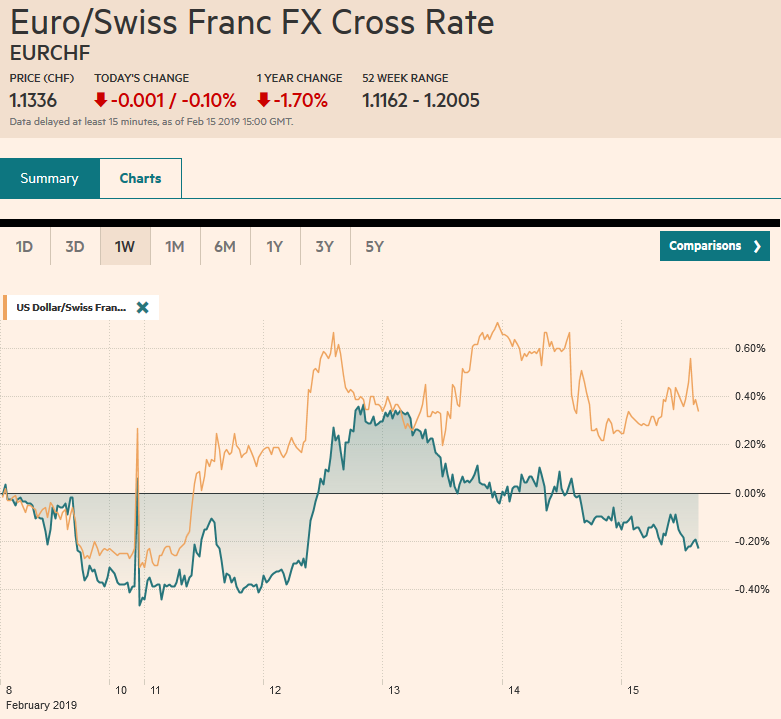

Swiss Franc The Euro has fallen by 0.10% at 1.1336 EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a four-day advance yesterday, and equities in the Asia Pacific followed suit. All the markets in the region were lower but in Australia. MSCI’s regional benchmark stalled after reached a four-month high in the middle of the week. European markets were mostly higher in the morning session after slipping yesterday. Including today’s gains, the Dow Jones Stoxx 600 has risen in 11 of the past 14 sessions and has only fallen one week so far this year for almost an 8% gain. It is about 2% below its 200-day moving

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.10% at 1.1336 |

EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The S&P 500 snapped a four-day advance yesterday, and equities in the Asia Pacific followed suit. All the markets in the region were lower but in Australia. MSCI’s regional benchmark stalled after reached a four-month high in the middle of the week. European markets were mostly higher in the morning session after slipping yesterday. Including today’s gains, the Dow Jones Stoxx 600 has risen in 11 of the past 14 sessions and has only fallen one week so far this year for almost an 8% gain. It is about 2% below its 200-day moving average. Benchmark 10-year bond yields eased moved lower in the Asia Pacific region after rates fell in the US yesterday. European bond markets are mixed, with core yields mostly a little lower and peripheral yields firmer, led by Italy. The US 10-year yield fell five basis points yesterday after the dismal retail sales report. The US dollar is firmer against most of the major currencies, and on the week, only Australian and New Zealand dollars resisted the draw. Among emerging market currencies, the Thai baht and Brazilian real were the only ones to buck the broader greenback advance. |

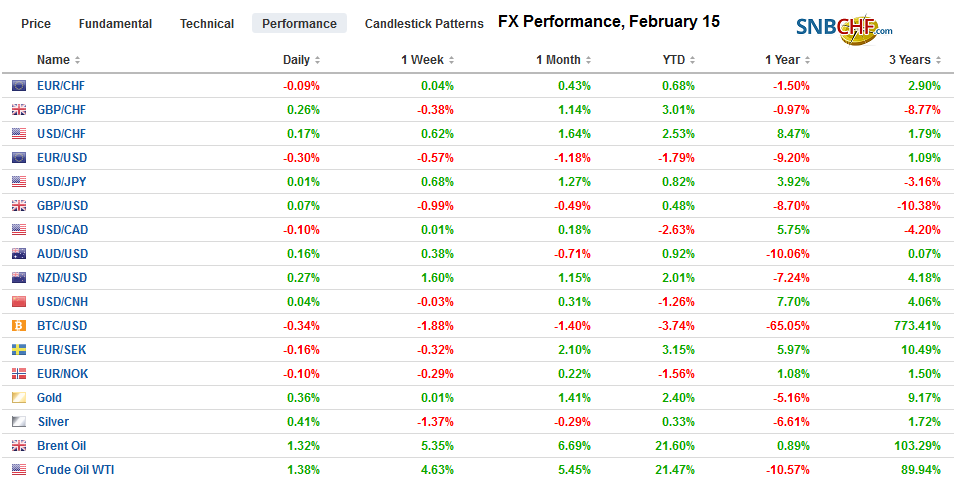

FX Performance, February 15 |

Asia Pacific

China reported softer than expected inflation but record aggregate financing. January PPI rose 0.1% year-over-year down from 0.9%. It is the lowest in a couple of years and led by a decline in raw material prices. Consumer prices unexpectedly eased to 1.7% from 1.9%. Soft price pressures play into the economic slowdown story. However, a slowing of food price inflation (from 2.5% to 2.0%) was the main weight on the CPI as non-food prices were steady at 1.7%. Nevertheless, many expect the PBOC to ease monetary policy through another reduction in the reserves requirements, though a rate cut cannot be entirely ruled out either. Separately, China reported a surge in lending. Aggregate financing jumped to CNY4.64 trillion, a record, from CNY1.59 in December. New bank loans (CNY3.23 trillion from CNY1.08 trillion in December) drove this, but the difference between new bank loans and aggregate financing is a rough and ready metric of the shadow banking sector. Officials had been squeezing it, but now seem to have backed off in an attempt to support the economy. Activity in the shadow banking sector increased for the first time in eleven months.

Japan reported Q4 GDP yesterday (0.3% after a 0.7% contraction in Q3) and this rendered today’s final December industrial output (-0.1%) moot. The MOF weekly portfolio flow data showed Japanese investors continue to buy foreign bonds. In the first six weeks of 2019, they bought an average of JPY640 bln a week. During the same period in 2018, there were net sellers of an average of JPY45.5 bln. Japanese have sold foreign equities at a slightly slower pace than last year (JPY190 bln average vs. JPY245 bln). Foreign investors have bought an average of JPY512 bln a week of Japanese bonds (sellers in the first six weeks of 2018 of an average JPY169 bln). Foreign investors have been set sellers of Japanese equities after having been small buyers at the start of last year.

The New Zealand dollar is the big winner this week. If sustained, the 1.5% advance this week would be the largest in three months. It comes on the back of a central bank that was less dovish than the market had expected. However, we suspect the market’s reaction is exaggerated. The January PMI hints at why. The headline eased to 53.1 from 54.8, but most troubling was the slump in new orders to 13-month lows.

The US dollar is little changed against the yen after slipped to a four-day low just above JPY110.25. There are options for about $3 bln struck at JPY109.95-JPY11000 that expire today. Initial resistance is pegged near JPY110.60 now. The US dollar recorded new 2019 highs yesterday near JPY111.15. The Australian dollar is also little changed. It has spent the week straddling the $0.7100 level. The US dollar gained 0.4% against the Chinese yuan during the first week since the Lunar New Year holiday to close onshore at CNY6.7745

Europe

While there may have been some seasonal distortion, UK retail sales strongly surprised on the upside in January. Economists forecast around a 0.2% gain, but instead, a 1.2% rise was reported excluding fuel. It appears UK shoppers were drawn by deep discounts for clothing, where sales rose 2.1%. On the other hand, and despite discounts, department stores and household goods purchases slumped 4.4%, the largest decline in a little more than a year and a half.

The eurozone reported December trade figures. Since Q4 GDP has already been reported, it did not attract much attention. It was little changed at slightly more than 15 bln euros. We looked at the 12-month moving average to smooth out the month-to-month noise and see the large picture. It peaked at the end of 2016 near 22 bln euros. The 12-month average last year was about 16.2 bln euros, a 25% decline.

Spain’s cabinet meeting is continuing now, but the outcome is expected to be an election announcement for mid-April. The minority Socialist government was unable to get Parliament’s approval for its budget proposal. Political jitters may see the premium Spain offers over Germany to widen, and short-term participants may look to sell Spain against Portugal, but medium and longer-term investors may see any meaningful underperformance of Spain as a new buying opportunity.

The euro has been straddling $1.13 this week, though so far, today is the first day this week that it has not poked above $1.13. Note that the euro has not posted a weekly close below $1.13 since June 2017. There are two sets of options expiring today. One is struck at $1.1275 for about 710 mln euros and the other is at $1.1250 for almost 750 mln euros. Look for North America try to push it lower, as many short-term participants see the Fed’s SOMA operations (System Open Market Account) that drains liquidity today as being dollar-friendly. Sterling is consolidating its recent losses by trading in a narrow range above yesterday’s lows. Just above $1.28, it has fallen about 1% this week and is the third consecutive weekly loss. There is an option for around GBP245 mln at $1.2790 that expires today.

America

This round of US-China trade talks is ending. The press is playing up the lack of visible signs of progress, but it is not clear what it expected. Although there is the early March deadline, it has seemed likely for more than a week that an extension was probable and the Xi and Trump would meet before the tariff freeze ended. There are some rumors that China sought a 90-day extension, but the US is favoring 60-days. We had previously suggested a 30-day extension seemed reasonable. Many recognize that China will be reluctant to capitulate to all of the US demands, a sense that Trump wants to avoid another December-like meltdown in stocks, secure a political victory, and is focused on short-term transactional goals makes an agreement likely. Of course, the longer-term strategic competition remains.

President Trump’s claim of emergency powers to secure funding for the wall on the Mexican border will likely face a legal challenge. Trump has done a good job of moving on issues that are important to his constituency, and even if he loses the legal challenge, he will make it 2020 rallying cry. While it is a focus of domestic politics, it does not seem to be much of a market factor.

The US reports a series of economic data today, but nothing will change the general view. Industrial production and manufacturing output soared in December and likely stagnated in January. The December Treasury International Capital report is not a market mover. It will be interesting though to see how investors shifted portfolios during the record bloodbath at the end of last year. February data is more interesting and relevant. It comes in the form of the Empire State manufacturing survey (look for modest improvement) and the University of Michigan consumer sentiment survey (small improvement is expected here too). Canada reports its portfolio flows and January existing home sales (looking for the fifth consecutive decline).

The US dollar is consolidating yesterday’s gains against the Canadian dollar that brought it to CAD1.3340, its highest level in a few weeks. There is a nearly $800 mln option at CAD1.3275 that expires today and could be in play. The pair is little changed on the week. The Mexican peso is off about 1% this week as political jitters and heavier EM, in general, took a toll. Previous dollar resistance near MXN19.20 now serves as support. The Dollar Index is up about 0.5% for the week and has held above 97.00 today. The cyclical high from the end of last year was near 97.70.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: Featured,newsletter