Summary:

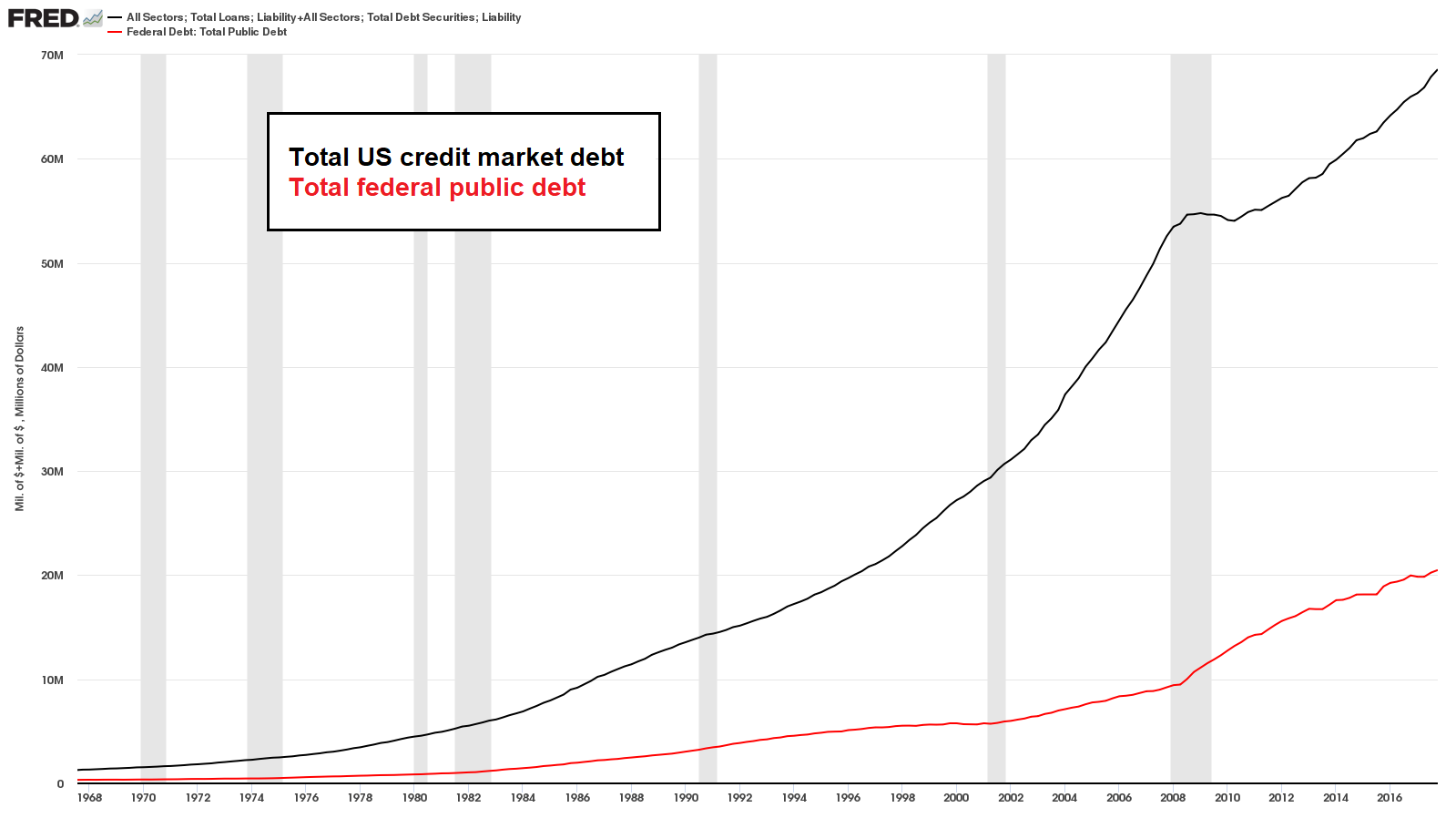

The Long Run is Here The dollar is failing. Millions of people can see at least some of the major signs, such as the collapse of interest rates, record high number of people not counted in the workforce, and debt rising from already-unpayable levels at an accelerating rate. US Total Credit Market Debt, 1968 - 2018Total US credit market debt has hit a new high of .6 trillion at the end of 2017. - Click to enlarge That’s up from .3 trillion a mere 20 years ago. It’s a fairly good bet this isn’t sustainable. I am going to share a little bit about myself and my personal motivation. I want to help fix this problem. The alternative, if it’s not fixed, will be a repeat not of 2008 or the inflation of the 1970’s or

Topics:

Keith Weiner considers the following as important: 6) Gold and Bitcoin, Featured, Feed, newsletter, Precious Metals

This could be interesting, too:

The Long Run is Here The dollar is failing. Millions of people can see at least some of the major signs, such as the collapse of interest rates, record high number of people not counted in the workforce, and debt rising from already-unpayable levels at an accelerating rate. US Total Credit Market Debt, 1968 - 2018Total US credit market debt has hit a new high of .6 trillion at the end of 2017. - Click to enlarge That’s up from .3 trillion a mere 20 years ago. It’s a fairly good bet this isn’t sustainable. I am going to share a little bit about myself and my personal motivation. I want to help fix this problem. The alternative, if it’s not fixed, will be a repeat not of 2008 or the inflation of the 1970’s or

Topics:

Keith Weiner considers the following as important: 6) Gold and Bitcoin, Featured, Feed, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Tags: Featured,newsletter,Precious Metals