Jamie Dimon Warns Of Potential ‘Market Panic’ – JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’ – In annual letter to shareholders Dimon warns of increased inflation and interest rates – Concerned QE unwinding could cause chaos as ‘markets will get more volatile’ – Hard to look at the last 20 years in America “and not think that it has been getting increasingly worse.” – Positive about US economy over next year, but ignores record levels of world and government debt – Believes major buyers of US debt (e.g. China) could reduce their purchases of US government debt – Investors can protect portfolios with gold and silver bullion – U.S. debt and dollar crisis coming which will propel gold higher (see chart)

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Jamie Dimon Warns Of Potential ‘Market Panic’

– JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’

– In annual letter to shareholders Dimon warns of increased inflation and interest rates

– Concerned QE unwinding could cause chaos as ‘markets will get more volatile’

– Hard to look at the last 20 years in America “and not think that it has been getting increasingly worse.”

– Positive about US economy over next year, but ignores record levels of world and government debt

– Believes major buyers of US debt (e.g. China) could reduce their purchases of US government debt

– Investors can protect portfolios with gold and silver bullion

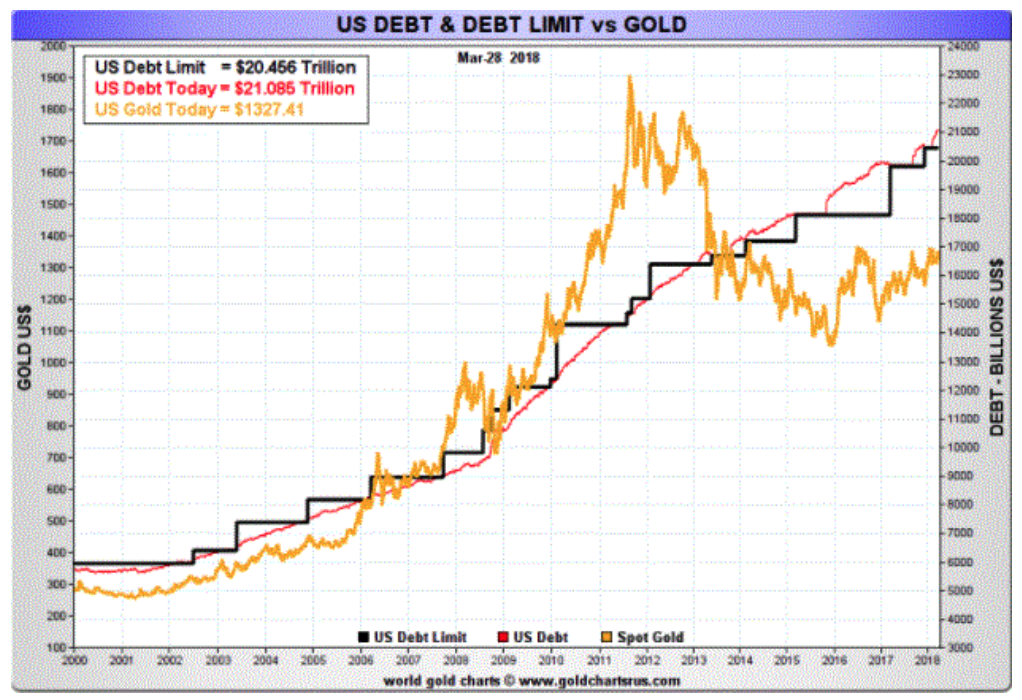

– U.S. debt and dollar crisis coming which will propel gold higher (see chart)

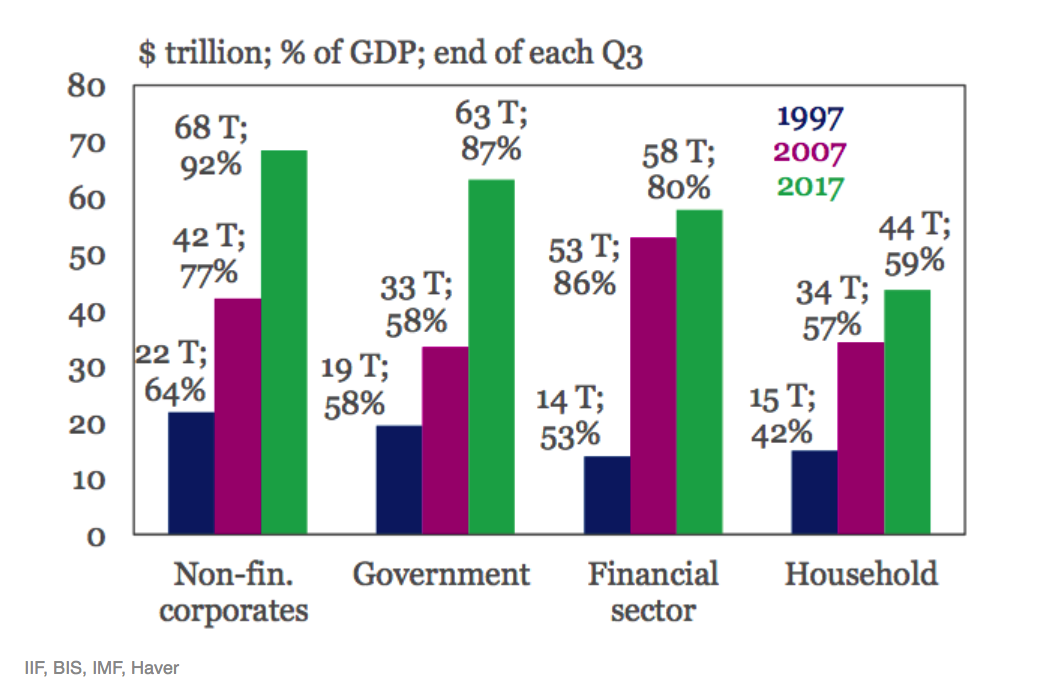

| Both corporations and consumers are sitting on a record amount of debt. And as I pointed out earlier this week, the fastest growing bank asset last year was subprime loans… meaning that the quality of debt is getting worse and worse. |

Non-fin Corporates, Government, Financial Sector and Household as % of GDP |

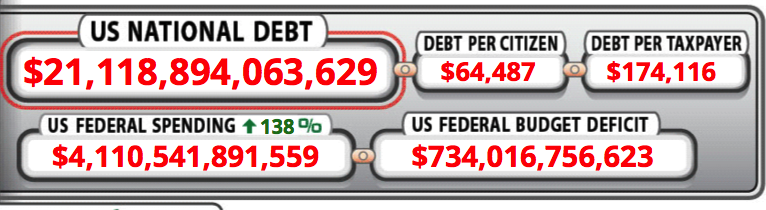

| Then there’s the US government, whose debts just passed $21 trillion for the first time in history. |

US National Debt |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below | |

|

The above was taken from Simon Black’s SovereignMan.com. Concluding commentsIn the words of Sovereign Man Simon Black, ‘Countries whose economic models are based on debt and consumption will suffer’. When the US does suffer (as Dimon clearly believes it will) it will not be a contained event, the whole world will feel the pinch as we are so intertwined with U.S., their policies and currency. Another crisis may well be in the pipeline, so bad it is that banks whose models run on debt are giving out warnings. Dimon’s warnings could be a strong signal for investors to allocate a part of their portfolios to gold and silver. These assets have historically held their value in times of economic contraction. This risk underlines the importance of owning physical gold to protect against geo-political risks, stock and bond market bubbles and the continuing devaluation of the dollar and all fiat currencies. |

US Debt and Debt Limit vs Gold, 2000 - 2018 |

Tags: Daily Market Update,Featured,newsletter